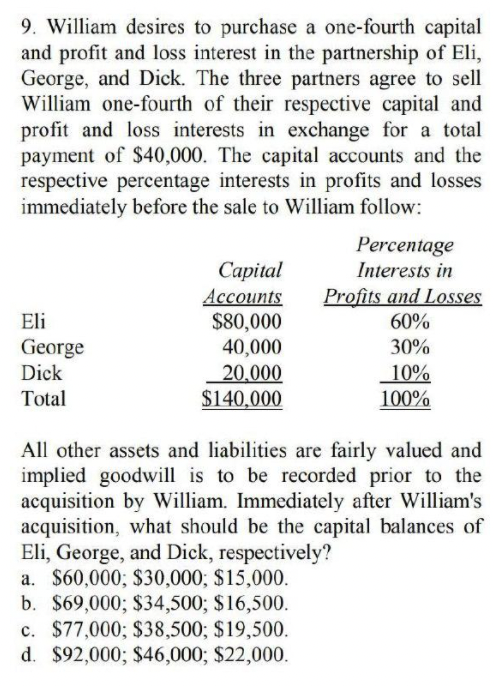

9. William desires to purchase a one-fourth capital and profit and loss interest in the partnership of Eli, George, and Dick. The three partners agree to sell William one-fourth of their respective capital and profit and loss interests in exchange for a total payment of $40,000. The capital accounts and the respective percentage interests in profits and losses immediately before the sale to William follow: Percentage Interests in Сapital Profits and Losses Ассounts $80,000 40,000 20,000 $140,000 Eli 60% George Dick 30% 10% 100% Total All other assets and liabilities are fairly valued and implied goodwill is to be recorded prior to the acquisition by William. Immediately after William's acquisition, what should be the capital balances of Eli, George, and Dick, respectively? a. $60,000; $30,000; $15,000. b. $69,000; $34,500; $16,500. c. $77,000; $38,500; $19,500. d. $92,000; $46,000; $22,000.

9. William desires to purchase a one-fourth capital and profit and loss interest in the partnership of Eli, George, and Dick. The three partners agree to sell William one-fourth of their respective capital and profit and loss interests in exchange for a total payment of $40,000. The capital accounts and the respective percentage interests in profits and losses immediately before the sale to William follow: Percentage Interests in Сapital Profits and Losses Ассounts $80,000 40,000 20,000 $140,000 Eli 60% George Dick 30% 10% 100% Total All other assets and liabilities are fairly valued and implied goodwill is to be recorded prior to the acquisition by William. Immediately after William's acquisition, what should be the capital balances of Eli, George, and Dick, respectively? a. $60,000; $30,000; $15,000. b. $69,000; $34,500; $16,500. c. $77,000; $38,500; $19,500. d. $92,000; $46,000; $22,000.

Chapter14: Choice Of Business Entity—operations And Distributions

Section: Chapter Questions

Problem 25P

Related questions

Question

Hi can you help me to answer this question?

Transcribed Image Text:9. William desires to purchase a one-fourth capital

and profit and loss interest in the partnership of Eli,

George, and Dick. The three partners agree to sell

William one-fourth of their respective capital and

profit and loss interests in exchange for a total

payment of $40,000. The capital accounts and the

respective percentage interests in profits and losses

immediately before the sale to William follow:

Percentage

Interests in

Сapital

Profits and Losses

Ассоunts

$80,000

40,000

20,000

$140,000

Eli

60%

George

Dick

30%

10%

100%

Total

All other assets and liabilities are fairly valued and

implied goodwill is to be recorded prior to the

acquisition by William. Immediately after William's

acquisition, what should be the capital balances of

Eli, George, and Dick, respectively?

a. $60,000; $30,000; $15,000.

b. $69,000; $34,500; $16,500.

c. $77,000; $38,500; $19,500.

d. $92,000; $46,000; $22,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College