A 68-year old retiree has a pension savings of $51,000, a 401k of $58,000, and an IRA account of $68,000. Before 2008, he had 2% more cash in the pension, 12% more in the IRA, and -1% in the 401k. He wants to take out 2% from each account before he turns 72, which will cost him a penalty of an extra 1% from the pension, 2% from the 401k, and 6% from the IRA. What is the relevant information for the amount that the retiree will have in his pension if he doesn't take money out now? Select the correct answer below. O The retiree had 2% more cash in the pension in 2008 O The retiree has a pension savings of $51,000 O The retiree has a 401k of $58, 000 O The retiree has an IRA account of $68,000

A 68-year old retiree has a pension savings of $51,000, a 401k of $58,000, and an IRA account of $68,000. Before 2008, he had 2% more cash in the pension, 12% more in the IRA, and -1% in the 401k. He wants to take out 2% from each account before he turns 72, which will cost him a penalty of an extra 1% from the pension, 2% from the 401k, and 6% from the IRA. What is the relevant information for the amount that the retiree will have in his pension if he doesn't take money out now? Select the correct answer below. O The retiree had 2% more cash in the pension in 2008 O The retiree has a pension savings of $51,000 O The retiree has a 401k of $58, 000 O The retiree has an IRA account of $68,000

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter14: Planning For Retirement

Section: Chapter Questions

Problem 2FPE

Related questions

Question

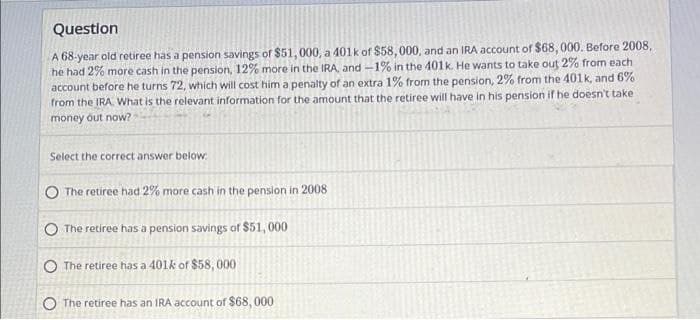

Transcribed Image Text:Question

A 68-year old retiree has a pension savings of $51, 000, a 401k of $58,000, and an IRA account of $68, 000. Before 2008,

he had 2% more cash in the pension, 12% more in the IRA, and -1% in the 401k He wants to take out 2% from each

account before he turns 72, which will cost him a penalty of an extra 1% from the pension, 2% from the 401k, and 6%

from the IRA. What is the relevant information for the amount that the retiree will have in his perision if he doesn't take

money out now?

Select the correct answer below.

The retiree had 2% more cash in the pension in 2008

The retiree has a pension savings of $51, 000

O The retiree has a 401k of $58, 000

O The retiree has an IRA account of $68, 000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning