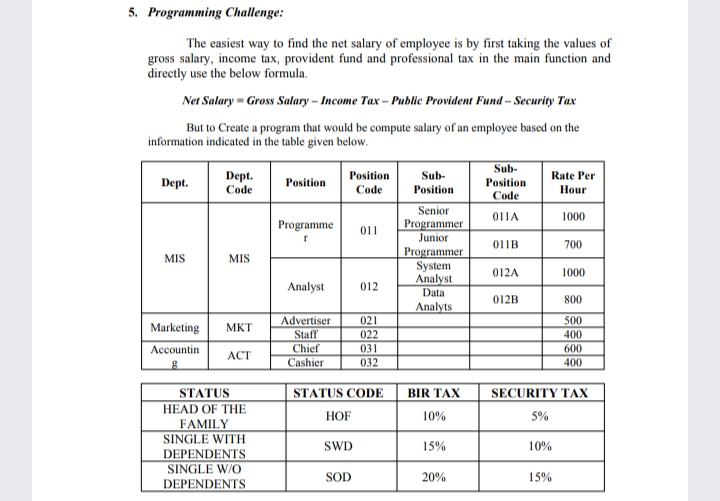

5. Programming Challenge: The easiest way to find the net salary of employee is by first taking the values of gross salary, income tax, provident fund and professional tax in the main function and directly use the below formula. Net Salary-Gross Salary-Income Tax- Public Provident Fund - Security Tax But to Create a program that would be compute salary of an employee based on the information indicated in the table given below. Dept. MIS Dept. Code MIS Marketing MKT Accountin ACT STATUS HEAD OF THE FAMILY SINGLE WITH DEPENDENTS SINGLE W/O DEPENDENTS Position Programme Position Code Advertiser Staff Chief Cashier Analyst 012 011 HOF SWD SOD 021 022 STATUS CODE 031 032 Sub- Position Senior Programmer Junior Programmer System Analyst Data Analyts BIR TAX 10% 15% 20% Sub- Position Code 011A 011B 012A 012B Rate Per Hour 1000 700 1000 800 500 400 SECURITY TAX 5% 10% 600 400 15%

5. Programming Challenge: The easiest way to find the net salary of employee is by first taking the values of gross salary, income tax, provident fund and professional tax in the main function and directly use the below formula. Net Salary-Gross Salary-Income Tax- Public Provident Fund - Security Tax But to Create a program that would be compute salary of an employee based on the information indicated in the table given below. Dept. MIS Dept. Code MIS Marketing MKT Accountin ACT STATUS HEAD OF THE FAMILY SINGLE WITH DEPENDENTS SINGLE W/O DEPENDENTS Position Programme Position Code Advertiser Staff Chief Cashier Analyst 012 011 HOF SWD SOD 021 022 STATUS CODE 031 032 Sub- Position Senior Programmer Junior Programmer System Analyst Data Analyts BIR TAX 10% 15% 20% Sub- Position Code 011A 011B 012A 012B Rate Per Hour 1000 700 1000 800 500 400 SECURITY TAX 5% 10% 600 400 15%

C++ for Engineers and Scientists

4th Edition

ISBN:9781133187844

Author:Bronson, Gary J.

Publisher:Bronson, Gary J.

Chapter6: Modularity Using Functions

Section6.2: Returning A Single Value

Problem 5E: (General math) a. The volume, V, of a cylinder is given by this formula: V=r2L r is the cylinder’s...

Related questions

Question

Create a simple flowchart using this informations

Transcribed Image Text:5. Programming Challenge:

The easiest way to find the net salary of employee is by first taking the values of

gross salary, income tax, provident fund and professional tax in the main function and

directly use the below formula.

Net Salary-Gross Salary-Income Tax - Public Provident Fund - Security Tax

But to Create a program that would be compute salary of an employee based on the

information indicated in the table given below.

Dept.

MIS

Dept.

Code

MIS

Marketing MKT

Accountin

ACT

g

STATUS

HEAD OF THE

FAMILY

SINGLE WITH

DEPENDENTS

SINGLE W/O

DEPENDENTS

Position

Programme

Position

Code

Advertiser

Staff

Chief

Cashier

Analyst 012

HOF

011

STATUS CODE

SWD

SOD

021

022

031

032

Sub-

Position

Senior

Programmer

Junior

Programmer

System

Analyst

Data

Analyts

BIR TAX

10%

15%

20%

Sub-

Position

Code

011A

011B

012A

012B

Rate Per

Hour

1000

10%

700

1000

SECURITY TAX

5%

15%

800

500

400

600

400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, computer-science and related others by exploring similar questions and additional content below.Recommended textbooks for you

C++ for Engineers and Scientists

Computer Science

ISBN:

9781133187844

Author:

Bronson, Gary J.

Publisher:

Course Technology Ptr

C++ Programming: From Problem Analysis to Program…

Computer Science

ISBN:

9781337102087

Author:

D. S. Malik

Publisher:

Cengage Learning

C++ for Engineers and Scientists

Computer Science

ISBN:

9781133187844

Author:

Bronson, Gary J.

Publisher:

Course Technology Ptr

C++ Programming: From Problem Analysis to Program…

Computer Science

ISBN:

9781337102087

Author:

D. S. Malik

Publisher:

Cengage Learning