8. RBC expects a deposit drain of $20 million. Show the Dis balance sheet if the following conditions occur: 1. RBC purchases liabilities to offset this expected drain ( II. The stored liquidity management method is used to meet the expected drain (RBC does not want the cash balance to fall below $5million, and securities can be sold at fair value)

8. RBC expects a deposit drain of $20 million. Show the Dis balance sheet if the following conditions occur: 1. RBC purchases liabilities to offset this expected drain ( II. The stored liquidity management method is used to meet the expected drain (RBC does not want the cash balance to fall below $5million, and securities can be sold at fair value)

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 8P

Related questions

Question

Help with question g.

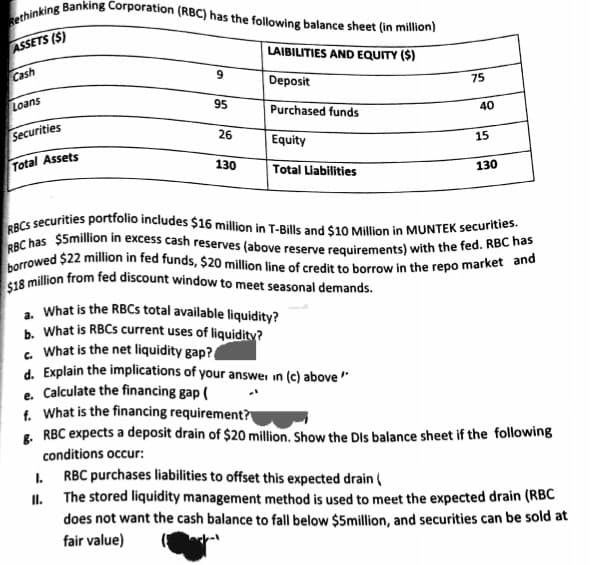

Transcribed Image Text:Rethinking Banking Corporation (RBC) has the following balance sheet (in million)

LAIBILITIES AND EQUITY ($)

ASSETS ($)

Cash

Deposit

Purchased funds

Equity

Total Liabilities

Loans

Securities

Total Assets

9

95

26

130

75

d. Explain the implications of your answer in (c) above

e. Calculate the financing gap (

f. What is the financing requirement?

40

15

130

RBCS securities portfolio includes $16 million in T-Bills and $10 Million in MUNTEK securities.

RBC has $5million in excess cash reserves (above reserve requirements) with the fed. RBC has

borrowed $22 million in fed funds, $20 million line of credit to borrow in the repo market and

$18 million from fed discount window to meet seasonal demands.

a. What is the RBCs total available liquidity?

b. What is RBCs current uses of liquidity?

c. What is the net liquidity gap?

8. RBC expects a deposit drain of $20 million. Show the Dis balance sheet if the following

conditions occur:

1.

RBC purchases liabilities to offset this expected drain (

II. The stored liquidity management method is used to meet the expected drain (RBC

does not want the cash balance to fall below $5million, and securities can be sold at

fair value)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT