681 ABC Co. changes its business model and determines the following information: 7. Carrying amount of previous classification Fair value on reclassification date (Jan. 1, 20x3) financial asset under 100,000 120,000 Requirements: Provide the entry (entries) on reclassification date under the following scenarios: Amortized cost to FVPL a. FVPL to Amortized cost b. Amortized cost to FVOCI (mandatory) FVOCI (mandatory) to Amortized cost - the cumulative balance of gain previously recognized in equity is P5,000. FVPL to FVOCI (mandatory) FVOCI (mandatory) to FVPL the cumulative balance of gain previously recognized in equity is P5,000. C. www d. е. www f. २२७०घरा Investments 682 Chapter 11 Disclosu 12. Whic requi 9. ABC Co. acquires bonds with face amount of P100,000 at fair value of P100,000. The effective interest rate is 10%, equal to the nominal interest rate. ABC Co. classifies the bonds as Impairment finar subsequently measured at FVOCI a. At the reporting date, the fair value of the bonds decreases to P90,000. ABC Co. estimates 12-month expected credit losses of b. C. P3,000. d. Requirements: Prepare the year-end journal entries to recognize the impairment loss and to accrue the interest income for the year (Adapted (assume 1-year interest). 13. In Dividends wh 10. Karter Company purchased 200 out of the 1,000 outstanding shares of Flynn Company's common stock (ordinary shares) for P180,000 o January 2, 2004. During 2004, Flynn Company declared dividends of P30,000 and reported earnings for the year of P120,000 a. b. с. If Karter Company used the fair value method of accounting for its investment in Flynn Company, how much dividend income is recognized by Karter in 2004? (Adapted) d. (ACCA Stock rights 11. Karter Company holds 200 shares of Flynn Companys common stock. On September 30, 2004, Flynn Compay issued stock rights on a "1-for-1" basis. The stock rights PRO 1. C are exercisable until June 30, 2005. The stock rights have fair values per right of P5.00 and P5.50 on September 30, 2004 and December 31, 2004, respectively. How much is the carrying amount of the stock rights in Karter's December 31, 2004 Ja statement of financial position? (Adapted)

681 ABC Co. changes its business model and determines the following information: 7. Carrying amount of previous classification Fair value on reclassification date (Jan. 1, 20x3) financial asset under 100,000 120,000 Requirements: Provide the entry (entries) on reclassification date under the following scenarios: Amortized cost to FVPL a. FVPL to Amortized cost b. Amortized cost to FVOCI (mandatory) FVOCI (mandatory) to Amortized cost - the cumulative balance of gain previously recognized in equity is P5,000. FVPL to FVOCI (mandatory) FVOCI (mandatory) to FVPL the cumulative balance of gain previously recognized in equity is P5,000. C. www d. е. www f. २२७०घरा Investments 682 Chapter 11 Disclosu 12. Whic requi 9. ABC Co. acquires bonds with face amount of P100,000 at fair value of P100,000. The effective interest rate is 10%, equal to the nominal interest rate. ABC Co. classifies the bonds as Impairment finar subsequently measured at FVOCI a. At the reporting date, the fair value of the bonds decreases to P90,000. ABC Co. estimates 12-month expected credit losses of b. C. P3,000. d. Requirements: Prepare the year-end journal entries to recognize the impairment loss and to accrue the interest income for the year (Adapted (assume 1-year interest). 13. In Dividends wh 10. Karter Company purchased 200 out of the 1,000 outstanding shares of Flynn Company's common stock (ordinary shares) for P180,000 o January 2, 2004. During 2004, Flynn Company declared dividends of P30,000 and reported earnings for the year of P120,000 a. b. с. If Karter Company used the fair value method of accounting for its investment in Flynn Company, how much dividend income is recognized by Karter in 2004? (Adapted) d. (ACCA Stock rights 11. Karter Company holds 200 shares of Flynn Companys common stock. On September 30, 2004, Flynn Compay issued stock rights on a "1-for-1" basis. The stock rights PRO 1. C are exercisable until June 30, 2005. The stock rights have fair values per right of P5.00 and P5.50 on September 30, 2004 and December 31, 2004, respectively. How much is the carrying amount of the stock rights in Karter's December 31, 2004 Ja statement of financial position? (Adapted)

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Please answer 7, 9,10,11. Thank you.

