6. Market value ratios Ratios are mostly calculated using data drawn from the financial statements of a firm. However, another group of ratios, called market value ratios, relate to a firm's observable market value, stock prices, and book values, integrating information from both the market and the firm's financial statements. Consider the case of Cold Goose Metal Works Inc.: Cold Goose Metal Works Inc. just reported earnings after tax (also called net income) of $9,000,000 and a current stock price of $34.00 per share. The company is forecasting an increase of 25% for its after-tax income next year, but it also expects it will have to issue 2,500,000 new shares of stock (raising its shares outstanding from 5,500,000 to 8,000,000). If Cold Goose's forecast turns out to be correct and its price/earnings (P/E) ratio does not change, what does the company's management expect its stock price to be one year from now? (Round any P/E ratio calculation to four decimal places.) O $29.23 per share O $34.00 per share O $21.92 per share O $36.54 per share

6. Market value ratios Ratios are mostly calculated using data drawn from the financial statements of a firm. However, another group of ratios, called market value ratios, relate to a firm's observable market value, stock prices, and book values, integrating information from both the market and the firm's financial statements. Consider the case of Cold Goose Metal Works Inc.: Cold Goose Metal Works Inc. just reported earnings after tax (also called net income) of $9,000,000 and a current stock price of $34.00 per share. The company is forecasting an increase of 25% for its after-tax income next year, but it also expects it will have to issue 2,500,000 new shares of stock (raising its shares outstanding from 5,500,000 to 8,000,000). If Cold Goose's forecast turns out to be correct and its price/earnings (P/E) ratio does not change, what does the company's management expect its stock price to be one year from now? (Round any P/E ratio calculation to four decimal places.) O $29.23 per share O $34.00 per share O $21.92 per share O $36.54 per share

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter12: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 2MAD: Analyze and compare Bank of America and Wells Fargo Bank of America Corporation (BAC) and Wells...

Related questions

Question

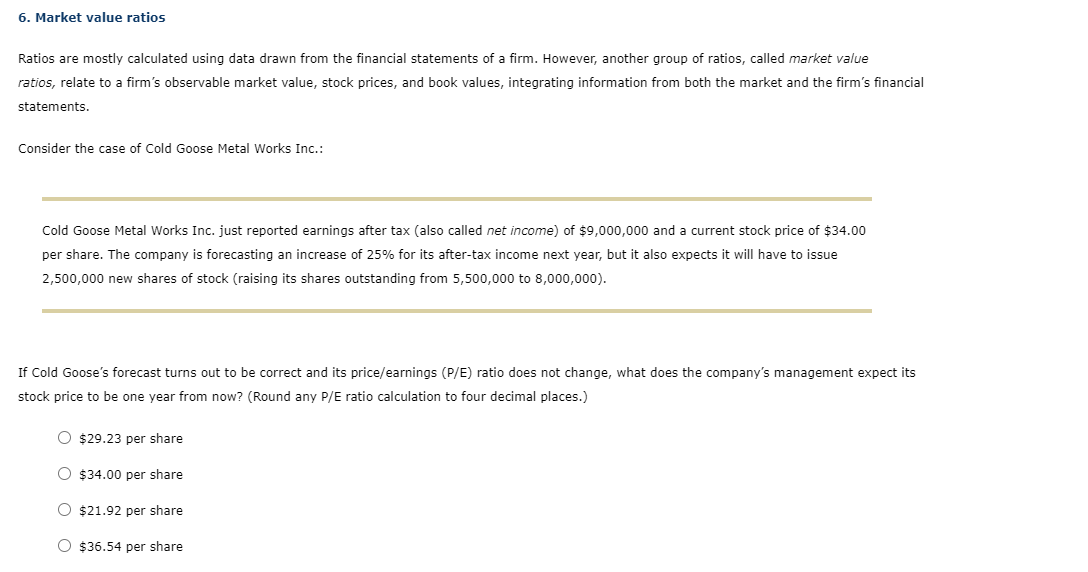

Transcribed Image Text:6. Market value ratios

Ratios are mostly calculated using data drawn from the financial statements of a firm. However, another group of ratios, called market value

ratios, relate to a firm's observable market value, stock prices, and book values, integrating information from both the market and the firm's financial

statements.

Consider the case of Cold Goose Metal Works Inc.:

Cold Goose Metal Works Inc. just reported earnings after tax (also called net income) of $9,000,000 and a current stock price of $34.00

per share. The company is forecasting an increase of 25% for its after-tax income next year, but it also expects it will have to issue

2,500,000 new shares of stock (raising its shares outstanding from 5,500,000 to 8,000,000).

If Cold Goose's forecast turns out to be correct and its price/earnings (P/E) ratio does not change, what does the company's management expect its

stock price to be one year from now? (Round any P/E ratio calculation to four decimal places.)

O $29.23 per share

$34.00 per share

O $21.92 per share

O $36.54 per share

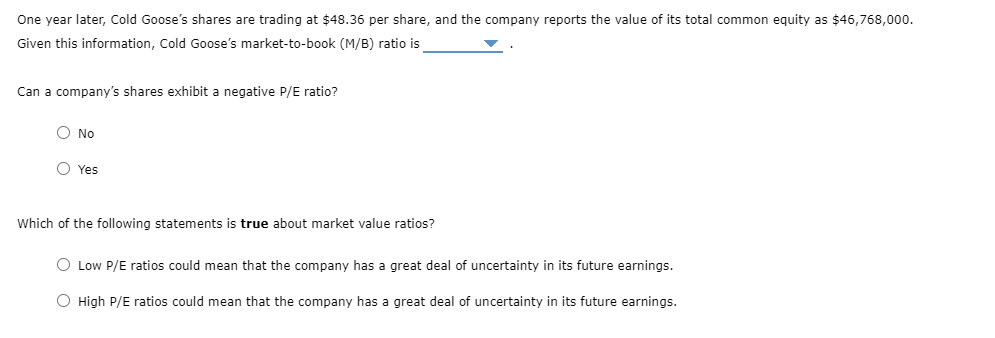

Transcribed Image Text:One year later, Cold Goose's shares are trading at $48.36 per share, and the company reports the value of its total common equity as $46,768,000.

Given this information, Cold Goose's market-to-book (M/B) ratio is

Can a company's shares exhibit a negative P/E ratio?

O No

O Yes

Which of the following statements is true about market value ratios?

O Low P/E ratios could mean that the company has a great deal of uncertainty in its future earnings.

O High P/E ratios could mean that the company has a great deal of uncertainty in its future earnings.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT