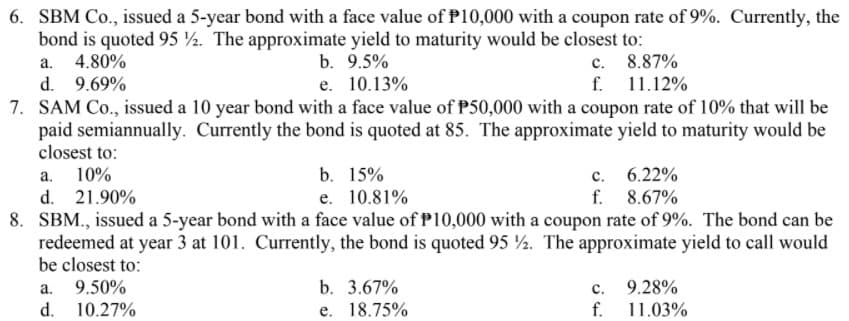

6. SBM Co., issued a 5-year bond with a face value of P10,000 with a coupon rate of 9%. Currently, the bond is quoted 95 ½. The approximate yield to maturity would be closest to: a. 4.80% d. 9.69% 7. SAM Co., issued a 10 year bond with a face value of P50,000 with a coupon rate of 10% that will be paid semiannually. Currently the bond is quoted at 85. The approximate yield to maturity would be closest to: b. 9.5% e. 10.13% c. 8.87% f. 11.12% a. 10% d. 21.90% b. 15% e. 10.81% c. 6.22% f. 8.67% 8. SBM., issued a 5-year bond with a face value of P10,000 with a coupon rate of 9%. The bond can be redeemed at year 3 at 101. Currently, the bond is quoted 95 2. The approximate yield to call would be closest to: 9.28% f. 11.03% a. 9.50% b. 3.67% с. d. 10.27% e. 18.75%

6. SBM Co., issued a 5-year bond with a face value of P10,000 with a coupon rate of 9%. Currently, the bond is quoted 95 ½. The approximate yield to maturity would be closest to: a. 4.80% d. 9.69% 7. SAM Co., issued a 10 year bond with a face value of P50,000 with a coupon rate of 10% that will be paid semiannually. Currently the bond is quoted at 85. The approximate yield to maturity would be closest to: b. 9.5% e. 10.13% c. 8.87% f. 11.12% a. 10% d. 21.90% b. 15% e. 10.81% c. 6.22% f. 8.67% 8. SBM., issued a 5-year bond with a face value of P10,000 with a coupon rate of 9%. The bond can be redeemed at year 3 at 101. Currently, the bond is quoted 95 2. The approximate yield to call would be closest to: 9.28% f. 11.03% a. 9.50% b. 3.67% с. d. 10.27% e. 18.75%

Chapter6: Bonds (debt) - Characteristics And Valuation

Section: Chapter Questions

Problem 4PROB

Related questions

Question

Transcribed Image Text:6. SBM Co., issued a 5-year bond with a face value of P10,000 with a coupon rate of 9%. Currently, the

bond is quoted 95 ½. The approximate yield to maturity would be closest to:

a. 4.80%

d. 9.69%

7. SAM Co., issued a 10 year bond with a face value of P50,000 with a coupon rate of 10% that will be

paid semiannually. Currently the bond is quoted at 85. The approximate yield to maturity would be

closest to:

b. 9.5%

c. 8.87%

f. 11.12%

e. 10.13%

b. 15%

e. 10.81%

c. 6.22%

f. 8.67%

а.

10%

d. 21.90%

8. SBM., issued a 5-year bond with a face value of P10,000 with a coupon rate of 9%. The bond can be

redeemed at year 3 at 101. Currently, the bond is quoted 95 ½. The approximate yield to call would

be closest to:

9.50%

d. 10.27%

a.

b. 3.67%

с.

9.28%

e. 18.75%

f.

11.03%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you