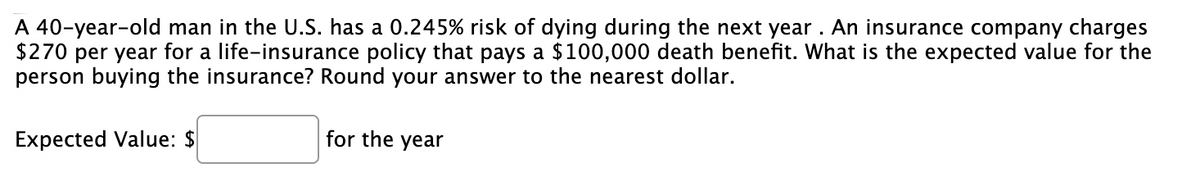

A 40-year-old man in the U.S. has a 0.245% risk of dying during the next year . An insurance company charges $270 per year for a life-insurance policy that pays a $100,000 death benefit. What is the expected value for the person buying the insurance? Round your answer to the nearest dollar. Expected Value: $ for the year

A 40-year-old man in the U.S. has a 0.245% risk of dying during the next year . An insurance company charges $270 per year for a life-insurance policy that pays a $100,000 death benefit. What is the expected value for the person buying the insurance? Round your answer to the nearest dollar. Expected Value: $ for the year

Algebra & Trigonometry with Analytic Geometry

13th Edition

ISBN:9781133382119

Author:Swokowski

Publisher:Swokowski

Chapter10: Sequences, Series, And Probability

Section: Chapter Questions

Problem 35T

Related questions

Topic Video

Question

100%

Transcribed Image Text:A 40-year-old man in the U.S. has a 0.245% risk of dying during the next year. An insurance company charges

$270 per year for a life-insurance policy that pays a $100,000 death benefit. What is the expected value for the

person buying the insurance? Round your answer to the nearest dollar.

Expected Value: $

for the year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, calculus and related others by exploring similar questions and additional content below.Recommended textbooks for you

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage