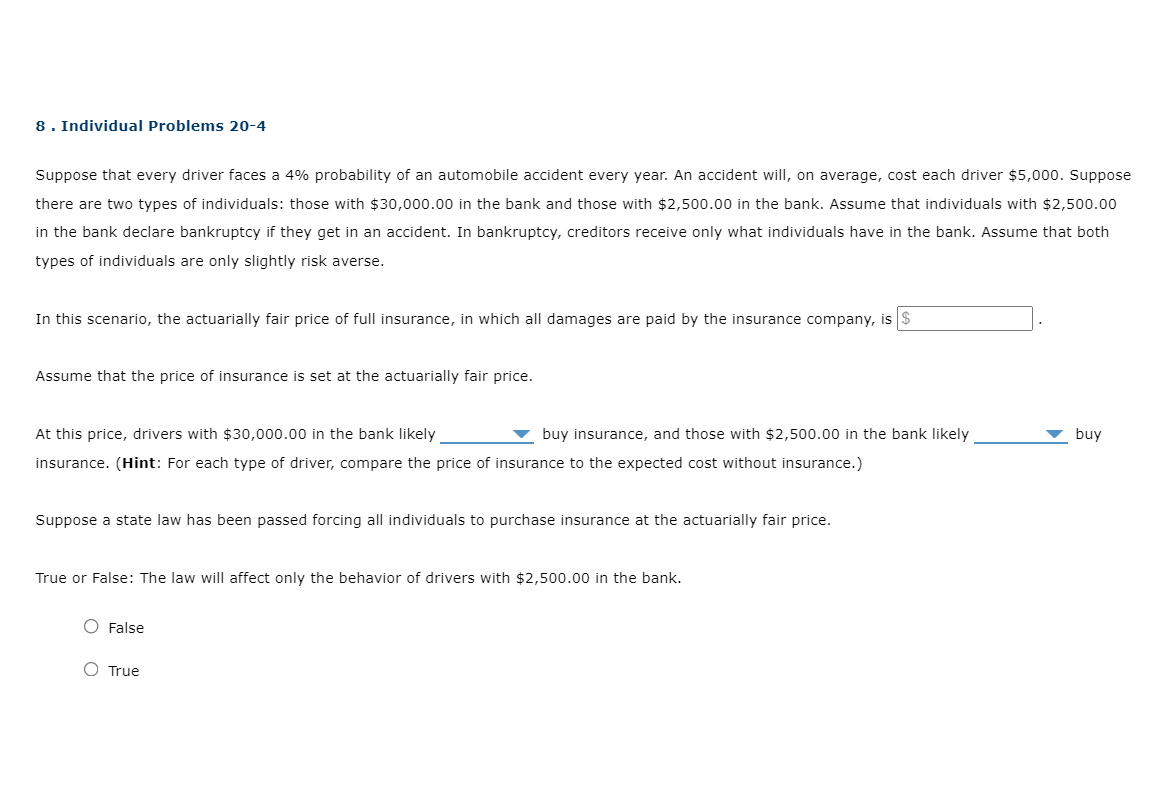

8. Individual Problems 20-4 Suppose that every driver faces a 4% probability of an automobile accident every year. An accident will, on average, cost each driver $5,000. Suppose there are two types of individuals: those with $30,000.00 in the bank and those with $2,500.00 in the bank. Assume that individuals with $2,500.00 in the bank declare bankruptcy if they get in an accident. In bankruptcy, creditors receive only what individuals have in the bank. Assume that both types of individuals are only slightly risk averse. In this scenario, the actuarially fair price of full insurance, in which all damages are paid by the insurance company, is $ Assume that the price of insurance is set at the actuarially fair price. At this price, drivers with $30,000.00 in the bank likely v buy insurance, and those with $2,500.00 in the bank likely buy insurance. (Hint: For each type driver, compare the price of insurance to the expected cost without insurance.) Suppose a state law has been passed forcing all individuals to purchase insurance at the actuarially fair price. True or False: The law will affect only the behavior of drivers with $2,500.00 in the bank. O False O True

8. Individual Problems 20-4 Suppose that every driver faces a 4% probability of an automobile accident every year. An accident will, on average, cost each driver $5,000. Suppose there are two types of individuals: those with $30,000.00 in the bank and those with $2,500.00 in the bank. Assume that individuals with $2,500.00 in the bank declare bankruptcy if they get in an accident. In bankruptcy, creditors receive only what individuals have in the bank. Assume that both types of individuals are only slightly risk averse. In this scenario, the actuarially fair price of full insurance, in which all damages are paid by the insurance company, is $ Assume that the price of insurance is set at the actuarially fair price. At this price, drivers with $30,000.00 in the bank likely v buy insurance, and those with $2,500.00 in the bank likely buy insurance. (Hint: For each type driver, compare the price of insurance to the expected cost without insurance.) Suppose a state law has been passed forcing all individuals to purchase insurance at the actuarially fair price. True or False: The law will affect only the behavior of drivers with $2,500.00 in the bank. O False O True

A First Course in Probability (10th Edition)

10th Edition

ISBN:9780134753119

Author:Sheldon Ross

Publisher:Sheldon Ross

Chapter1: Combinatorial Analysis

Section: Chapter Questions

Problem 1.1P: a. How many different 7-place license plates are possible if the first 2 places are for letters and...

Related questions

Question

Transcribed Image Text:8. Individual Problems 20-4

Suppose that every driver faces a 4% probability of an automobile accident every year. An accident will, on average, cost each driver $5,000. Suppose

there are two types of individuals: those with $30,000.00 in the bank and those with $2,500.00 in the bank. Assume that individuals with $2,500.00

in the bank declare bankruptcy if they get in an accident. In bankruptcy, creditors receive only what individuals have in the bank. Assume that both

types of individuals are only slightly risk averse.

In this scenario, the actuarially fair price of full insurance, in which all damages are paid by the insurance company, is $

Assume that the price of insurance is set at the actuarially fair price.

At this price, drivers with $30,000.00 in the bank likely

v buy insurance, and those with $2,500.00 in the bank likely

buy

insurance. (Hint: For each type

driver, compare the price of insurance to the expected cost without insurance.)

Suppose a state law has been passed forcing all individuals to purchase insurance at the actuarially fair price.

True or False: The law will affect only the behavior of drivers with $2,500.00 in the bank.

O False

O True

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

A First Course in Probability (10th Edition)

Probability

ISBN:

9780134753119

Author:

Sheldon Ross

Publisher:

PEARSON

A First Course in Probability (10th Edition)

Probability

ISBN:

9780134753119

Author:

Sheldon Ross

Publisher:

PEARSON