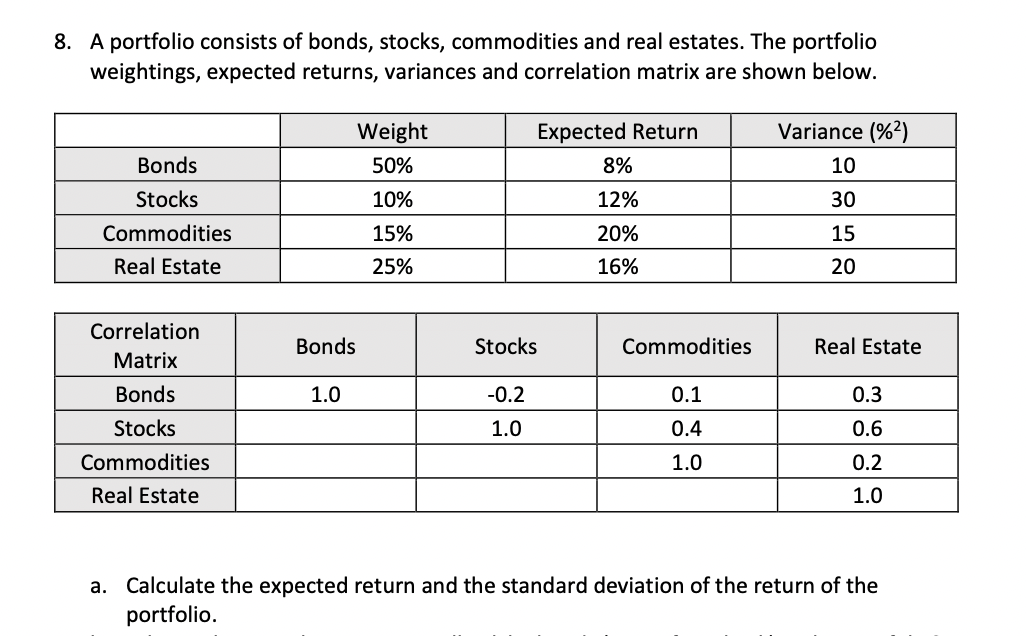

8. A portfolio consists of bonds, stocks, commodities and real estates. The portfolio weightings, expected returns, variances and correlation matrix are shown below. Bonds Stocks Commodities Real Estate Correlation Matrix Bonds Stocks Commodities Real Estate Weight 50% 10% 15% 25% Bonds 1.0 Stocks -0.2 1.0 Expected Return 8% 12% 20% 16% Commodities 0.1 0.4 1.0 Variance (%²) 10 30 15 20 Real Estate 0.3 0.6 0.2 1.0 a. Calculate the expected return and the standard deviation of the return of the portfolio.

Q: The activity date, company, and amount for a credit card bill are shown below. The due date of the…

A: Given The interest rate is 1.9% per month. Unpaid balance on June 10 is $987.91.

Q: a. Use the appropriate formula to determine the periodic deposit. b. How much of the financial goal…

A: 1) Future Value of anuity = P * [ { (1 + r )n -1 } /r ] where, P = periodic payment r = interest…

Q: 2. Trixy needs to accumulate 780,000.00 for her insurance investment for 5 years. She set up a…

A:

Q: Differentiate between a stated rate of interest and an effective rate of interest. 7. What is the…

A: Given The amount borrowed is $25,000 term is 5 months

Q: 11 #9) There is a loan obligation to pay $1000 one year from today and another $1000 two years from…

A: Duration of bond shows the change in prices of bond with change in interes rate and it shows the…

Q: 8. Roger and Samantha are brother and sister that will split an inheritance equally. Roger spends…

A: A perpetuity is an annuity that pays a periodic amount to its holder forever. Perpetuity due is a…

Q: An amount of $12 000 is invested for a period of 9 months at 3% p.a. compounded monthly. The…

A: We need to use the FV formula to determine the value after 9 months. The formula is as below FV = PV…

Q: An analyst knows with certainty that Skipper Inc, will exist for two years and have the following…

A: Solution:- Stock price means the price at which the stock of a company is trading in the market. As…

Q: A farmer in Vancouver faces a dilemma. The weather forecast is for hot weather, and there is a 50%…

A: Sensitivity analysis refers to the model of finance that is being adopted by the company for…

Q: You want to buy a $188,000 home. You plan to pay 20% as a down payment, and take out a 30 year loan…

A: Given Cost of house is $188000 Down payment is 20%

Q: Consider the following information about the various states of economy and the returns of various…

A: State of the economy Probability T-Bills Philips Pay-up Rubber-Made Market Index Recession 0.2 7%…

Q: Consider a five-year, default-free bond with annual coupons of 8% and a face value of $1,000 and…

A: Bond Bonds are an integral aspect of the financial system, serving as a vital source of cash for…

Q: O'Brien Ltd.'s outstanding bonds have a $1,000 par value, and they mature in 25 years. Their…

A: Coupon interest rate The rate of return paid to the bondholder from the date of issue of the bond to…

Q: What is a forward hedge market and a derivatives market?

A: A stock market, equity market, or share market is a collection of buyers and sellers of securities,…

Q: You want to buy a new car. You can afford payments of $200 per month and can borrow the money at an…

A: EMI or monthly mortgage payments are the fixed amount paid by the borrower to the lender that…

Q: What are the advantages and disadvantages of a fixed principal, fixed interest loan? 4. What is the…

A: Please not that as per the guidelines, I am required to answer only the first three questions.…

Q: Please tell the procedure of investment banker, from the event that Company decide to issue IPO…

A: Companies have the option to go public by issuing their shares for the first time to the public, and…

Q: A $5,000 bond with a coupon rate of 5.7% paid semiannually has nine years to maturity and a yield to…

A:

Q: Joey realizes that he has charged too much on his credit card and has racked up $5,800 in debt. If…

A: Monthly interest rate = APRFrequency of compounding in a year Where, APR is annual percentage rate…

Q: QUESTION 6 A project has the following cash flows: Year 0 0123 0 0 0 0 If the required return is…

A: Internal rate of return (IRR) is the rate at which present value of cash inflows will be equal to…

Q: Which is true about Futures contracts? a. is not traded on an organized exchange and is customized…

A: A futures contract is an agreement between two parties to acquire or sell an item at a specific time…

Q: A packaging employee making $18 per hour can package 90 items during that hour. The direct material…

A: Solution:- Total direct cost means the cost incurred on the direct factors of production i.e. direct…

Q: m has an opportunity to buy a $1,000 par value bond with a coupon rate of 7% and a maturity of 5…

A: Price of bond is sum of the present value of coupon payment and present value of par value of bond…

Q: WEEKLY Molly is a salaried employee; she makes $42,000 a year and is paid bi-weekly. What is her…

A: Some employees are paid weekly , some are paid biweekly and some are paid on the basis of monthly…

Q: Suppose a seven-year, $1,000 bond with a 7.97% coupon rate and semiannual coupons is trading with a…

A: Given The Face value is $1000 Coupon rate is 7.97% Term of bond is 7 years

Q: The cost of money is expressed through interest rates. Describe three different “premiums” that have…

A: Solution:- Interest rate is the price of money. It can be interpreted in 3 ways: i) Required rate of…

Q: A friend asks you for a loan of $1,000 and offers to pay you back at the rate of $90 per month for…

A: The time value of money says that the worth of money changes with time. It states that the amount…

Q: What methods are used to conduct a new system's cost-benefit analysis? i. Net prevent value; ii.…

A: Cost-benefit analysis refers to the process of comparing the cost and benefits of an intervention…

Q: Fill the parts in the above table that are shaded in yellow. You will notice that there are nine…

A: State of the Economy Probability T-Bills Philips Pay-up Rubber made Market Index Recession 0.2 7%…

Q: What is the difference between CAPM beta and cash-flow beta (from certainty equivalency approach)?…

A: The certainty equivalent is the amount of guaranteed money that an investor will accept now rather…

Q: Your portfolio consists of two stocks. Consider the following table, which gives a security…

A: Capital asset pricing model helps in calculating the expected rate of return on an asset or…

Q: Radu purchased a short-term $17.000, 60-day GIC which will earn 1% interest annually When the GIC…

A: Given: Amount invested "P" = $17,000 Period of investment "n"= 60 day Rate "r"= 1% The maturity…

Q: A $7311 bond bearing interest at 6% payable semi- annually matures in 5 years. If it is bought to…

A: P0 = Price of the bond C = Semiannual coupon amount i.e. $219.33 ($7311 * 0.06 / 2) r = Semiannual…

Q: Annapurna Trading Ltd. is evaluating two mutually exclusive projects: Project A and Project B. The…

A: As per our guidelines, we are supposed to answer only 3 sub-parts (if there are multiple sub-parts…

Q: Leslie's Unique Clothing Stores offers a common stock that pays an annual dividend of $2.70 a share.…

A: A zero-growth model is a type of dividend discount model (DDM) that assumes a corporation or…

Q: Jarett & Sons' common stock currently trades at $30.00 a share. It is expected to pay an annual…

A: Solution:- Cost of common equity means the rate of return required by the equity shareholders. As…

Q: After paying GH¢ 30,000 for an initial investigation on projects assessments, the finance department…

A: Honor code: Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: There was an example of having a hedge fund with 100 million dollars. If you insured a one billion…

A: A leverage ratio is any of many financial indicators that assess a company's ability to meet its…

Q: Consider the following information about the various states of economy and the returns of various…

A: State of the economy Probability T-Bills Philips Pay-up Rubber-Made Market Index Recession 0.2 7%…

Q: What’s the interest rate of a 8-year, annual $3,500 annuity with present value of $20,000? (Use a…

A: Given Term is 8 years Annuity payment is $3500 PV is $20,000

Q: Sachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1.2% ×…

A: Project benefit obligation refers to the measurement of the present need of the company for…

Q: Jim Company bought a machine for $54,260 with an estimated life of 5 years. The residual value of…

A: Units of production method The method under which the depreciation of an asset is calculated on the…

Q: 15. A 25,000 4% bond with interest payable annually will mature on May 1, 1998. The date of purchase…

A: As per the given information: Amount of bond - 25,000 Interest rate - 4% payable annually Purchase…

Q: You decide to quit using your credit card and want to pay off the balance of $9,500 in 4 years. Your…

A: The periodic payment is the payment made at regular intervals that have the same amount. The…

Q: What does the P/E ratio or EPS tell you about a companies’ overall financial condition?

A: “Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only…

Q: If money is worth 5% compounded quarterly, find the equated time for paying a loan of P150000 due in…

A: We have to find the equated time for scheduled payment of two loans. Equated time is the time in…

Q: A loan is offered with monthly payments and a 9.25 percent APR. What’s the loan’s effective annual…

A: APR = 0.0925 or 9.25% Number of compounding (n) = 12 Effective annual rate (EAR) = ? Effective…

Q: A bridge that was constructed at a cost of P 7.5 M, is expected to last 30 years at the end of which…

A: On a company's balance sheet, a capitalized cost is an item added to the cost base of a fixed asset.…

Q: A family has taken out a mortga uary 2022. The mortgage is repaid ar over 20 years. Le of payments…

A: Loans are paid by the equal and periodic and fixed payments and these payments carry the payment for…

Q: Assume you want to start your own small business. You like to open a bakery or nail salon. We assume…

A:

Step by step

Solved in 2 steps with 2 images

- 8. A portfolio consists of bonds, stocks, commodities and real estates. The portfolio weightings, expected returns, variances and correlation matrix are shown below. Weight Expected Return Variance (%2) Bonds 50% 10% 15% 25% 8% 12% 20% 16% 10 30 15 20 0.1 0.3 0.4 0.6 1.0 0.2 1.0 Stocks Commodities Real Estate Correlation Matrix Bonds 1.0 -0.2 1.0 Stocks Commodities Real Estate Bonds Stocks Commodities Real Estate Calculate the standard deviation of the return of the portfolio.In the APT model, what is the nonsystematic standard deviation of an equally-weighted portfolio that has an average value of σ(ei) equal to 20% and 40 securities? A. 0.5% B. 3.16% C. 3.54% D. 12.5% E. 625%Consider a portfolio comprise of three securities in the following proportion and with the indicated securities beta. Security Amount Invested Beta Expected return A 1.5million 1.0 12% B 1million 1.5 13.5% C 2million 0.8 9% Calculate the portfolio’s; Beta Expected return Determine whether this portfolio have more or less systematic risk than an average asset.

- For the above shares if the expected inter correlations are given as follows: Investment in RM millions Weight Correlation Petronas 23 ? 0.15(P,M) Maxis 47 ? 0.25(M,B) Berjaya 40 ? 0.35(B,P) d) Compute Weights e) Compute the expected portfolio return and f) Expected portfolio risk g) Portfolio Sharpe ratioAngela’s portfolio holds security A, which returned 12.0%, security B, which returned 15.0% and security C, which returned -5.0%. At the beginning of the year 45% was invested in security A, 25.0% in security B and the remaining 30% was invested in security C. The correlation between AB is 0.75, between AC 0.35, and between BC -0.5. Securities A's standard deviation is 12%, security B's standard deviations is 15% and security C's is 10%. Required: Calculate the: A five-year bond pays interest The par value is GHc 1000 and the coupon rate equals seven (7) percent. If the market's required return on the bond is eight (8) percent, at what market price does this sell for? Literature argues that bond prices are inversely related to interest rates leading to different types of bonds issue. Briefly define Par Bonds, Premium Bonds and Discount Cal Bank has a corporate bond that matures in two years but makes semi-annual interest The par…Angela’s portfolio holds security A, which returned 12.0%, security B, which returned 15.0% and security C, which returned -5.0%. At the beginning of the year 45% was invested in security A, 25.0% in security B and the remaining 30% was invested in security C. The correlation between AB is 0.75, between AC 0.35, and between BC -0.5. Securities A's standard deviation is 12%, security B's standard deviations is 15% and security C's is 10%. Required: Calculate the: a) Explain what happens to a portfolio's overall risk when securities that are uncorrelated are combined. b) List four steps that go into selecting an optimal portfolio of risky assets.

- Angela’s portfolio holds security A, which returned 12.0%, security B, which returned 15.0% and security C, which returned -5.0%. At the beginning of the year 45% was invested in security A, 25.0% in security B and the remaining 30% was invested in security C. The correlation between AB is 0.75, between AC 0.35, and between BC -0.5. Securities A's standard deviation is 12%, security B's standard deviations is 15% and security C's is 10%. Required: Calculate the: a) Expected return and Portfolio variance of Angela's Portfolio b) Portfolio Standard deviation of What happens to the portfolio risk if market conditions reduce the risk of security B by 50%? c) Explain what happens to a portfolio's overall risk when securities that are uncorrelated are combined.Angela’s portfolio holds security A, which returned 12.0%, security B, which returned 15.0% and security C, which returned -5.0%. At the beginning of the year 45% was invested in security A, 25.0% in security B and the remaining 30% was invested in security C. The correlation between AB is 0.75, between AC 0.35, and between BC -0.5. Securities A's standard deviation is 12%, security B's standard deviations is 15% and security C's is 10%. Required: Calculate the: 1. Portfolio Standard deviation of What happens to the portfolio risk if market conditions reduce the risk of security B by 50%?Angela’s portfolio holds security A, which returned 12.0%, security B, which returned 15.0% and security C, which returned -5.0%. At the beginning of the year 45% was invested in security A, 25.0% in security B and the remaining 30% was invested in security C. The correlation between AB is 0.75, between AC 0.35, and between BC -0.5. Securities A's standard deviation is 12%, security B's standard deviations is 15% and security C's is 10%. Required: Calculate the: a) Expected return b) Portfolio variance of Angela's Portfolio

- Angela’s portfolio holds security A, which returned 12.0%, security B, which returned 15.0% and security C, which returned -5.0%. At the beginning of the year 45% was invested in security A, 25.0% in security B and the remaining 30% was invested in security C. The correlation between AB is 0.75, between AC 0.35, and between BC -0.5. Securities A's standard deviation is 12%, security B's standard deviations is 15% and security C's is 10%. Required: Calculate the: a) Expected return and Portfolio variance of Angela's Portfolio b) Portfolio Standard deviation of What happens to the portfolio risk if market conditions reduce the risk of security B by 50%?Angela’s portfolio holds security A, which returned 12.0%, security B, which returned 15.0% and security C, which returned -5.0%. At the beginning of the year 45% was invested in security A, 25.0% in security B and the remaining 30% was invested in security C. The correlation between AB is 0.75, between AC 0.35, and between BC -0.5. Securities A's standard deviation is 12%, security B's standard deviations is 15% and security C's is 10%. a) A five-year bond pays interest The par value is GHc 1000 and the coupon rate equals seven (7) percent. If the market's required return on the bond is eight (8) percent, at what market price does this sell for? Literature argues that bond prices are inversely related to interest rates leading to different types of bonds issue. Briefly define Par Bonds, Premium Bonds and Discount Bonds. b) Cal Bank has a corporate bond that matures in two years but makes semi-annual interest The par value is GHc 1000,…In-class Example 4: Portfolio Risk Return Suppose that a portfolio of stocks has an expected return E(rS) = 12% and a standard deviation of returns sS = 20%. A portfolio of corporate bonds has an expected return E(rB) = 6% and a standard deviation sB = 9%. a) What is the expected portfolio return and portfolio standard deviation for an equally weighted combination of the stock and bond portfolio if the correlation between stock and bond portfolio returns, rSB, is -0.5? b) Suppose you require a portfolio expected return of 15% per year. What weights must you assign to the stock and bond portfolios to achieve this expected return? What is the standard deviation of returns for this combination portfolio if the correlation between stock and bond returns is -0.5? C) Suppose that the standard deviation of the market (sM) is 15% and the correlation between the stock portfolio and the market is 0.7. What is the beta of the stock portfolio?