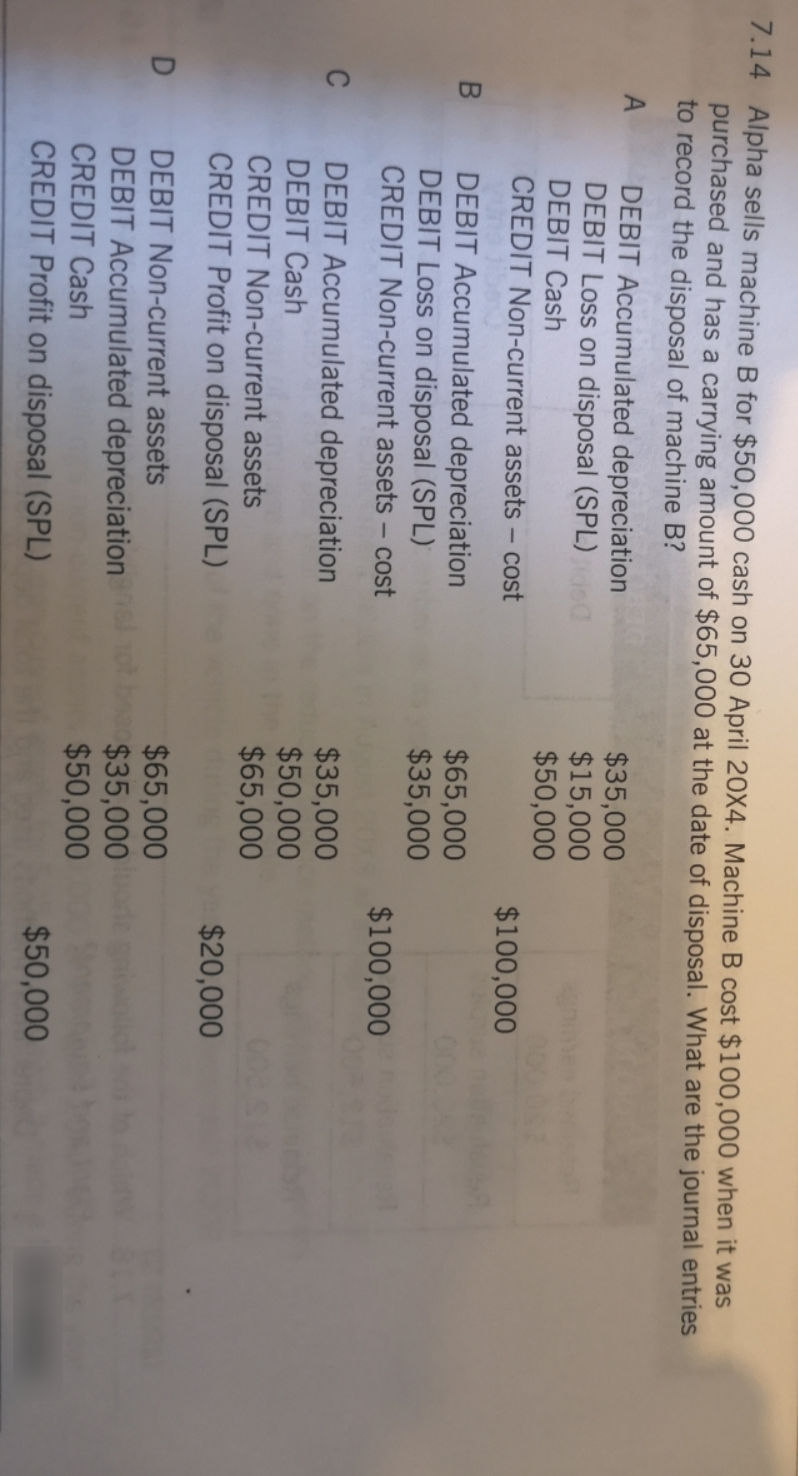

7.14 Alpha sells machine B for $50,000 cash on 30 April 20X4. Machine B cost $100,000 when it was purchased and has a carrying amount of $65,000 at the date of disposal. What are the journal entries to record the disposal of machine B? DEBIT Accumulated depreciation DEBIT Loss on disposal (SPL) A $35,000 $15,000 $50,000 DEBIT Cash CREDIT Non-current assets – cost $100,000 DEBIT Accumulated depreciation DEBIT Loss on disposal (SPL) CREDIT Non-current assets - cost B $65,000 $35,000 $100,000 DEBIT Accumulated depreciation DEBIT Cash $35,000 $50,000 $65,000 C CREDIT Non-current assets CREDIT Profit on disposal (SPL) $20,000 $65,000 $35,000 $50,000 DEBIT Non-current assets DEBIT Accumulated depreciation CREDIT Cash CREDIT Profit on disposal (SPL) $50,000

7.14 Alpha sells machine B for $50,000 cash on 30 April 20X4. Machine B cost $100,000 when it was purchased and has a carrying amount of $65,000 at the date of disposal. What are the journal entries to record the disposal of machine B? DEBIT Accumulated depreciation DEBIT Loss on disposal (SPL) A $35,000 $15,000 $50,000 DEBIT Cash CREDIT Non-current assets – cost $100,000 DEBIT Accumulated depreciation DEBIT Loss on disposal (SPL) CREDIT Non-current assets - cost B $65,000 $35,000 $100,000 DEBIT Accumulated depreciation DEBIT Cash $35,000 $50,000 $65,000 C CREDIT Non-current assets CREDIT Profit on disposal (SPL) $20,000 $65,000 $35,000 $50,000 DEBIT Non-current assets DEBIT Accumulated depreciation CREDIT Cash CREDIT Profit on disposal (SPL) $50,000

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 8PA: Referring to PA7 where Kenzie Company purchased a 3-D printer for $450,000, consider how the...

Related questions

Question

Can you explain the answer in detail please?

Transcribed Image Text:7.14 Alpha sells machine B for $50,000 cash on 30 April 20X4. Machine B cost $100,000 when it was

purchased and has a carrying amount of $65,000 at the date of disposal. What are the journal entries

to record the disposal of machine B?

DEBIT Accumulated depreciation

DEBIT Loss on disposal (SPL)

A

$35,000

$15,000

$50,000

DEBIT Cash

CREDIT Non-current assets – cost

$100,000

DEBIT Accumulated depreciation

DEBIT Loss on disposal (SPL)

CREDIT Non-current assets - cost

B

$65,000

$35,000

$100,000

DEBIT Accumulated depreciation

DEBIT Cash

$35,000

$50,000

$65,000

C

CREDIT Non-current assets

CREDIT Profit on disposal (SPL)

$20,000

$65,000

$35,000

$50,000

DEBIT Non-current assets

DEBIT Accumulated depreciation

CREDIT Cash

CREDIT Profit on disposal (SPL)

$50,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning