5. Suppose you are the sole owner of company ABC. The market value of your c $100 and there are 20 shares. Now you are thinking about acquiring the target XYZ with a standing alone market value of $50 with 25 shares outstanding. TI of the two companies is $20. We assume the cost of the merger is zero, meanir shareholders break even. a) Suppose you pay XYZ's shareholders in cash from your company ABC. Wh total firm value post-merger? What is the share price?

5. Suppose you are the sole owner of company ABC. The market value of your c $100 and there are 20 shares. Now you are thinking about acquiring the target XYZ with a standing alone market value of $50 with 25 shares outstanding. TI of the two companies is $20. We assume the cost of the merger is zero, meanir shareholders break even. a) Suppose you pay XYZ's shareholders in cash from your company ABC. Wh total firm value post-merger? What is the share price?

Chapter23: Corporate Restructuring

Section: Chapter Questions

Problem 7P

Related questions

Question

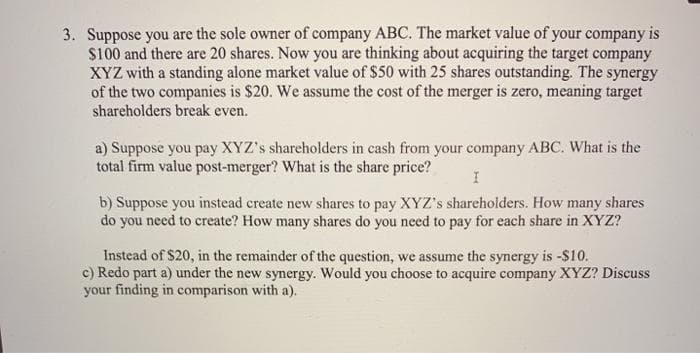

Transcribed Image Text:3. Suppose you are the sole owner of company ABC. The market value of your company is

$100 and there are 20 shares. Now you are thinking about acquiring the target company

XYZ with a standing alone market value of $50 with 25 shares outstanding. The synergy

of the two companies is $20. We assume the cost of the merger is zero, meaning target

shareholders break even.

a) Suppose you pay XYZ's shareholders in cash from your company ABC. What is the

total firm value post-merger? What is the share price?

b) Suppose you instead create new shares to pay XYZ's shareholders. How many shares

do you need to create? How many shares do you need to pay for each share in XYZ?

Instead of $20, in the remainder of the question, we assume the synergy is -$10.

c) Redo part a) under the new synergy. Would you choose to acquire company XYZ? Discuss

your finding in comparison with a).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning