61. A and B are partners sharing profits in the ratio of 2:3. Their Balance St shows Machinery at 2,00,000; Stock at 80,000 and Debtors at 1,60, Cis admitted and new profit sharing ratio is agreed at 6:9:5. Machiner revalued at 1,40,000 and a provision is made for doubtful debts @5%. share in loss on revaluation amount to 20,000. Revalued value of Stock G0.000 be: (A) 262,000 (B) 1,00,000 (C) 260,000 (D) 98,000

61. A and B are partners sharing profits in the ratio of 2:3. Their Balance St shows Machinery at 2,00,000; Stock at 80,000 and Debtors at 1,60, Cis admitted and new profit sharing ratio is agreed at 6:9:5. Machiner revalued at 1,40,000 and a provision is made for doubtful debts @5%. share in loss on revaluation amount to 20,000. Revalued value of Stock G0.000 be: (A) 262,000 (B) 1,00,000 (C) 260,000 (D) 98,000

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 1PA: The partnership of Tatum and Brook shares profits and losses in a 60:40 ratio respectively after...

Related questions

Question

Transcribed Image Text:ADMISSION OF A PARTNER

4.231

(A) 4:3:5

(C) 1:2:2

() 2:2:1

(D) 2:1:2

HOTS

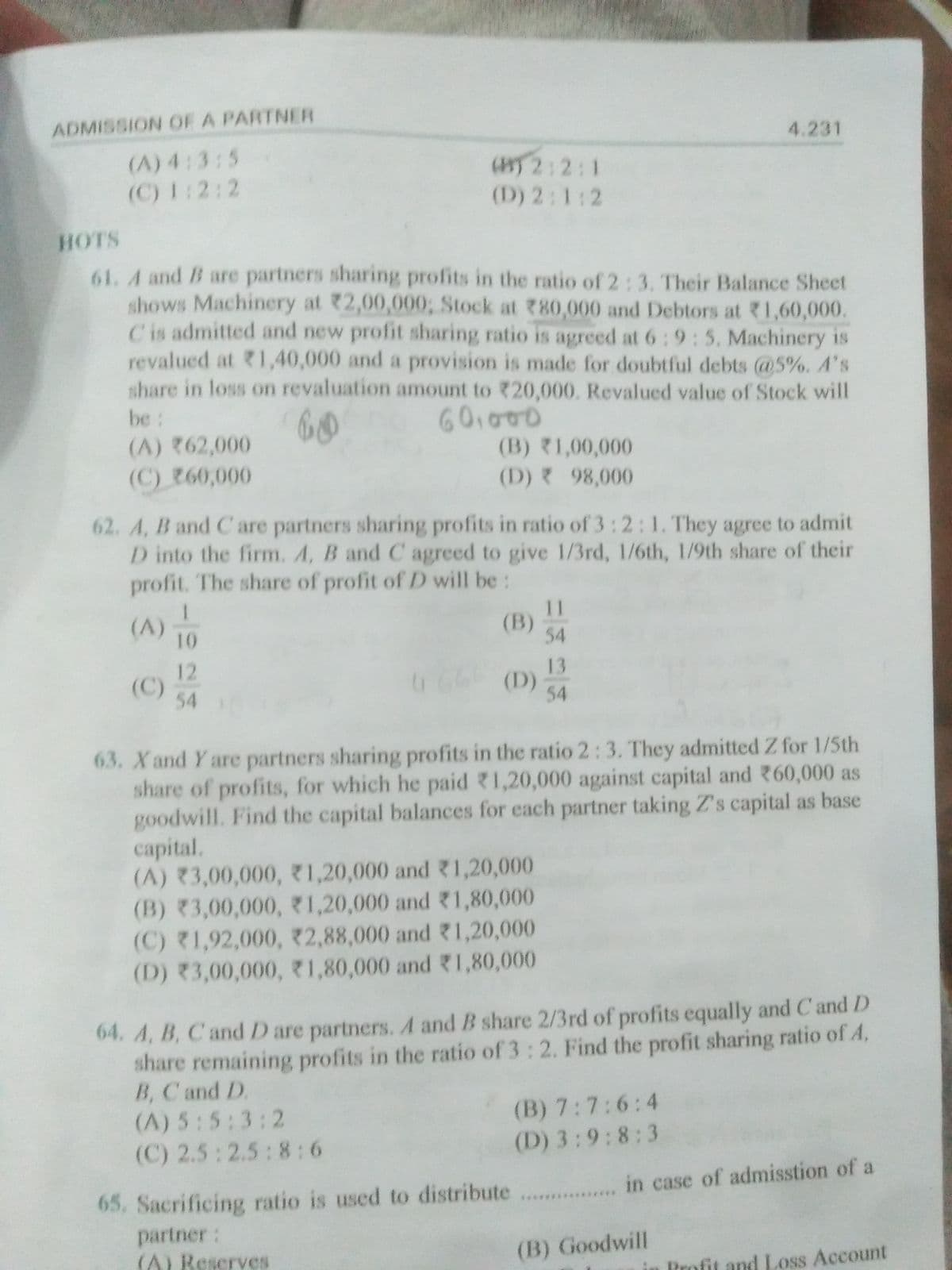

61. A and B are partners sharing profits in the ratio of 2: 3. Their Balance Sheet

shows Machinery at 2,00,000; Stock at 780,000 and Debtors at 1,60,000.

Cis admitted and new profit sharing ratio is agreed at 6:9:5. Machinery is

revalued at 1,40,000 and a provision is made for doubtful debts @5%. A's

share in loss on revaluation amount to 20,000. Revalued value of Stock will

be:

60

60.000

(A) 62,000

(B) 1,00,000

(C) 60,000

(D) 98,000

62. A, B and C are partners sharing profits in ratio of 3:2:1. They agree to admit

D into the firm. A, B and C agreed to give 1/3rd, 1/6th, 1/9th share of their

profit. The share of profit of D will be:

(A)

10

11

(B)

54

12

(C)

54

13

(D)

54

63. Xand Y are partners sharing profits in the ratio 2:3. They admitted Z for 1/5th

share of profits, for which he paid 1,20,000 against capital and 60,000 as

goodwill. Find the capital balances for each partner taking Z's capital as base

capital.

(A) 23,00,000, 1,20,000 and 1,20,000

(B) 3,00,000, 1,20,000 and 1,80,000

(C) 1,92,000, 2,88,000 and 1,20,000

(D) 3,00,000, 1,80,000 and 1,80,000

64. A, B, CandD are partners. A and B share 2/3rd of profits equally and C and D

share remaining profits in the ratio of 3: 2. Find the profit sharing ratio of A,

B, C and D.

(A) 5:5:3:2

(C) 2.5:2.5:8:6

(B) 7:7:6:4

(D) 3:9:8:3

in case of admisstion of a

65. Sacrificing ratio is used to distribute

partner:

(AL Reserves

(B) Goodwill

in Brofit and Loss Account

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning