8. How much is the total Capital Gains tax due?

Chapter2: The Domestic And International Financial Marketplace

Section2.A: Taxes

Problem 2P

Related questions

Question

Pls provide solution for numbers 8 and 9

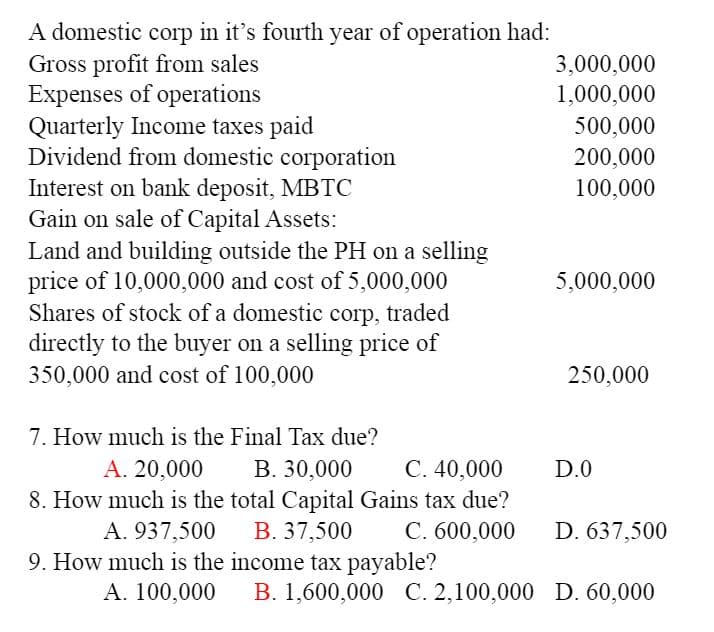

A domestic corp in it’s fourth year of operation had:

Gross profit from sales 3,000,000

Expenses of operations 1,000,000

Quarterly Income taxes paid 500,000

Dividend from domestic corporation 200,000

Interest on bank deposit, MBTC 100,000

Gain on sale of Capital Assets:

Land and building outside the PH on a selling

price of 10,000,000 and cost of 5,000,000 5,000,000

Shares of stock of a domestic corp, traded

directly to the buyer on a selling price of

350,000 and cost of 100,000 250,000

How much is the total Capital Gains tax due?

How much is the income tax payable?

Transcribed Image Text:A domestic corp in it's fourth year of operation had:

Gross profit from sales

Expenses of operations

Quarterly Income taxes paid

Dividend from domestic corporation

Interest on bank deposit, MBTC

Gain on sale of Capital Assets:

Land and building outside the PH on a selling

price of 10,000,000 and cost of 5,000,000

Shares of stock of a domestic corp, traded

directly to the buyer on a selling price of

350,000 and cost of 100,000

3,000,000

1,000,000

500,000

200,000

100,000

5,000,000

250,000

7. How much is the Final Tax due?

А. 20,000

C. 40,000

В. 30,000

8. How much is the total Capital Gains tax due?

В. 37,500

D.0

A. 937,500

C. 600,000

D. 637,500

9. How much is the income tax payable?

А. 100,000

B. 1,600,000 C. 2,100,000 D. 60,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT