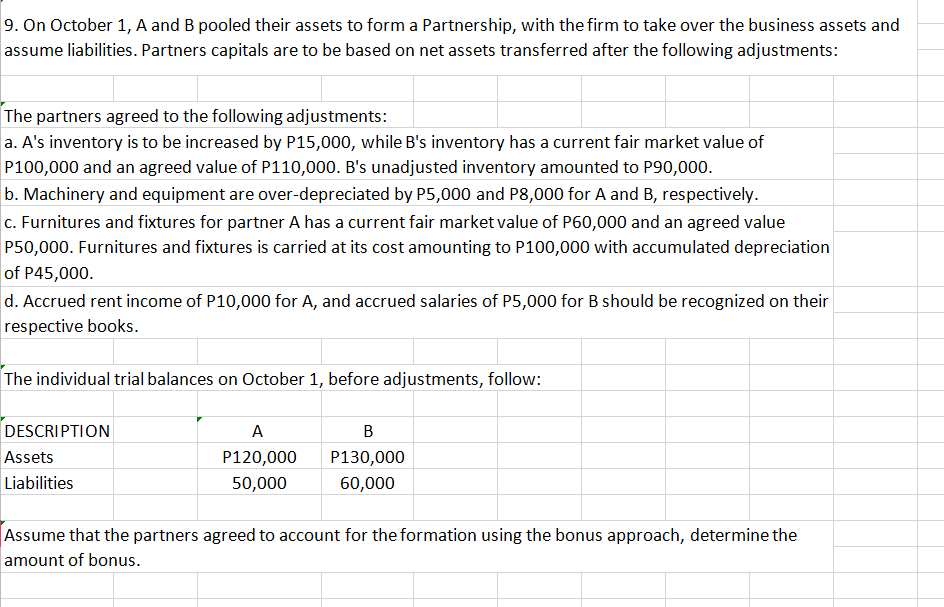

9. On October 1, A and B pooled their assets to form a Partnership, with the firm to take over the business assets and assume liabilities. Partners capitals are to be based on net assets transferred after the following adjustments: The partners agreed to the following adjustments: a. A's inventory is to be increased by P15,000, while B's inventory has a current fair market value of P100,000 and an agreed value of P110,000. B's unadjusted inventory amounted to P90,000. b. Machinery and equipment are over-depreciated by P5,000 and P8,000 for A and B, respectively. c. Furnitures and fixtures for partner A has a current fair market value of P60,000 and an agreed value P50,000. Furnitures and fixtures is carried at its cost amounting to P100,000 with accumulated depreciation of P45,000. d. Accrued rent income of P10,000 for A, and accrued salaries of P5,000 for B should be recognized on their respective books. The individual trial balances on October 1, before adjustments, follow: DESCRIPTION A B Assets P120,000 P130,000 Liabilities 50,000 60,000 Assume that the partners agreed to account for the formation using the bonus approach, determine the amount of bonus.

9. On October 1, A and B pooled their assets to form a Partnership, with the firm to take over the business assets and assume liabilities. Partners capitals are to be based on net assets transferred after the following adjustments: The partners agreed to the following adjustments: a. A's inventory is to be increased by P15,000, while B's inventory has a current fair market value of P100,000 and an agreed value of P110,000. B's unadjusted inventory amounted to P90,000. b. Machinery and equipment are over-depreciated by P5,000 and P8,000 for A and B, respectively. c. Furnitures and fixtures for partner A has a current fair market value of P60,000 and an agreed value P50,000. Furnitures and fixtures is carried at its cost amounting to P100,000 with accumulated depreciation of P45,000. d. Accrued rent income of P10,000 for A, and accrued salaries of P5,000 for B should be recognized on their respective books. The individual trial balances on October 1, before adjustments, follow: DESCRIPTION A B Assets P120,000 P130,000 Liabilities 50,000 60,000 Assume that the partners agreed to account for the formation using the bonus approach, determine the amount of bonus.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 4PB

Related questions

Question

Transcribed Image Text:9. On October 1, A and B pooled their assets to form a Partnership, with the firm to take over the business assets and

assume liabilities. Partners capitals are to be based on net assets transferred after the following adjustments:

The partners agreed to the following adjustments:

a. A's inventory is to be increased by P15,000, while B's inventory has a current fair market value of

P100,000 and an agreed value of P110,000. B's unadjusted inventory amounted to P90,000.

b. Machinery and equipment are over-depreciated by P5,000 and P8,000 for A and B, respectively.

c. Furnitures and fixtures for partner A has a current fair market value of P60,000 and an agreed value

P50,000. Furnitures and fixtures is carried at its cost amounting to P100,000 with accumulated depreciation

of P45,000.

d. Accrued rent income of P10,000 for A, and accrued salaries of P5,000 for B should be recognized on their

respective books.

The individual trial balances on October 1, before adjustments, follow:

DESCRIPTION

A

B

Assets

P120,000

P130,000

Liabilities

50,000

60,000

Assume that the partners agreed to account for the formation using the bonus approach, determine the

amount of bonus.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT