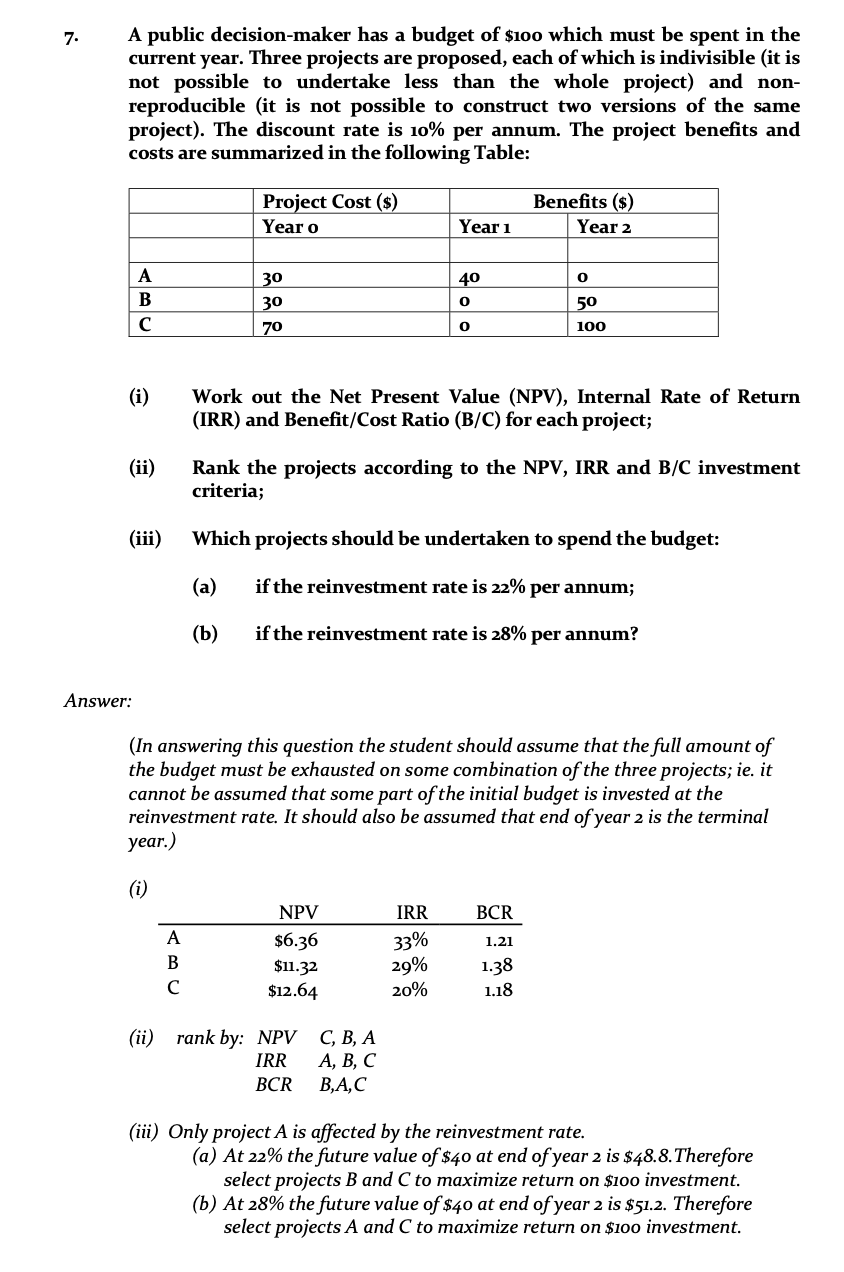

7. A public decision-maker has a budget of $100 which must be spent in the current year. Three projects are proposed, each of which is indivisible (it is not possible to undertake less than the whole project) and non- reproducible (it is not possible to construct two versions of the same project). The discount rate is 10% per annum. The project benefits and costs are summarized in the following Table: Project Cost (s) Benefits ($) Year 2 Year o Year 1 A 30 40 0 B 30 0 50 с 70 0 100 (i) Work out the Net Present Value (NPV), Internal Rate of Return (IRR) and Benefit/Cost Ratio (B/C) for each project; (ii) Rank the projects according to the NPV, IRR and B/C investment criteria; (iii) Which projects should be undertaken to spend the budget: (a) if the reinvestment rate is 22% per annum; (b) if the reinvestment rate is 28% per annum?

7. A public decision-maker has a budget of $100 which must be spent in the current year. Three projects are proposed, each of which is indivisible (it is not possible to undertake less than the whole project) and non- reproducible (it is not possible to construct two versions of the same project). The discount rate is 10% per annum. The project benefits and costs are summarized in the following Table: Project Cost (s) Benefits ($) Year 2 Year o Year 1 A 30 40 0 B 30 0 50 с 70 0 100 (i) Work out the Net Present Value (NPV), Internal Rate of Return (IRR) and Benefit/Cost Ratio (B/C) for each project; (ii) Rank the projects according to the NPV, IRR and B/C investment criteria; (iii) Which projects should be undertaken to spend the budget: (a) if the reinvestment rate is 22% per annum; (b) if the reinvestment rate is 28% per annum?

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 3P

Related questions

Question

100%

Please answer this and kindly show the solution using microsoft excel or google sheets. I'll give you a like. Thank you!

Transcribed Image Text:7.

A public decision-maker has a budget of $100 which must be spent in the

current year. Three projects are proposed, each of which is indivisible (it is

not possible to undertake less than the whole project) and non-

reproducible (it is not possible to construct two versions of the same

project). The discount rate is 10% per annum. The project benefits and

costs are summarized in the following Table:

Project Cost (s)

Year o

Benefits ($)

Year 2

Year 1

A

30

40

0

B

30

0

50

с

70

0

100

(i)

Work out the Net Present Value (NPV), Internal Rate of Return

(IRR) and Benefit/Cost Ratio (B/C) for each project;

(ii)

Rank the projects according to the NPV, IRR and B/C investment

criteria;

(iii)

Which projects should be undertaken to spend the budget:

(a)

if the reinvestment rate is 22% per annum;

(b)

if the reinvestment rate is 28% per annum?

Answer:

(In answering this question the student should assume that the full amount of

the budget must be exhausted on some combination of the three projects; ie. it

cannot be assumed that some part of the initial budget is invested at the

reinvestment rate. It should also be assumed that end of year 2 is the terminal

year.)

(i)

NPV

IRR

BCR

A

$6.36

33%

1.21

B

$11.32

29%

1.38

C

$12.64

20%

1.18

(ii) rank by: NPV C, B, A

IRR

A, B, C

BCR

B,A,C

(iii) Only project A is affected by the reinvestment rate.

(a) At 22% the future value of $40 at end of year 2 is $48.8. Therefore

select projects B and C to maximize return on $100 investment.

(b) At 28% the future value of $40 at end of year 2 is $51.2. Therefore

select projects A and C to maximize return on $100 investment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College