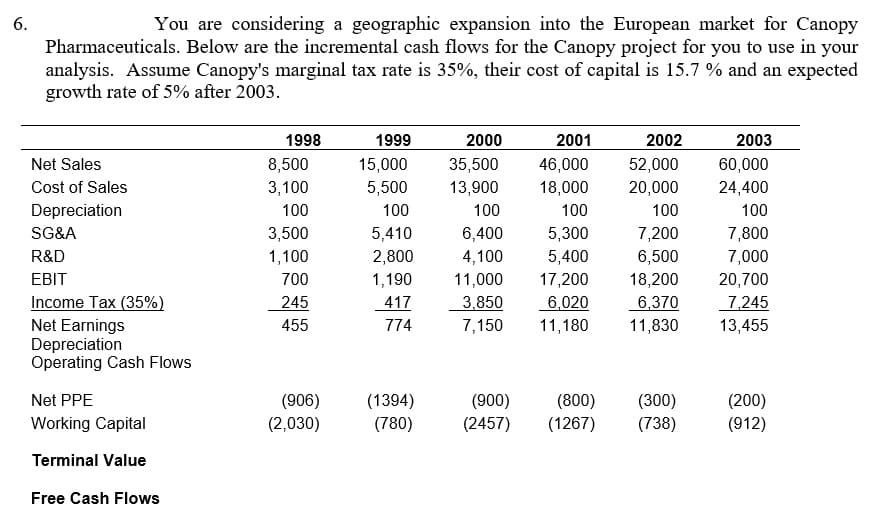

6. You are considering a geographic expansion into the European market for Canopy Pharmaceuticals. Below are the incremental cash flows for the Canopy project for you to use in your analysis. Assume Canopy's marginal tax rate is 35%, their cost of capital is 15.7 % and an expected growth rate of 5% after 2003. 1998 1999 2000 2001 2002 2003 Net Sales 8,500 15,000 35,500 46,000 52,000 60,000 24,400 Cost of Sales 3,100 5,500 13,900 18,000 20,000 Depreciation 100 100 100 100 100 100 SG&A 3,500 5,410 6,400 5,300 7,200 7,800 7,000 R&D 1,100 2,800 4,100 5,400 6,500 1,190 417 EBIT 700 11,000 17,200 18,200 20,700 Income Tax (35%) 6,370 245 455 3.850 6,020 7,245 Net Earnings Depreciation Operating Cash Flows 774 7,150 11,180 11,830 13,455 Net PPE (906) (2,030) (1394) (900) (800) (300) (200) Working Capital (780) (2457) (1267) (738) (912) Terminal Value Free Cash Flows

6. You are considering a geographic expansion into the European market for Canopy Pharmaceuticals. Below are the incremental cash flows for the Canopy project for you to use in your analysis. Assume Canopy's marginal tax rate is 35%, their cost of capital is 15.7 % and an expected growth rate of 5% after 2003. 1998 1999 2000 2001 2002 2003 Net Sales 8,500 15,000 35,500 46,000 52,000 60,000 24,400 Cost of Sales 3,100 5,500 13,900 18,000 20,000 Depreciation 100 100 100 100 100 100 SG&A 3,500 5,410 6,400 5,300 7,200 7,800 7,000 R&D 1,100 2,800 4,100 5,400 6,500 1,190 417 EBIT 700 11,000 17,200 18,200 20,700 Income Tax (35%) 6,370 245 455 3.850 6,020 7,245 Net Earnings Depreciation Operating Cash Flows 774 7,150 11,180 11,830 13,455 Net PPE (906) (2,030) (1394) (900) (800) (300) (200) Working Capital (780) (2457) (1267) (738) (912) Terminal Value Free Cash Flows

Chapter11: Capital Budgeting And Risk

Section: Chapter Questions

Problem 20P

Related questions

Question

Estimate the free cash flows ('98-'03), the terminal value of the Canopy project in 2003 & the

Transcribed Image Text:6.

You are considering a geographic expansion into the European market for Canopy

Pharmaceuticals. Below are the incremental cash flows for the Canopy project for you to use in your

analysis. Assume Canopy's marginal tax rate is 35%, their cost of capital is 15.7 % and an expected

growth rate of 5% after 2003.

1998

1999

2000

2001

2002

2003

Net Sales

8,500

15,000

35,500

46,000

52,000

60,000

Cost of Sales

3,100

5,500

13,900

18,000

20,000

24,400

Depreciation

100

100

100

100

100

100

SG&A

3,500

5,410

6,400

5,300

7,200

7,800

4,100

11,000

R&D

1,100

2,800

5,400

6,500

7,000

EBIT

700

1,190

17,200

18,200

20,700

Income Tax (35%)

245

6,020

417

774

3,850

6.370

7,245

7,150

Net Earnings

Depreciation

Operating Cash Flows

455

11,180

11,830

13,455

Net PPE

(906)

(1394)

(780)

(900)

(800)

(300)

(200)

Working Capital

(2,030)

(2457)

(1267)

(738)

(912)

Terminal Value

Free Cash Flows

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT