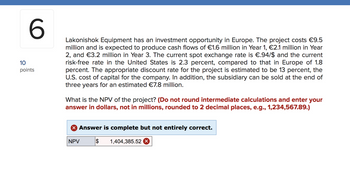

6 10 points Lakonishok Equipment has an investment opportunity in Europe. The project costs €9.5 million and is expected to produce cash flows of €1.6 million in Year 1, €2.1 million in Year 2, and €3.2 million in Year 3. The current spot exchange rate is €.94/$ and the current risk-free rate in the United States is 2.3 percent, compared to that in Europe of 1.8 percent. The appropriate discount rate for the project is estimated to be 13 percent, the U.S. cost of capital for the company. In addition, the subsidiary can be sold at the end of three years for an estimated €7.8 million. What is the NPV of the project? (Do not round intermediate calculations and enter your answer in dollars, not in millions, rounded to 2 decimal places, e.g., 1,234,567.89.) X Answer is complete but not entirely correct. NPV $ 1,404,385.52 X

6 10 points Lakonishok Equipment has an investment opportunity in Europe. The project costs €9.5 million and is expected to produce cash flows of €1.6 million in Year 1, €2.1 million in Year 2, and €3.2 million in Year 3. The current spot exchange rate is €.94/$ and the current risk-free rate in the United States is 2.3 percent, compared to that in Europe of 1.8 percent. The appropriate discount rate for the project is estimated to be 13 percent, the U.S. cost of capital for the company. In addition, the subsidiary can be sold at the end of three years for an estimated €7.8 million. What is the NPV of the project? (Do not round intermediate calculations and enter your answer in dollars, not in millions, rounded to 2 decimal places, e.g., 1,234,567.89.) X Answer is complete but not entirely correct. NPV $ 1,404,385.52 X

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

It looks like you may have submitted a graded question that, per our Honor Code, experts cannot answer. We've credited a question to your account.

Your Question:

Transcribed Image Text:6

10

points

Lakonishok Equipment has an investment opportunity in Europe. The project costs €9.5

million and is expected to produce cash flows of €1.6 million in Year 1, €2.1 million in Year

2, and €3.2 million in Year 3. The current spot exchange rate is €.94/$ and the current

risk-free rate in the United States is 2.3 percent, compared to that in Europe of 1.8

percent. The appropriate discount rate for the project is estimated to be 13 percent, the

U.S. cost of capital for the company. In addition, the subsidiary can be sold at the end of

three years for an estimated €7.8 million.

What is the NPV of the project? (Do not round intermediate calculations and enter your

answer in dollars, not in millions, rounded to 2 decimal places, e.g., 1,234,567.89.)

X Answer is complete but not entirely correct.

NPV

$ 1,404,385.52 X

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education