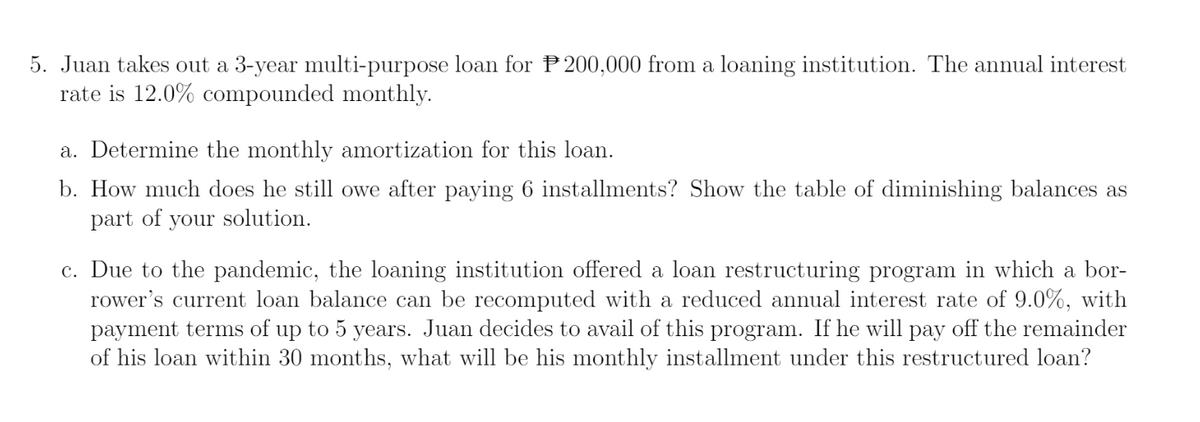

5. Juan takes out a 3-year multi-purpose loan for P200,000 from a loaning institution. The annual interest rate is 12.0% compounded monthly. a. Determine the monthly amortization for this loan. b. How much does he still owe after paying 6 installments? Show the table of diminishing balances as part of your solution. c. Due to the pandemic, the loaning institution offered a loan restructuring program in which a bor- rower's current loan balance can be recomputed with a reduced annual interest rate of 9.0%, with payment terms of up to 5 years. Juan decides to avail of this program. If he will pay off the remainder of his loan within 30 months, what will be his monthly installment under this restructured loan?

5. Juan takes out a 3-year multi-purpose loan for P200,000 from a loaning institution. The annual interest rate is 12.0% compounded monthly. a. Determine the monthly amortization for this loan. b. How much does he still owe after paying 6 installments? Show the table of diminishing balances as part of your solution. c. Due to the pandemic, the loaning institution offered a loan restructuring program in which a bor- rower's current loan balance can be recomputed with a reduced annual interest rate of 9.0%, with payment terms of up to 5 years. Juan decides to avail of this program. If he will pay off the remainder of his loan within 30 months, what will be his monthly installment under this restructured loan?

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter7: Using Consumer Loans

Section: Chapter Questions

Problem 9FPE: Calculating and comparing add-on and simple interest loans. Eli Nelson is borrowing 10,000 for five...

Related questions

Question

PLEASE ANSWER THIS USING YOUR OWN ANSWERS. DO NOT COPY ON INTERNET. IF YOU SEE THIS QUESTION AGAIN, DO NOT ANSWER. IF YOU ANSWER THIS IN TYPEWRITTEN, COMPLETE, CORRECT, AND IN ORIGINAL WAY, I WILL UPVOTE. THANK YOU!

Transcribed Image Text:5. Juan takes out a 3-year multi-purpose loan for P200,000 from a loaning institution. The annual interest

rate is 12.0% compounded monthly.

a. Determine the monthly amortization for this loan.

b. How much does he still owe after paying 6 installments? Show the table of diminishing balances as

part of your solution.

c. Due to the pandemic, the loaning institution offered a loan restructuring program in which a bor-

rower's current loan balance can be recomputed with a reduced annual interest rate of 9.0%, with

payment terms of up to 5 years. Juan decides to avail of this program. If he will pay off the remainder

of his loan within 30 months, what will be his monthly installment under this restructured loan?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College