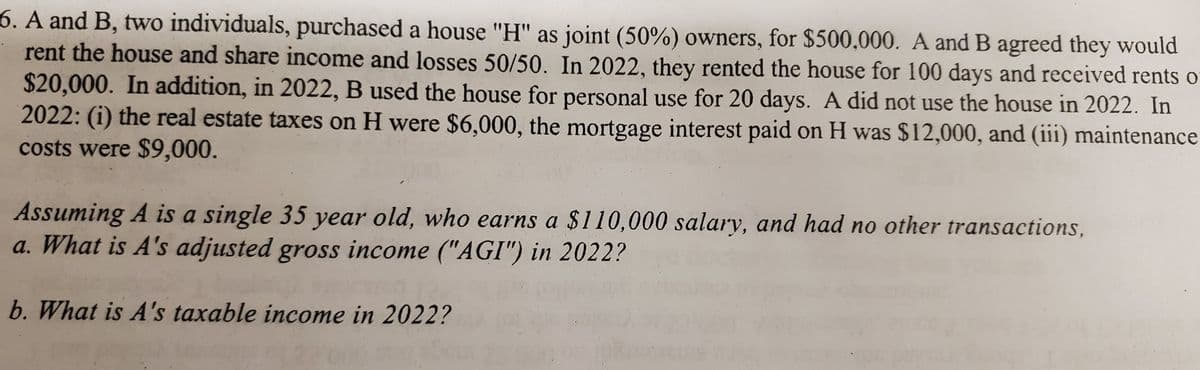

6. A and B, two individuals, purchased a house "H" as joint (50%) owners, for $500,000. A and B agreed they would rent the house and share income and losses 50/50. In 2022, they rented the house for 100 days and received rents of $20,000. In addition, in 2022, B used the house for personal use for 20 days. A did not use the house in 2022. In 2022: (i) the real estate taxes on H were $6,000, the mortgage interest paid on H was $12,000, and (iii) maintenance costs were $9,000. Assuming A is a single 35 year old, who earns a $110,000 salary, and had no other transactions, a. What is A's adjusted gross income ("AGI") in 2022? b. What is A's taxable income in 2022?

6. A and B, two individuals, purchased a house "H" as joint (50%) owners, for $500,000. A and B agreed they would rent the house and share income and losses 50/50. In 2022, they rented the house for 100 days and received rents of $20,000. In addition, in 2022, B used the house for personal use for 20 days. A did not use the house in 2022. In 2022: (i) the real estate taxes on H were $6,000, the mortgage interest paid on H was $12,000, and (iii) maintenance costs were $9,000. Assuming A is a single 35 year old, who earns a $110,000 salary, and had no other transactions, a. What is A's adjusted gross income ("AGI") in 2022? b. What is A's taxable income in 2022?

Chapter15: Property Transactions: Nontaxable Exchanges

Section: Chapter Questions

Problem 1BCRQ

Related questions

Question

Transcribed Image Text:6. A and B, two individuals, purchased a house "H" as joint (50%) owners, for $500,000. A and B agreed they would

rent the house and share income and losses 50/50. In 2022, they rented the house for 100 days and received rents of

$20,000. In addition, in 2022, B used the house for personal use for 20 days. A did not use the house in 2022. In

2022: (i) the real estate taxes on H were $6,000, the mortgage interest paid on H was $12,000, and (iii) maintenance

costs were $9,000.

Assuming A is a single 35 year old, who earns a $110,000 salary, and had no other transactions,

a. What is A's adjusted gross income ("AGI") in 2022?

b. What is A's taxable income in 2022?

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT