Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 16MC: When using the NPV method for a particular investment decision, if the present value of all cash...

Related questions

Question

i need the answer quickly

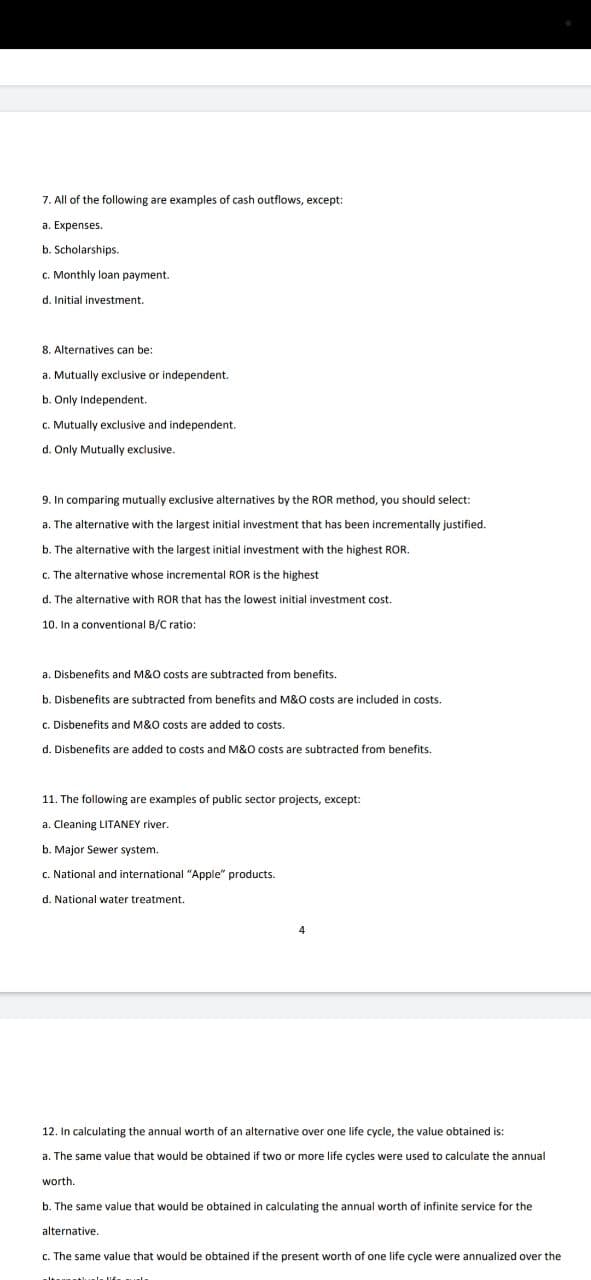

Transcribed Image Text:7. All of the following are examples of cash outflows, except:

a. Expenses.

b. Scholarships.

c. Monthly loan payment.

d. Initial investment.

8. Alternatives can be:

a. Mutually exclusive or independent.

b. Only Independent.

c. Mutually exclusive and independent.

d. Only Mutually exclusive.

9. In comparing mutually exclusive alternatives by the ROR method, you should select:

a. The alternative with the largest initial investment that has been incrementally justified.

b. The alternative with the largest initial investment with the highest ROR.

c. The alternative whose incremental ROR is the highest

d. The alternative with ROR that has the lowest initial investment cost.

10. In a conventional B/C ratio:

a. Disbenefits and M&O costs are subtracted from benefits.

b. Disbenefits are subtracted from benefits and M&O costs are included in costs.

c. Disbenefits and M&O costs are added to costs.

d. Disbenefits are added to costs and M&O costs are subtracted from benefits.

11. The following are examples of public sector projects, except:

a. Cleaning LITANEY river.

b. Major Sewer system.

National and interna

d. National water treatment.

12. In calculating the annual worth of an alternative over one life cycle, the value obtained is:

a. The same value that would be obtained if two or more life cycles were used to calculate the annual

worth.

b. The same value that would be obtained in calculating the annual worth of infinite service for the

alternative.

c. The same value that would be obtained if the present worth of one life cycle were annualized over the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College