Transcribed Image Text:681

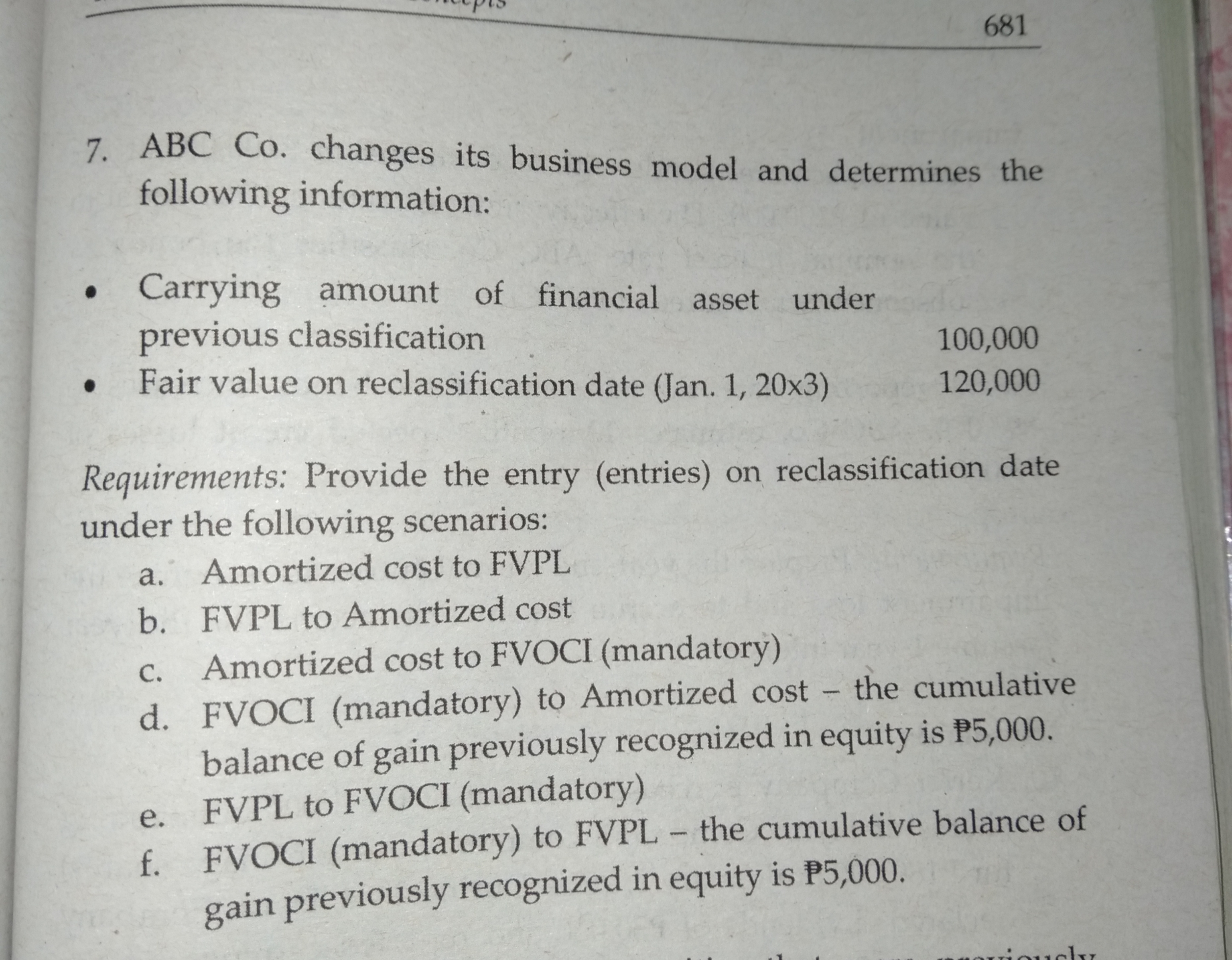

ABC Co. changes its business model and determines the

following information:

7.

Carrying amount of

previous classification

Fair value on reclassification date (Jan. 1, 20x3)

financial asset under

100,000

120,000

Requirements: Provide the entry (entries) on reclassification date

under the following scenarios:

Amortized cost to FVPL

a.

FVPL to Amortized cost

b.

Amortized cost to FVOCI (mandatory)

FVOCI (mandatory) to Amortized cost - the cumulative

balance of gain previously recognized in equity is P5,000.

FVPL to FVOCI (mandatory)

FVOCI (mandatory) to FVPL the cumulative balance of

gain previously recognized in equity is P5,000.

C.

www

d.

е.

www

f.

२२७०घरा

Transcribed Image Text:Investments

682

Chapter 11

Disclosu

12. Whic

requi

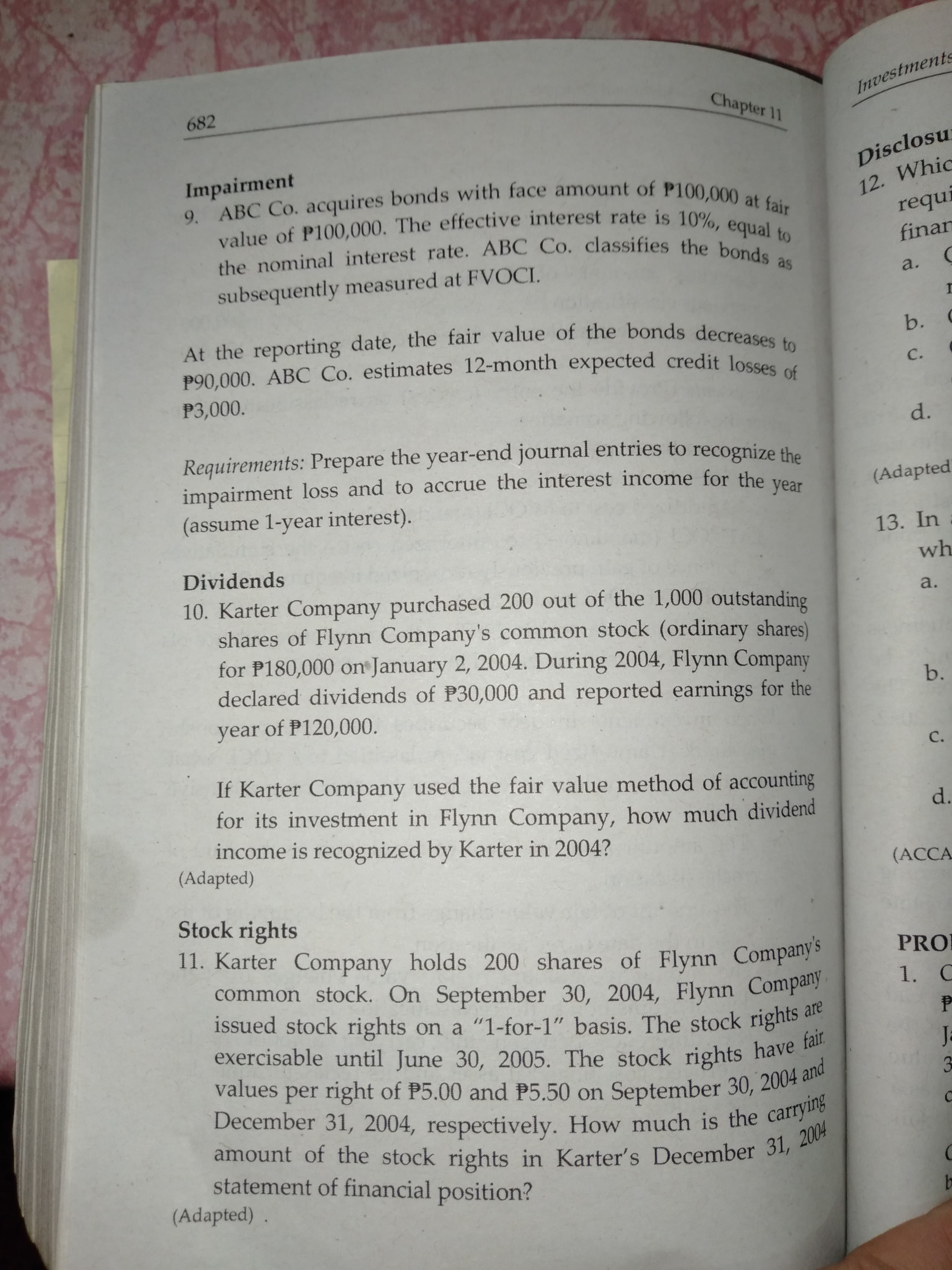

9. ABC Co. acquires bonds with face amount of P100,000 at fair

value of P100,000. The effective interest rate is 10%, equal to

the nominal interest rate. ABC Co. classifies the bonds as

Impairment

finar

subsequently measured at FVOCI

a.

At the reporting date, the fair value of the bonds decreases to

P90,000. ABC Co. estimates 12-month expected credit losses of

b.

C.

P3,000.

d.

Requirements: Prepare the year-end journal entries to recognize the

impairment loss and to accrue the interest income for the year

(Adapted

(assume 1-year interest).

13. In

Dividends

wh

10. Karter Company purchased 200 out of the 1,000 outstanding

shares of Flynn Company's common stock (ordinary shares)

for P180,000 o January 2, 2004. During 2004, Flynn Company

declared dividends of P30,000 and reported earnings for the

year of P120,000

a.

b.

с.

If Karter Company used the fair value method of accounting

for its investment in Flynn Company, how much dividend

income is recognized by Karter in 2004?

(Adapted)

d.

(ACCA

Stock rights

11. Karter Company holds 200 shares of Flynn Companys

common stock. On September 30, 2004, Flynn Compay

issued stock rights on a "1-for-1" basis. The stock rights

PRO

1. C

are

exercisable until June 30, 2005. The stock rights have fair

values per right of P5.00 and P5.50 on September 30, 2004 and

December 31, 2004, respectively. How much is the carrying

amount of the stock rights in Karter's December 31, 2004

Ja

statement of financial position?

(Adapted)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education