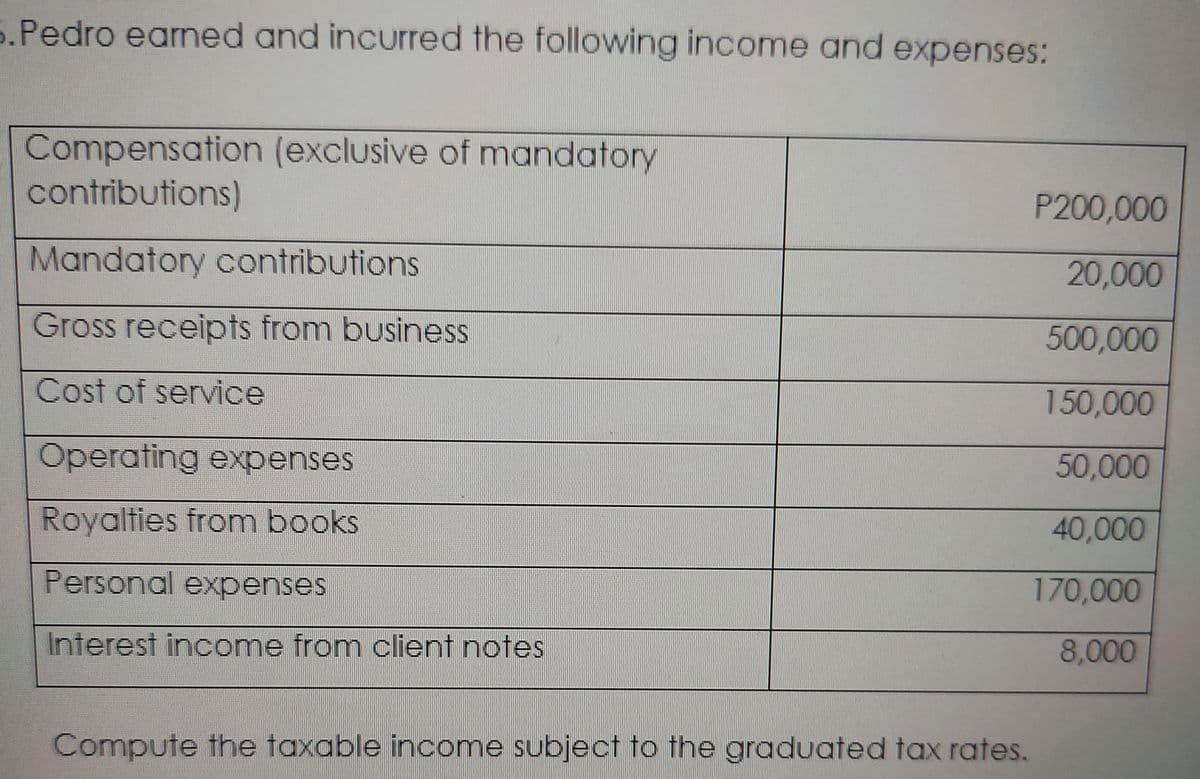

5.Pedro earned and incurred the following income and expenses: Compensation (exclusive of mandatory contributions) P200,000 Mandatory contributions 20,000 Gross receipts from business 500,000 Cost of service 150,000 Operating expenses 50,000 Royalties from books 40,000 Personal expenses 170,000 Interest income from client notes 8,000 Compute the taxable income subject to the graduated tax rates.

5.Pedro earned and incurred the following income and expenses: Compensation (exclusive of mandatory contributions) P200,000 Mandatory contributions 20,000 Gross receipts from business 500,000 Cost of service 150,000 Operating expenses 50,000 Royalties from books 40,000 Personal expenses 170,000 Interest income from client notes 8,000 Compute the taxable income subject to the graduated tax rates.

Chapter14: Property Transactions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 67P

Related questions

Question

450,000

468,000

508,000

558,000

Answer is 450,000 can you tell me how it was solved?

Transcribed Image Text:5.Pedro earned and incurred the following income and expenses:

Compensation (exclusive of mandatory

contributions)

P200,000

Mandatory contributions

20,000

Gross receipts from business

500,000

Cost of service

150,000

Operating expenses

50,000

Royalties from books

40,000

Personal expenses

170,000

Interest income from client notes

8,000

Compute the taxable income subject to the graduated tax rates.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you