7. Determine the amount of the donation deduction for each of the following situations: (Assume all organizations are qualified public charities)

7. Determine the amount of the donation deduction for each of the following situations: (Assume all organizations are qualified public charities)

Chapter20: Corporations And Parterships

Section: Chapter Questions

Problem 39P

Related questions

Question

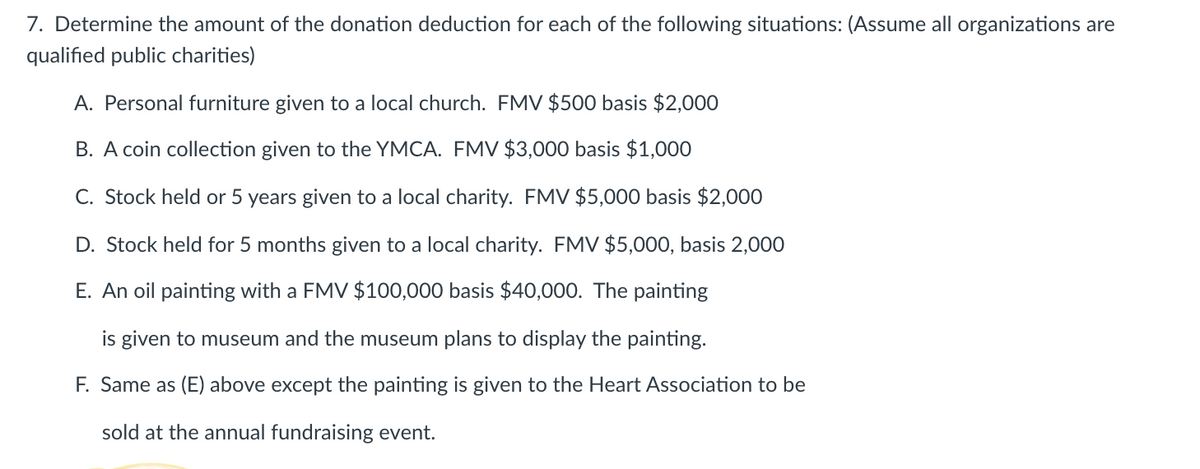

Transcribed Image Text:7. Determine the amount of the donation deduction for each of the following situations: (Assume all organizations are

qualified public charities)

A. Personal furniture given to a local church. FMV $500 basis $2,000

B. A coin collection given to the YMCA. FMV $3,000 basis $1,000

C. Stock held or 5 years given to a local charity. FMV $5,000 basis $2,000

D. Stock held for 5 months given to a local charity. FMV $5,000, basis 2,000

E. An oil painting with a FMV $100,000 basis $40,000. The painting

is given to museum and the museum plans to display the painting.

F. Same as (E) above except the painting is given to the Heart Association to be

sold at the annual fundraising event.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you