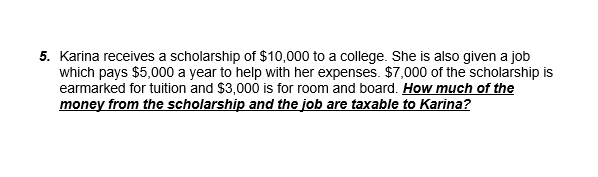

5. Karina receives a scholarship of $10,000 to a college. She is also given a job which pays $5,000 a year to help with her expenses. $7,000 of the scholarship is earmarked for tuition and $3,000 is for room and board. How much of the money from the scholarship and the job are taxable to Karina?

5. Karina receives a scholarship of $10,000 to a college. She is also given a job which pays $5,000 a year to help with her expenses. $7,000 of the scholarship is earmarked for tuition and $3,000 is for room and board. How much of the money from the scholarship and the job are taxable to Karina?

Chapter2: Gross Income And Exclusions

Section: Chapter Questions

Problem 26P

Related questions

Question

I need help doing this exercise! If some can help me resolve this, I would really be really apreciated!

Transcribed Image Text:5. Karina receives a scholarship of $10,000 to a college. She is also given a job

which pays $5,000 a year to help with her expenses. $7,000 of the scholarship is

earmarked for tuition and $3,000 is for room and board. How much of the

money from the scholarship and the job are taxable to Karina?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT