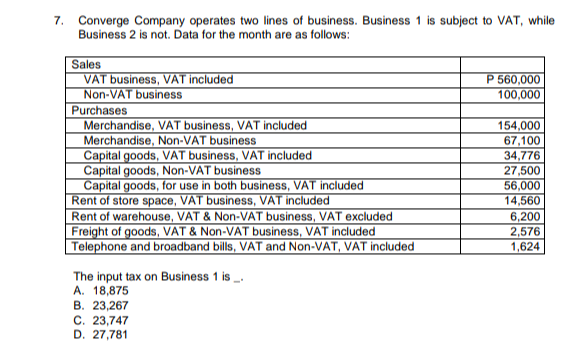

7. Converge Company operates two lines of business. Business 1 is subject to VAT, while Business 2 is not. Data for the month are as follows: Sales VAT business, VAT included Non-VAT business Purchases Merchandise, VAT business, VAT included Merchandise, Non-VAT business Capital goods, VAT business, VAT included Capital goods, Non-VAT business Capital goods, for use in both business, VAT included Rent of store space, VAT business, VAT included Rent of warehouse, VAT & Non-VAT business, VAT excluded Freight of goods, VAT & Non-VAT business, VAT included Telephone and broadband bills, VAT and Non-VAT, VAT included The input tax on Business 1 is. A. 18,875 B. 23,267 C. 23.747 P 560,000 100,000 154,000 67,100 34,776 27,500 56,000 14,560 6,200 2,576 1,624

7. Converge Company operates two lines of business. Business 1 is subject to VAT, while Business 2 is not. Data for the month are as follows: Sales VAT business, VAT included Non-VAT business Purchases Merchandise, VAT business, VAT included Merchandise, Non-VAT business Capital goods, VAT business, VAT included Capital goods, Non-VAT business Capital goods, for use in both business, VAT included Rent of store space, VAT business, VAT included Rent of warehouse, VAT & Non-VAT business, VAT excluded Freight of goods, VAT & Non-VAT business, VAT included Telephone and broadband bills, VAT and Non-VAT, VAT included The input tax on Business 1 is. A. 18,875 B. 23,267 C. 23.747 P 560,000 100,000 154,000 67,100 34,776 27,500 56,000 14,560 6,200 2,576 1,624

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter2: Financial Statements And The Annual Report

Section: Chapter Questions

Problem 2.2P: Costs and Expenses The following costs are incurred by a retailer: Display fixtures in a retail...

Related questions

Question

Transcribed Image Text:7. Converge Company operates two lines of business. Business 1 is subject to VAT, while

Business 2 is not. Data for the month are as follows:

Sales

VAT business, VAT included

Non-VAT business

Purchases

Merchandise, VAT business, VAT included

Merchandise, Non-VAT business

Capital goods, VAT business, VAT included

Capital goods, Non-VAT business

Capital goods, for use in both business, VAT included

Rent of store space, VAT business, VAT included

Rent of warehouse, VAT & Non-VAT business, VAT excluded

Freight of goods, VAT & Non-VAT business, VAT included

Telephone and broadband bills, VAT and Non-VAT, VAT included

The input tax on Business 1 is _.

A. 18,875

B. 23,267

C. 23,747

D. 27,781

P 560,000

100,000

154,000

67,100

34,776

27,500

56,000

14,560

6,200

2,576

1,624

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning