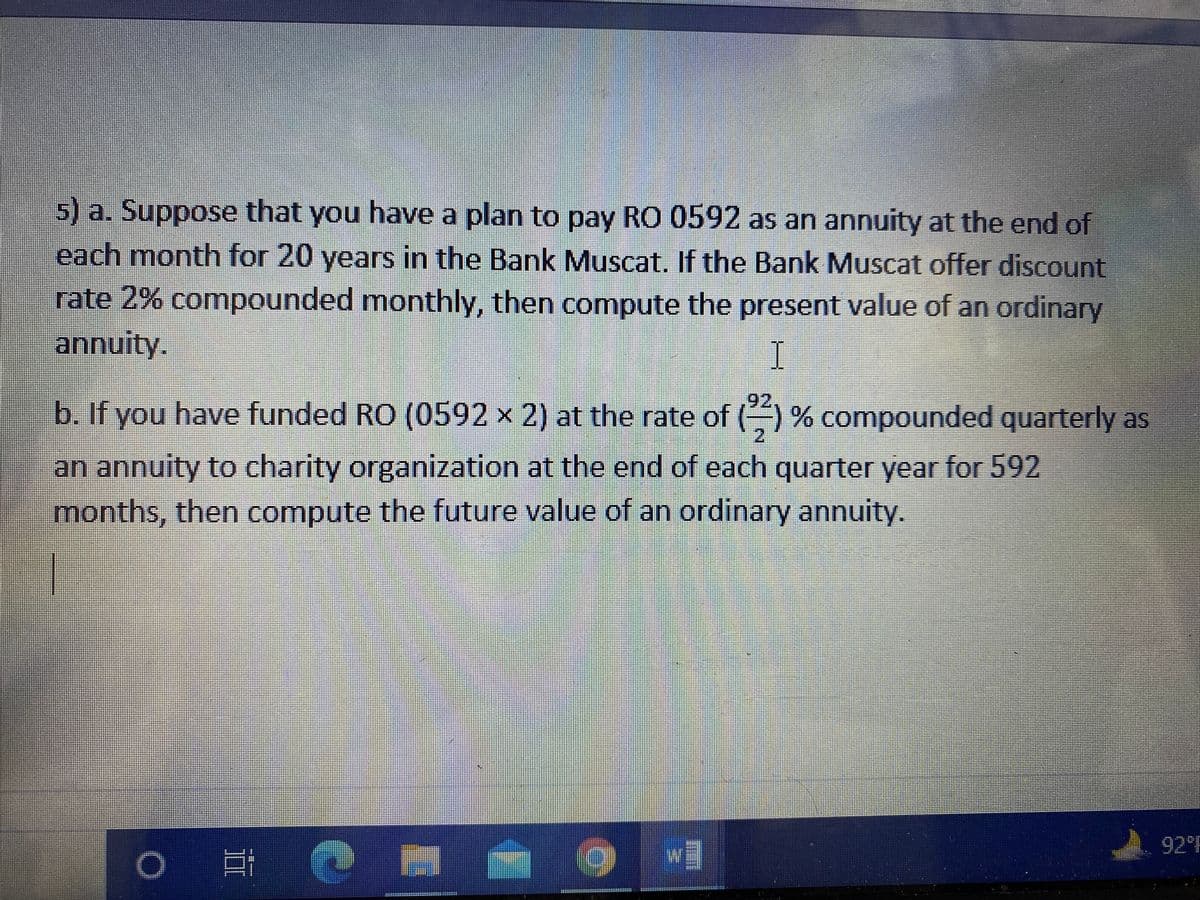

5) a. Suppose that you have a plan to pay RO 0592 as an annuity at the end of each month for 20 years in the Bank Muscat. If the Bank Muscat offer discount rate 2% compounded monthly, then compute the present value of an ordinary annuity. b. If you have funded RO (0592 x 2) at the rate of () % compounded quarterly as an annuity to charity organization at the end of each quarter year for 592 months, then compute the future value of an ordinary annuity.

5) a. Suppose that you have a plan to pay RO 0592 as an annuity at the end of each month for 20 years in the Bank Muscat. If the Bank Muscat offer discount rate 2% compounded monthly, then compute the present value of an ordinary annuity. b. If you have funded RO (0592 x 2) at the rate of () % compounded quarterly as an annuity to charity organization at the end of each quarter year for 592 months, then compute the future value of an ordinary annuity.

Chapter6: Exponential And Logarithmic Functions

Section: Chapter Questions

Problem 5RE: A retirement account is opened with an initialdeposit of 8,500 and earns 8.12 interest compounded...

Related questions

Question

Transcribed Image Text:5)a. Suppose that you have a plan to pay RO 0592 as an annuity at the end of

each month for 20 years in the Bank Muscat. If the Bank Muscat offer discount

rate 2% compounded monthly, then compute the present value of an ordinary

annuity.

I

92

b. If you have funded RO (0592 x 2) at the rate of () % compounded quarterly as

an annuity to charity organization at the end of each quarter year for 592

months, then compute the future value of an ordinary annuity.

92 F

w

*** --

II

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you