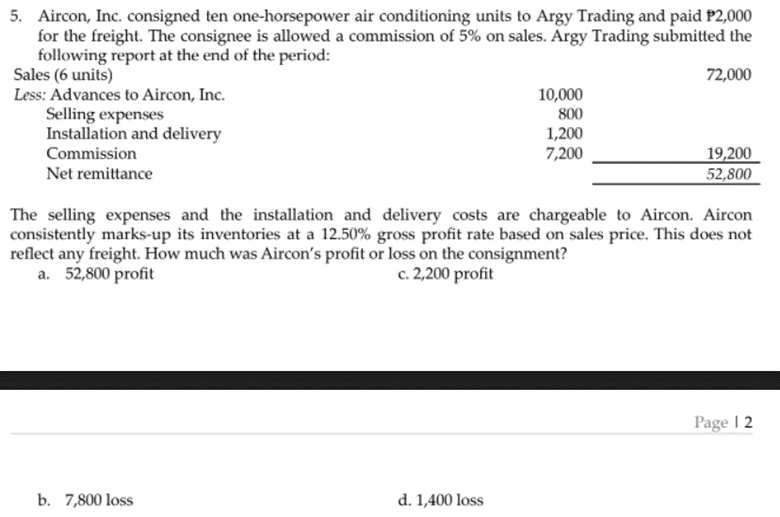

5. Aircon, Inc. consigned ten one-horsepower air conditioning units to Argy Trading and paid P2,000 for the freight. The consignee is allowed a commission of 5% on sales. Argy Trading submitted the following report at the end of the period: Sales (6 units) Less: Advances to Aircon, Inc. Selling expenses Installation and delivery 72,000 10,000 800 1,200 7,200 Commission 19,200 52,800 Net remittance The selling expenses and the installation and delivery costs are chargeable to Aircon. Aircon consistently marks-up its inventories at a 12.50% gross profit rate based on sales price. This does not reflect any freight. How much was Aircon's profit or loss on the consignment? a. 52,800 profit c. 2,200 profit Page I 2 b. 7,800 loss d. 1,400 loss

5. Aircon, Inc. consigned ten one-horsepower air conditioning units to Argy Trading and paid P2,000 for the freight. The consignee is allowed a commission of 5% on sales. Argy Trading submitted the following report at the end of the period: Sales (6 units) Less: Advances to Aircon, Inc. Selling expenses Installation and delivery 72,000 10,000 800 1,200 7,200 Commission 19,200 52,800 Net remittance The selling expenses and the installation and delivery costs are chargeable to Aircon. Aircon consistently marks-up its inventories at a 12.50% gross profit rate based on sales price. This does not reflect any freight. How much was Aircon's profit or loss on the consignment? a. 52,800 profit c. 2,200 profit Page I 2 b. 7,800 loss d. 1,400 loss

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 63P

Related questions

Question

Transcribed Image Text:5. Aircon, Inc. consigned ten one-horsepower air conditioning units to Argy Trading and paid P2,000

for the freight. The consignee is allowed a commission of 5% on sales. Argy Trading submitted the

following report at the end of the period:

Sales (6 units)

Less: Advances to Aircon, Inc.

Selling expenses

Installation and delivery

Commission

72,000

10,000

800

1,200

7,200

19,200

52,800

Net remittance

The selling expenses and the installation and delivery costs are chargeable to Aircon. Aircon

consistently marks-up its inventories at a 12.50% gross profit rate based on sales price. This does not

reflect any freight. How much was Aircon's profit or loss on the consignment?

a. 52,800 profit

c. 2,200 profit

Page I 2

b. 7,800 loss

d. 1,400 loss

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning