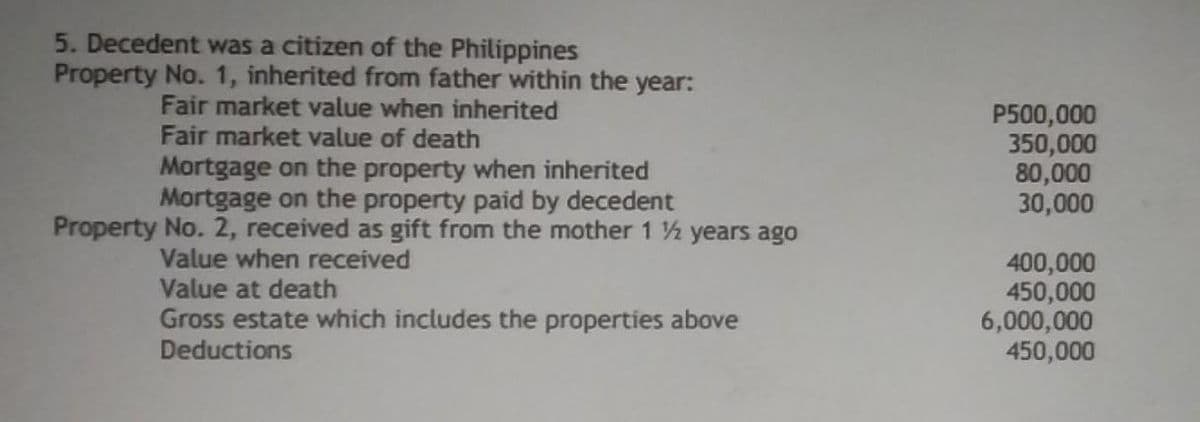

5. Decedent was a citizen of the Philippines Property No. 1, inherited from father within the year: Fair market value when inherited Fair market value of death Mortgage on the property when inherited Mortgage on the property paid by decedent Property No. 2, received as gift from the mother 1 ½ years ago P500,000 350,000 80,000 30,000 Value when received Value at death Gross estate which includes the properties above Deductions 400,000 450,000 6,000,000 450,000

5. Decedent was a citizen of the Philippines Property No. 1, inherited from father within the year: Fair market value when inherited Fair market value of death Mortgage on the property when inherited Mortgage on the property paid by decedent Property No. 2, received as gift from the mother 1 ½ years ago P500,000 350,000 80,000 30,000 Value when received Value at death Gross estate which includes the properties above Deductions 400,000 450,000 6,000,000 450,000

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 58P

Related questions

Question

compute for vanishing deduction

Transcribed Image Text:5. Decedent was a citizen of the Philippines

Property No. 1, inherited from father within the year:

Fair market value when inherited

Fair market value of death

Mortgage on the property when inherited

Mortgage on the property paid by decedent

Property No. 2, received as gift from the mother 1 2 years ago

P500,000

350,000

80,000

30,000

Value when received

Value at death

Gross estate which includes the properties above

Deductions

400,000

450,000

6,000,000

450,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT