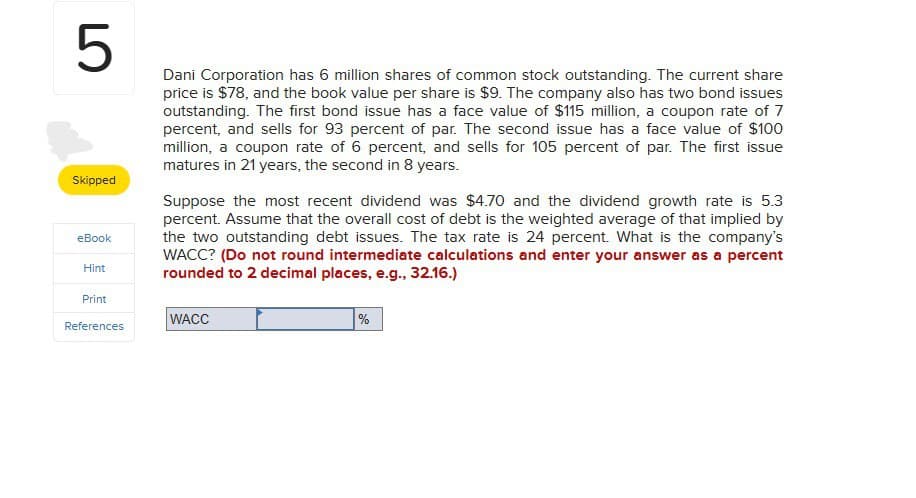

5 Skipped eBook Hint Print Dani Corporation has 6 million shares of common stock outstanding. The current share price is $78, and the book value per share is $9. The company also has two bond issues outstanding. The first bond issue has a face value of $115 million, a coupon rate of 7 percent, and sells for 93 percent of par. The second issue has a face value of $100 million, a coupon rate of 6 percent, and sells for 105 percent of par. The first issue matures in 21 years, the second in 8 years. Suppose the most recent dividend was $4.70 and the dividend growth rate is 5.3 percent. Assume that the overall cost of debt is the weighted average of that implied by the two outstanding debt issues. The tax rate is 24 percent. What is the company's WACC? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) WACC References %

5 Skipped eBook Hint Print Dani Corporation has 6 million shares of common stock outstanding. The current share price is $78, and the book value per share is $9. The company also has two bond issues outstanding. The first bond issue has a face value of $115 million, a coupon rate of 7 percent, and sells for 93 percent of par. The second issue has a face value of $100 million, a coupon rate of 6 percent, and sells for 105 percent of par. The first issue matures in 21 years, the second in 8 years. Suppose the most recent dividend was $4.70 and the dividend growth rate is 5.3 percent. Assume that the overall cost of debt is the weighted average of that implied by the two outstanding debt issues. The tax rate is 24 percent. What is the company's WACC? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) WACC References %

Chapter20: Financing With Derivatives

Section: Chapter Questions

Problem 14P

Related questions

Question

Transcribed Image Text:5

Skipped

eBook

Hint

Print

Dani Corporation has 6 million shares of common stock outstanding. The current share

price is $78, and the book value per share is $9. The company also has two bond issues

outstanding. The first bond issue has a face value of $115 million, a coupon rate of 7

percent, and sells for 93 percent of par. The second issue has a face value of $100

million, a coupon rate of 6 percent, and sells for 105 percent of par. The first issue

matures in 21 years, the second in 8 years.

Suppose the most recent dividend was $4.70 and the dividend growth rate is 5.3

percent. Assume that the overall cost of debt is the weighted average of that implied by

the two outstanding debt issues. The tax rate is 24 percent. What is the company's

WACC? (Do not round intermediate calculations and enter your answer as a percent

rounded to 2 decimal places, e.g., 32.16.)

WACC

References

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning