6. Mommy Hai-dee, Inc. as of yearend of 2019 has a Total Working Capital of Php 3,000,000.00 and with a Current ratio of 2:1. Non- current asset balance is Php 2,000,000.00 comprised of Fixed Asset. There is no long-term debt with debt ratio of only 0.25:1. Using Book Value Method, what is the minimum value it can sell the 15% of the business? a. Php 750,000.00 b. Php 550,000.00 c. Php 450,000.00 d. Php 400,000.00

6. Mommy Hai-dee, Inc. as of yearend of 2019 has a Total Working Capital of Php 3,000,000.00 and with a Current ratio of 2:1. Non- current asset balance is Php 2,000,000.00 comprised of Fixed Asset. There is no long-term debt with debt ratio of only 0.25:1. Using Book Value Method, what is the minimum value it can sell the 15% of the business? a. Php 750,000.00 b. Php 550,000.00 c. Php 450,000.00 d. Php 400,000.00

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter16: Financial Planning And Forecasting

Section: Chapter Questions

Problem 8P: LONG-TERM FINANCING NEEDED At year-end 2019, total assets for Arrington Inc. were 1.8 million and...

Related questions

Question

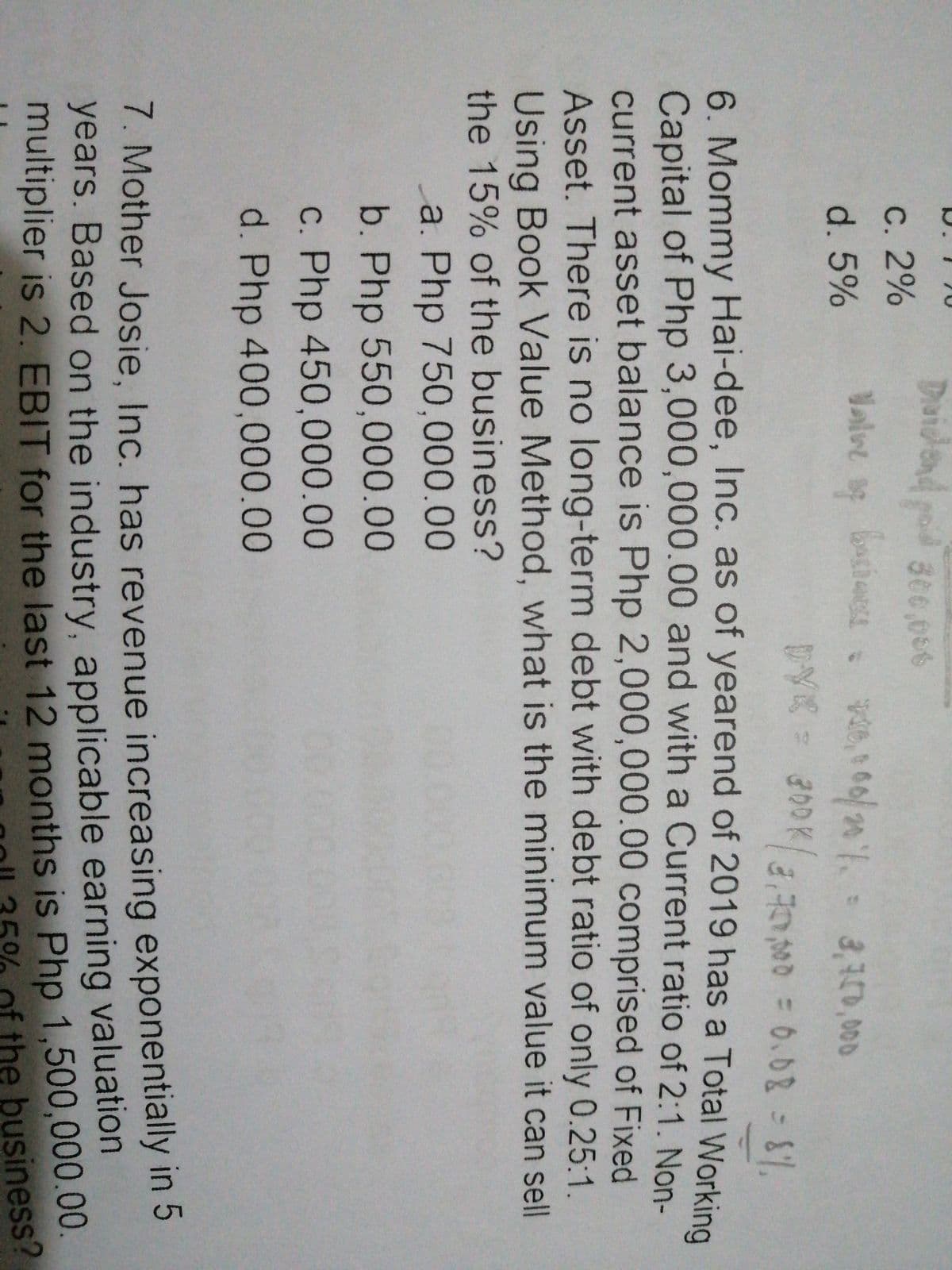

Transcribed Image Text:Dvidend

pod see.0s6

300,006

C. 2%

Valve

d. 5%

3,100,000

300K

6. Mommy Hai-dee, Inc. as of yearend of 2019 has a Total Working

Capital of Php 3,000,000.00 and with a Current ratio of 2:1. Non-

current asset balance is Php 2,000,000.00 comprised of Fixed

Asset. There is no long-term debt with debt ratio of only 0.25:1.

Using Book Value Method, what is the minimum value it can sel

the 15% of the business?

a. Php 750,000.00

b. Php 550,000.00

c. Php 450,000.00

d. Php 400,000.00

7. Mother Josie, Inc. has revenue increasing exponentially in 5

years. Based on the industry, applicable earning valuation

multiplier is 2. EBIT for the last 12 months is Php 1,500,000.00.

of the business?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning