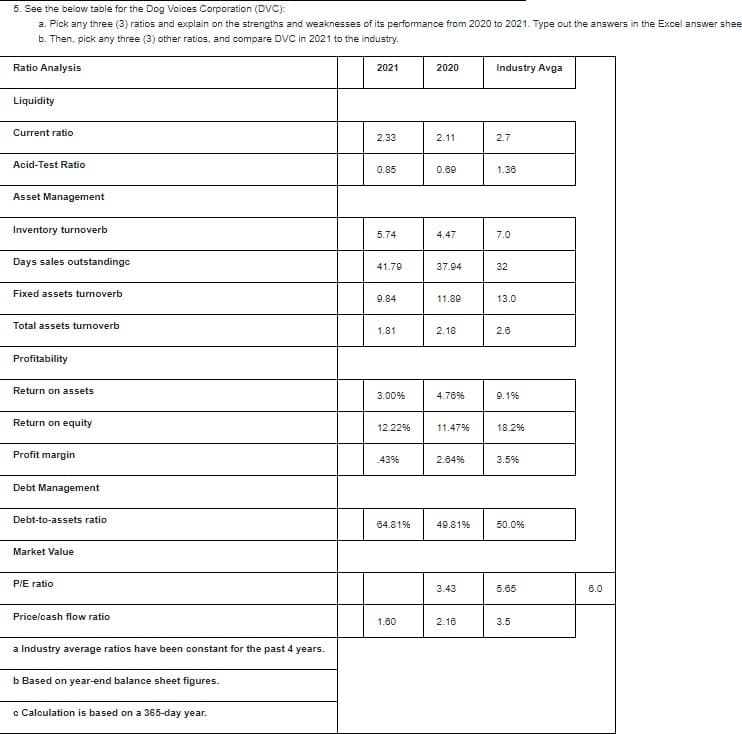

5. See the below table for the Dog Voices Corporation (DVC): a. Pick any three (3) ratios and explain on the strengths and weaknesses of its performance from 2020 to 2021. Type out the answers in the Excel answer sh b. Then, pick any three (3) other ratios, and compare DVC in 2021 to the industry. Ratio Analysis 2021 2020 Industry Avga Liquidity Current ratio 2.33 2.11 2.7 Acid-Test Ratio 0.85 0.69 1.36 Asset Management Inventory turnoverb 5.74 4.47 7.0 Days sales outstandingc 41.79 37.94 32 Fixed assets turnoverb 9.84 11.80 13.0 Total assets turnoverb 1.81 2.18 2.6 Profitability Return on assets 3.00% 4.76% 9.1% Return on equity 12.22% 11.47% 18.2% Profit margin .43% 2.64% 3.5% Debt Management Debt-to-assets ratio 64.81% 49.81% 50.0%

5. See the below table for the Dog Voices Corporation (DVC): a. Pick any three (3) ratios and explain on the strengths and weaknesses of its performance from 2020 to 2021. Type out the answers in the Excel answer sh b. Then, pick any three (3) other ratios, and compare DVC in 2021 to the industry. Ratio Analysis 2021 2020 Industry Avga Liquidity Current ratio 2.33 2.11 2.7 Acid-Test Ratio 0.85 0.69 1.36 Asset Management Inventory turnoverb 5.74 4.47 7.0 Days sales outstandingc 41.79 37.94 32 Fixed assets turnoverb 9.84 11.80 13.0 Total assets turnoverb 1.81 2.18 2.6 Profitability Return on assets 3.00% 4.76% 9.1% Return on equity 12.22% 11.47% 18.2% Profit margin .43% 2.64% 3.5% Debt Management Debt-to-assets ratio 64.81% 49.81% 50.0%

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter3: Analysis Of Financial Statements

Section: Chapter Questions

Problem 14P: The Jimenez Corporation’s forecasted 2020 financial statements follow, along with some industry...

Related questions

Question

please show excel formulas

Transcribed Image Text:5. See the below table for the Dog Voices Corporation (DVC):

a. Pick any three (3) ratios and explain on the strengths and weaknesses of its performance from 2020 to 2021. Type out the answers in the Excel answer shee

b. Then, pick any three (3) other ratios, and compare DVC in 2021 to the industry.

Ratio Analysis

2021

2020

Industry Avga

Liquidity

Current ratio

2.33

2.11

2.7

Acid-Test Ratio

0.85

0.69

1.36

Asset Management

Inventory turnoverb

5.74

4.47

7.0

Days sales outstandingc

41.79

37.94

32

Fixed assets turnoverb

9.84

11.80

13.0

Total assets turnoverb

1.81

2.18

2.6

Profitability

Return on assets

3.00%

4.76%

9.1%

Return on equity

12.22%

11.47%

18.2%

Profit margin

.43%

2.64%

3.5%

Debt Management

Debt-to-assets ratio

64.81%

49.81%

50.0%

Market Value

PIE ratio

3.43

5.65

6.0

Price/cash flow ratio

1.60

2.18

3.5

a Industry average ratios have been constant for the past 4 years.

b Based on year-end balance sheet figures.

c Calculation is based on a 365-day year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning