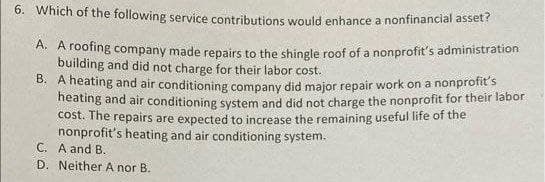

6. Which of the following service contributions would enhance a nonfinancial asset? A. A roofing company made repairs to the shingle roof of a nonprofit's administration building and did not charge for their labor cost. B. A heating and air conditioning company did major repair work on a nonprofit's heating and air conditioning system and did not charge the nonprofit for their labor cost. The repairs are expected to increase the remaining useful life of the nonprofit's heating and air conditioning system. C. A and B. D. Neither A nor B.

6. Which of the following service contributions would enhance a nonfinancial asset? A. A roofing company made repairs to the shingle roof of a nonprofit's administration building and did not charge for their labor cost. B. A heating and air conditioning company did major repair work on a nonprofit's heating and air conditioning system and did not charge the nonprofit for their labor cost. The repairs are expected to increase the remaining useful life of the nonprofit's heating and air conditioning system. C. A and B. D. Neither A nor B.

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 23P

Related questions

Question

Transcribed Image Text:6. Which of the following service contributions would enhance a nonfinancial asset?

A. Aroofing company made repairs to the shingle roof of a nonprofit's administration

building and did not charge for their labor cost.

B. A heating and air conditioning company did major repair work on a nonprofit's

eating and air conditioning system and did not charge the nonprofit for their labor

cost. The repairs are expected to increase the remaining useful life of the

nonprofit's heating and air conditioning system.

C. A and B.

D. Neither A nor B.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage