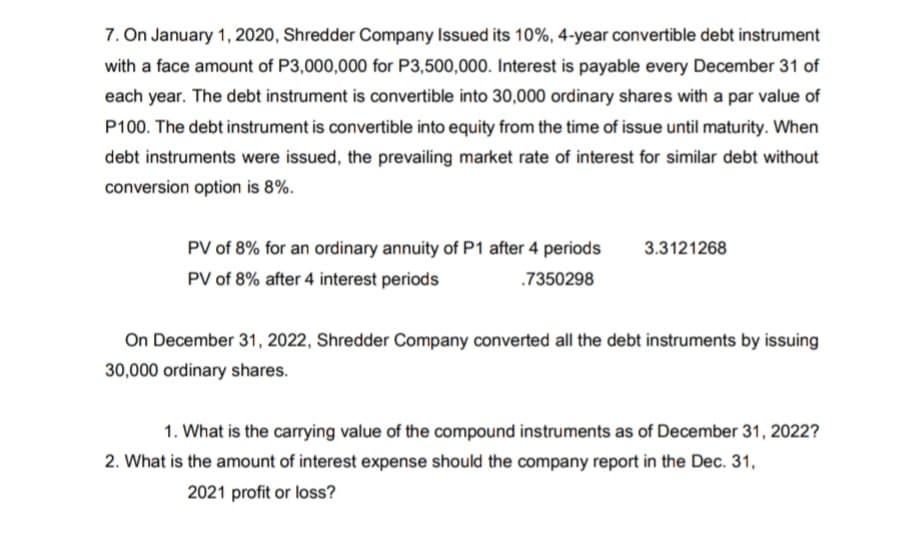

7. On January 1, 2020, Shredder Company Issued its 10%, 4-year convertible debt instrument with a face amount of P3,000,000 for P3,500,000. Interest is payable every December 31 of each year. The debt instrument is convertible into 30,000 ordinary shares with a par value of P100. The debt instrument is convertible into equity from the time of issue until maturity. When debt instruments were issued, the prevailing market rate of interest for similar debt without conversion option is 8%. PV of 8% for an ordinary annuity of P1 after 4 periods 3.3121268 PV of 8% after 4 interest periods .7350298 On December 31, 2022, Shredder Company converted all the debt instruments by issuing 30,000 ordinary shares. 1. What is the carrying value of the compound instruments as of December 31, 2022? 2. What is the amount of interest expense should the company report in the Dec. 31, 2021 profit or loss?

7. On January 1, 2020, Shredder Company Issued its 10%, 4-year convertible debt instrument with a face amount of P3,000,000 for P3,500,000. Interest is payable every December 31 of each year. The debt instrument is convertible into 30,000 ordinary shares with a par value of P100. The debt instrument is convertible into equity from the time of issue until maturity. When debt instruments were issued, the prevailing market rate of interest for similar debt without conversion option is 8%. PV of 8% for an ordinary annuity of P1 after 4 periods 3.3121268 PV of 8% after 4 interest periods .7350298 On December 31, 2022, Shredder Company converted all the debt instruments by issuing 30,000 ordinary shares. 1. What is the carrying value of the compound instruments as of December 31, 2022? 2. What is the amount of interest expense should the company report in the Dec. 31, 2021 profit or loss?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 21P: Waseca Company had 5 convertible securities outstanding during all of 2019. It paid the appropriate...

Related questions

Question

Please put all of the necessary data and computations for better understanding. Thanks ?

Transcribed Image Text:7. On January 1, 2020, Shredder Company Issued its 10%, 4-year convertible debt instrument

with a face amount of P3,000,000 for P3,500,000. Interest is payable every December 31 of

each year. The debt instrument is convertible into 30,000 ordinary shares with a par value of

P100. The debt instrument is convertible into equity from the time of issue until maturity. When

debt instruments were issued, the prevailing market rate of interest for similar debt without

conversion option is 8%.

PV of 8% for an ordinary annuity of P1 after 4 periods

3.3121268

PV of 8% after 4 interest periods

.7350298

On December 31, 2022, Shredder Company converted all the debt instruments by issuing

30,000 ordinary shares.

1. What is the carrying value of the compound instruments as of December 31, 2022?

2. What is the amount of interest expense should the company report in the Dec. 31,

2021 profit or loss?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College