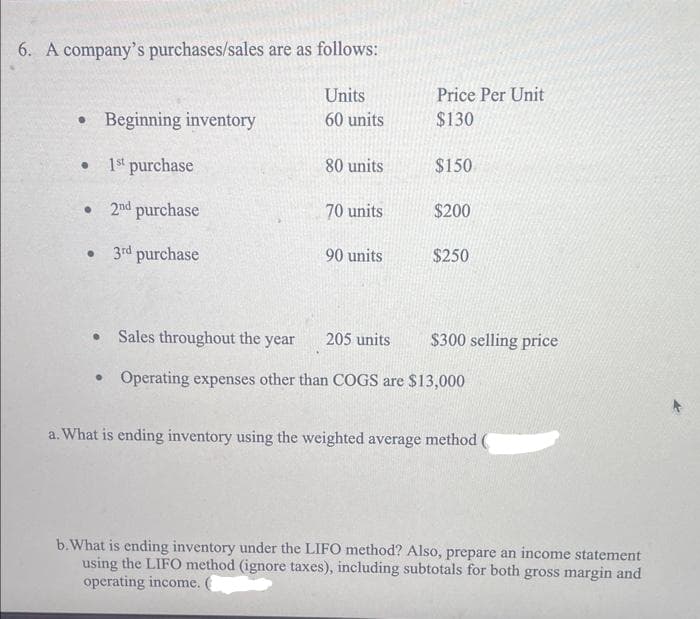

6. A company's purchases/sales are as follows: • Beginning inventory 1st purchase • 2nd purchase 3rd purchase ● ● Units 60 units 80 units 70 units 90 units Price Per Unit $130 $150 $200 $250 • Sales throughout the year 205 units • Operating expenses other than COGS are $13,000 $300 selling price a. What is ending inventory using the weighted average method ( b. What is ending inventory under the LIFO method? Also, prepare an income statement using the LIFO method (ignore taxes), including subtotals for both gross margin and operating income.

6. A company's purchases/sales are as follows: • Beginning inventory 1st purchase • 2nd purchase 3rd purchase ● ● Units 60 units 80 units 70 units 90 units Price Per Unit $130 $150 $200 $250 • Sales throughout the year 205 units • Operating expenses other than COGS are $13,000 $300 selling price a. What is ending inventory using the weighted average method ( b. What is ending inventory under the LIFO method? Also, prepare an income statement using the LIFO method (ignore taxes), including subtotals for both gross margin and operating income.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 62E

Related questions

Topic Video

Question

Don't give answer in image format

Transcribed Image Text:6. A company's purchases/sales are as follows:

• Beginning inventory

● 1st purchase

• 2nd purchase

•

3rd purchase

Units

60 units

●

80 units

70 units

90 units

Price Per Unit

$130

205 units

$150

$200

• Sales throughout the year

Operating expenses other than COGS are $13,000

$250

$300 selling price

a. What is ending inventory using the weighted average method (

b. What is ending inventory under the LIFO method? Also, prepare an income statement

using the LIFO method (ignore taxes), including subtotals for both gross margin and

operating income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning