6. Yerojin Company provide the folowing data on December 31, 2022: Petty cash fund P 12,500 Cash on hand 250,000 Current account 625,000 Cash in sinking fund Money market placement Savings deposit - set aside for dividend payable on June 30, 2022 750,000 s00,000 125,000 The petty cash fund included unreplenished petty cash vouchers of PS,000. The cash on hand included a customer check of P100,000 received on December 15, 2021 but dated January 15, 2022. The sinking fund is restricted for the payment of bonds payable that is due on July 31, 2023. What is the amount of cash and cash equivalents should be reported on December 31, 2022? A 907,000 C 1,657,500 D. 2,157,500 B. 1,407,500

6. Yerojin Company provide the folowing data on December 31, 2022: Petty cash fund P 12,500 Cash on hand 250,000 Current account 625,000 Cash in sinking fund Money market placement Savings deposit - set aside for dividend payable on June 30, 2022 750,000 s00,000 125,000 The petty cash fund included unreplenished petty cash vouchers of PS,000. The cash on hand included a customer check of P100,000 received on December 15, 2021 but dated January 15, 2022. The sinking fund is restricted for the payment of bonds payable that is due on July 31, 2023. What is the amount of cash and cash equivalents should be reported on December 31, 2022? A 907,000 C 1,657,500 D. 2,157,500 B. 1,407,500

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter5: Internal Control And Cash

Section: Chapter Questions

Problem 2SEQ

Related questions

Question

100%

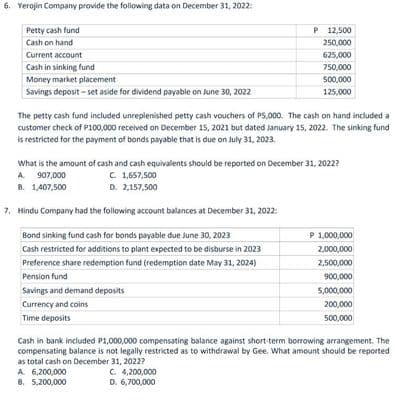

Transcribed Image Text:6. Yerojin Company provide the following data on December 31, 2022:

Petty cash fund

P 12,500

Cash on hand

250,000

Current account

625,000

Cash in sinking fund

750,000

Money market placement

Savings deposit - set aside for dividend payable on June 30, 2022

500,000

125,000

The petty cash fund included unreplenished petty cash vouchers of P5,000. The cash on hand included a

customer check of P100,000 received on December 15, 2021 but dated January 15, 2022. The sinking fund

is restricted for the payment of bonds payable that is due on July 31, 2023.

What is the amount of cash and cash equivalents should be reported on December 31, 2022?

A 907,000

B. 1,407,500

C 1,657,500

D. 2,157,500

7. Hindu Company had the following account balances at December 31, 2022:

Bond sinking fund cash for bonds payable due June 30, 2023

P 1,000,000

Cash restricted for additions to plant expected to be disburse in 2023

2,000,000

Preference share redemption fund (redemption date May 31, 2024)

2,500,000

Pension fund

900,000

Savings and demand deposits

5,000,000

Currency and coins

200,000

Time deposits

500,000

Cash in bank included P1,000,000 compensating balance against short-term borrowing arrangement. The

compensating balance is not legally restricted as to withdrawal by Gee. What amount should be reported

as total cash on December 31, 2022?

A. 6,200,000

8. 5,200,000

C 4,200,000

D. 6,700,000

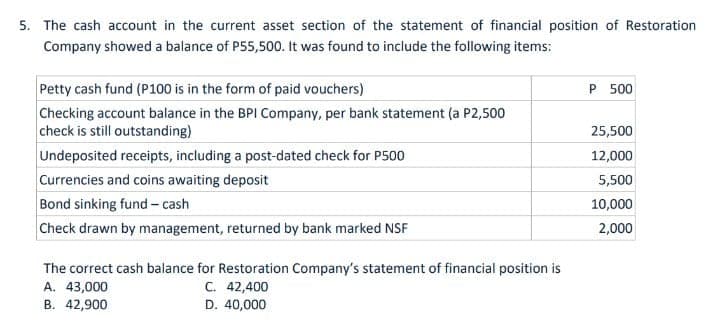

Transcribed Image Text:5. The cash account in the current asset section of the statement of financial position of Restoration

Company showed a balance of P55,500. It was found to include the following items:

Petty cash fund (P100 is in the form of paid vouchers)

Checking account balance in the BPI Company, per bank statement (a P2,500

check is still outstanding)

P 500

25,500

Undeposited receipts, including a post-dated check for P500

Currencies and coins awaiting deposit

Bond sinking fund - cash

Check drawn by management, returned by bank marked NSF

12,000

5,500

10,000

2,000

The correct cash balance for Restoration Company's statement of financial position is

C. 42,400

D. 40,000

A. 43,000

B. 42,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub