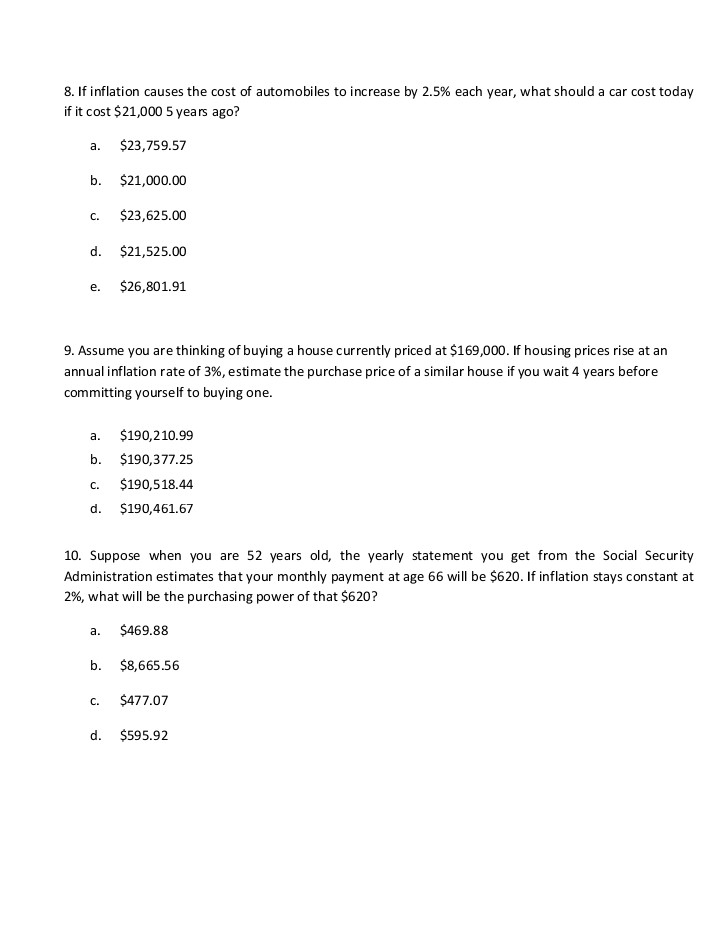

8. If inflation causes the cost of automobiles to increase by 2.5% each year, what should a car cost today if it cost $21,000 5 years ago? а. $23,759.57 b. $21,000.00 C. $23,625.00 d. $21,525.00 е. $26,801.91 9. Assume you are thinking of buying a house currently priced at $169,000. If housing prices rise at an annual inflation rate of 3%, estimate the purchase price of a similar house if you wait 4 years before committing yourself to buying one. a. $190,210.99 b. $190,377.25 с. $190,518.44 d. $190,461.67 10. Suppose when you are 52 years old, the yearly statement you get from the Social Security Administration estimates that your monthly payment at age 66 will be $620. If inflation stays constant at 2%, what will be the purchasing power of that $620? а. $469.88 b. $8,665.56 с. $477.07 d. $595.92

8. If inflation causes the cost of automobiles to increase by 2.5% each year, what should a car cost today if it cost $21,000 5 years ago? а. $23,759.57 b. $21,000.00 C. $23,625.00 d. $21,525.00 е. $26,801.91 9. Assume you are thinking of buying a house currently priced at $169,000. If housing prices rise at an annual inflation rate of 3%, estimate the purchase price of a similar house if you wait 4 years before committing yourself to buying one. a. $190,210.99 b. $190,377.25 с. $190,518.44 d. $190,461.67 10. Suppose when you are 52 years old, the yearly statement you get from the Social Security Administration estimates that your monthly payment at age 66 will be $620. If inflation stays constant at 2%, what will be the purchasing power of that $620? а. $469.88 b. $8,665.56 с. $477.07 d. $595.92

Chapter4A: Nopat Breakeven: Revenues Needed To Cover Total Operating Costs

Section: Chapter Questions

Problem 1EP

Related questions

Question

Transcribed Image Text:8. If inflation causes the cost of automobiles to increase by 2.5% each year, what should a car cost today

if it cost $21,000 5 years ago?

a.

$23,759.57

b.

$21,000.00

С.

$23,625.00

d. $21,525.00

е.

$26,801.91

9. Assume you are thinking of buying a house currently priced at $169,000. If housing prices rise at an

annual inflation rate of 3%, estimate the purchase price of a similar house if you wait 4 years before

committing yourself to buying one.

а.

$190,210.99

b. $190,377.25

с.

$190,518.44

d.

$190,461.67

10. Suppose when you are 52 years old, the yearly statement you get from the Social Security

Administration estimates that your monthly payment at age 66 will be $620. If inflation stays constant at

2%, what will be the purchasing power of that $620?

a. $469.88

b. $8,665.56

с.

$477.07

d. $595.92

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you