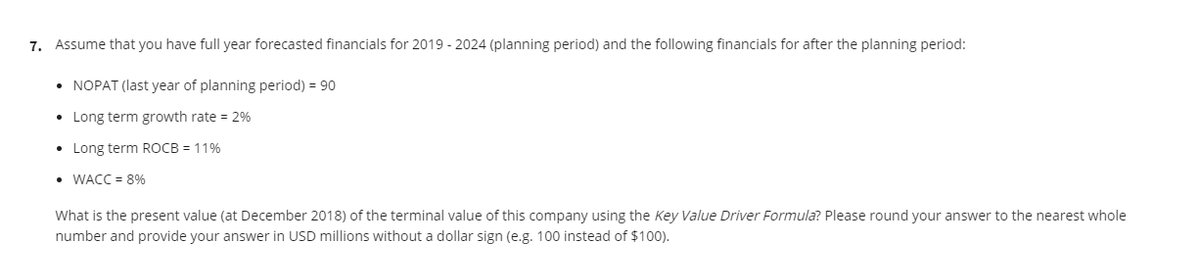

7. Assume that you have full year forecasted financials for 2019 - 2024 (planning period) and the following financials for after the planning period: • NOPAT (last year of planning period) = 90 • Long term growth rate = 2% • Long term ROCB = 11% • WACC = 8% What is the present value (at December 2018) of the terminal value of this company using the Key Value Driver Formula? Please round your answer to the nearest whole number and provide your answer in USD millions without a dollar sign (e.g. 100 instead of $100).

7. Assume that you have full year forecasted financials for 2019 - 2024 (planning period) and the following financials for after the planning period: • NOPAT (last year of planning period) = 90 • Long term growth rate = 2% • Long term ROCB = 11% • WACC = 8% What is the present value (at December 2018) of the terminal value of this company using the Key Value Driver Formula? Please round your answer to the nearest whole number and provide your answer in USD millions without a dollar sign (e.g. 100 instead of $100).

Chapter15: Harvesting The Business Venture Investment

Section: Chapter Questions

Problem 7EP

Related questions

Question

Transcribed Image Text:7. Assume that you have full year forecasted financials for 2019 - 2024 (planning period) and the following financials for after the planning period:

• NOPAT (last year of planning period) = 90

• Long term growth rate = 2%

• Long term ROCB = 11%

• WACC = 8%

What is the present value (at December 2018) of the terminal value of this company using the Key Value Driver Formula? Please round your answer to the nearest whole

number and provide your answer in USD millions without a dollar sign (e.g. 100 instead of $100).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning