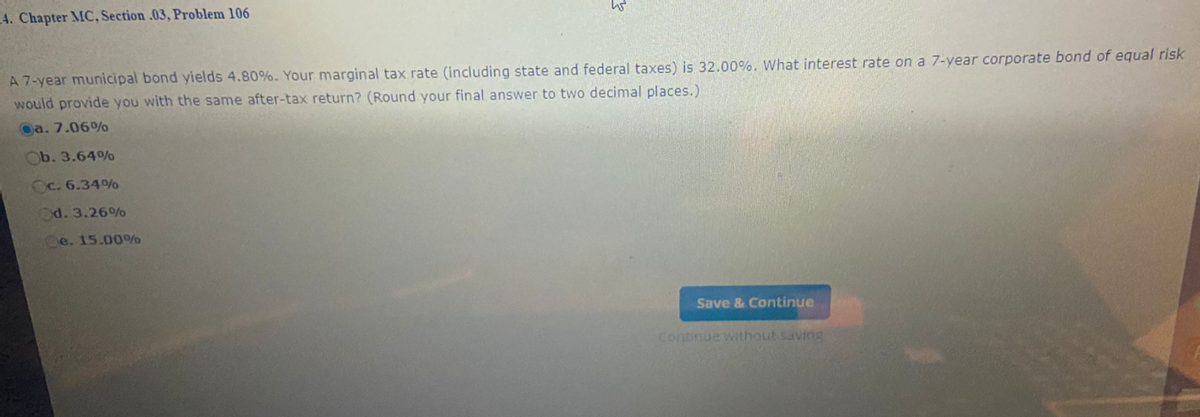

A 7-year municipal bond yields 4.80%. Your marginal tax rate (including state and federal taxes) is 32.00%. What interest rate on a 7-year corporate bond of equal risk would provide you with the same after-tax return? (Round your final answer to two decimal places.) a. 7.06% Ob. 3.64% Oc. 6.34% Od. 3.26% e. 15.00%/

Q: Municipal bonds are yielding 4.4 percent if they are insured and 4.7 percent if they are uninsured.…

A: Bonds are the debt security which is offered or issued by the corporates or the governments to…

Q: An investor purchases a 30-year U.S. government bond for $1,020. The bond's coupon rate is 9…

A: Given information: Present value of bond is $1,020 Par value of bond is $1,000 Coupon rate is 9%…

Q: Jones Cricket Institute issued a 30 year, 8 percent semi-annual bond 3 year ago. The bond currently…

A: Debt is the kind of loan which is taken by the company from outside to satisfy the capital…

Q: Suppose you invest in a municipal bond that pays a yield of 149%. If your marginal tax is 15%, what…

A: A municipal bond is a government debt security issued to raise long-term debt funds. The yield…

Q: 3. Jones Cricket Institute issued a 30 year, 8 percent semi-annual bond 3 year ago. The bond…

A: Solution- (a) the pre-taxed cost of debt is its yield to maturity (YTM) Assume that Face value or…

Q: What is your best estimate of the after-tax cost of debt now?

A: Price =93%*1000 =930Par Value =1000

Q: Consider the decision to purchase either a five year corporate bond or a five year municipal bond.…

A:

Q: Bond interest payments before and after taxes Charter Corp. has issued 1,719 debentures with a total…

A: The interest rate on the debenture is calculated on the face value. The company gets a tax benefit…

Q: bond

A: 1) To calculate which bond is more beneficial we have to calculate the YTM. Formula for YTM is: YTM…

Q: Bond interest payments before and after taxes Charter Corp. has issued 2,500 debentures with a total…

A: When a company needs to acquire funds from outside sources it has to seek either the issuance of…

Q: Your company is borrowing $5,800,000 in the form of bonds. The par value and market value are the…

A: Bonds are debt securities issued by Government or other companies, who seek to raise money from…

Q: Husky Enterprises recently sold an issue of 13-year maturity bonds. The bonds were sold at a deep…

A: The yield to maturity is the rate of return realized when bond is held till the maturity of bond and…

Q: An LGU bond offers a yield of 8.5%. What rate should a corporation offer on its bond so investors…

A: Bonds are the liabilities of the company which is issued to raise the funds required to finance the…

Q: Assume a municipal bond has a yield of 5.75% and corporate bond of comparable maturity and credit…

A: After tax yield on any investment is the total rate of return that is generated after accounting for…

Q: Freddy’s Farm issued a 25-year, 5 percent semiannual bond three years ago. The bond currently sells…

A: Given:

Q: Simple Corp. has one bond issue oustanding, with a maturity of 10.5 years, a coupon rate of 3.6% and…

A: Here, Maturity = 10.5 years Coupon rate = 3.6% Yield to maturity = 5.4% Average tax rate = 18%…

Q: A Corporation believes that it can sell long term-bonds with an 8% coupon rate, although the…

A: Corporate bond kind of debt issued by profit-generating organizations. These bonds are risky, unlike…

Q: You can invest in taxable bonds that are paying a yield of 9.7 percent or a municipal bond paying a…

A: A financial instrument that does not affect the ownership of the common shareholders or management…

Q: e-Midland, Inc. is issuing a $1,000 par value bond that pays 7.5 percent annual interest and…

A: After tax cost of bond is the yield to maturity of bond that is rate of return realized on the bond…

Q: A corporate bond that you own at the beginning of the year is worth $915. During the year, it pays…

A: A CORPORATE BOND IS A DEBT ISSUED BY A COMPANY IN ORDER TO RAISE CAPITAL . CAPITAL GAIN : = VALUE…

Q: Assume a municipal bond has a yield of 5.75% and corporate bond of comparable maturity and credit…

A: After tax Yield on Municipal Bond = Before Tax Yield on Municipal Bond After tax Yield on Municipal…

Q: 1.) Madoff Corporation raised money through a bond issue with a total principal value of $3,000,000.…

A: Given information in this question Face value =$1000 Coupon rate =6% Tax rate =21%

Q: 1. Calculate the price of a zero-coupon bond that matures in 12 years if the market interest rate is…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: If a 5 year annual bond with a 6% coupon rate, currently priced at $988 and par value is $1000, what…

A: Borrowings are the liability of the company which is used to finance the requirement of the funds.…

Q: If a 5 yr. AA- General Dynamics note is yielding a 35% tax bracket investor 7.56125% while a…

A: Tax equivalent yield is used to determine the yield from a municipal bond or a note.

Q: You pay $5600 for a municipal bond. When it matures after 15 years, you receive $11,000 The total…

A: Pay for Municipal Bond $ 5600 Matures After 15 Years. We received $11000 Total Return calculated as…

Q: Jones Cricket Institute issued a 30 year, 8 percent semi-annual bond 3 year ago. The bond currently…

A: Coupon rate on bond = 8% Semi-annual coupon amount = 8%/2 = 4% Let Face Value = 1000 Selling Price…

Q: A municipal bond has a yield to maturity of 3.8 percent. What corporate bond yield would make an…

A: Yield on Municipal Bond should be equal to corporate bond yield * (1-tax rate), for indifference…

Q: 3. Jones Cricket Institute issued a 30 year, 8 percent semi-annual bond 3 year ago. The bond…

A: Since you have posted a question with multiple sub-parts, we will solve the first three subparts for…

Q: To calculate the after-tax cost of debt, multiply the before-tax cost of debt by Three Waters…

A: Cost of debt(Kd) is the minimum rate of return on the debt funds raised by the company. It should be…

Q: what is the equivalent yield on the taxable bond?

A: Equivalent Yield on Taxable Bond: It refers to the yield on the taxable bond needed to be made equal…

Q: Pearce's Cricket Farm issued a 30-year, 9% semiannual bond 4 years ago. The bond currently sells for…

A: Given:

Q: Determine the after-tax yield (i.e., IRR on the ATCF) obtained by an individual who purchases a…

A: The IRR is the rate at which the cost to purchase an asset is equal to the present value of cash…

Q: Suppose your marginal federal income tax rate is 25 percent. 1. What is your after-tax return from…

A: The question is to study the impact on tax rate on yield of different types of bonds, in general…

Q: For a face value of $1,000, a zero-coupon bond maturates in 15 years. It has a 7% coupon, so I…

A: Please find the answer to the above question below:

Q: Jiminy's Cricket Farm Issued a bond with 25 years to maturity and a semlannual coupon rate of 4…

A: The company needs funds in order to carrying the long term as well as short term expenses. Those…

Q: Charter Corp. has issued 2,500 debentures with a total principal value of $1,500,000. The bonds have…

A: Debentures are a kind of long-term debt financing instrument that a company or government of a…

Q: A Corporation believe that it can sell long term-bonds with an 8% coupon rate, although the…

A: Coupon rate = 8% Effective rate = 10% Tax rate = 35%

Q: Bond interest payments before and after taxes Charter Corp. has issued 2,985 debentures with a total…

A: Part (a): Calculation of dollar amount of interest per bond: Answer: Dollar amount of interest per…

Q: To calculate the after-tax cost of debt, multiply the before-tax cost of debt by Western Gas &…

A: Question 1:To calculate the after-tax cost of debt, multiply the before-tax cost of debt by “1-Tax…

Q: Ernie's has 3,500 bonds outstanding with a face value of $1,000 each and a coupon rate of 8.5…

A: The interest tax shield is the amount of rebate granted from taxable income because of the tax…

Q: An investor is comparing the following two bonds: a bond from ABC Corp which pays an interest rate…

A: Taxation-Taxation means imposing a tax on individuals and different types of organizations. Which…

Q: Bond interest payments before and after taxes Charter Corp. has issued 2,798 debentures with a…

A: Calculation of Amount of Interest per bond, Total Interest Expense and After-tax Interest Cost:The…

Q: To calculate the after-tax cost of debt, multiply the before-tax cost of debt by ______. 2.…

A: Cost of debt is nothing but yield to maturity of bond and cost of debt has advantage of taxes due to…

Q: A 7-year municipal bond with a face value of $1,000 earns annual income of $480. Your marginal tax…

A: Given: Annual income = $480 Tax rate = 36%

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Bond Yield and After-Tax Cost of Debt A companys 6% coupon rate, semiannual payment, 1,000 par value bond that matures in 30 years sells at a price of 515.16. The companys federal-plus-state tax rate is 40%. What is the firms after-tax component cost of debt for purposes of calculating the WACC? (Hint: Base your answer on the nominal rate.)A 5-year corporate bond yields 10.70%. A 5-year municipal bond of equal risk yields 6.50%. Assume that the state tax rate is zero. At what federal tax rate are you indifferent between the two bonds? (Round your final answer to two decimal places.)A 7-year municipal bond with a face value of $1,000 earns annual income of $480. Your marginal tax rate (including state and federal taxes) is 36%. What annual pretax income on a 7-year corporate bond of equal risk would provide you with the same annual after-tax income as the municipal bond?

- An 8.4 percent coupon bond issued by the state of Indiana sells for $1,000. What coupon rate on a corporate bond selling at its $1,000 par value would produce the same after-tax return to the investor as the municipal bond if the investor is in: a. the 15 percent marginal tax bracket? b. the 25 percent marginal tax bracket? c. the 35 percent marginal tax bracket?7A-12 For a face value of $1,000, a zero-coupon bond maturates in 15 years. It has a 7% coupon, so I should be able to cash it in by the time I'm 70. pay in the first year For argument's sake, assume the taxpayer has a 25% effective tax rate a. $5.25b. $5.44c. $5.99d. $6.25e. $6.34An LGU bond offers a yield of 8.5%. What rate should a corporation offer on its bond so investors will invest on them? Assume a tax rate of 25%. Round-off final answer only to two decimal places.

- You can invest in taxable bonds that are paying a yield of 9.7 percent or a municipal bond paying a yield of 7.95 percent. Assume your marginal tax rate is 21 percent. a. Calculate the after-tax rate of return on the taxable bond? (Round your answer to 2 decimal places. (e.g., 32.16))b. Which security bond should you buy?1. To calculate the after-tax cost of debt, multiply the before-tax cost of debt by ______. 2. Western Gas & Electric Company (WGC) can borrow funds at an interest rate of 12.50% for a period of six years. Its marginal federal-plus-state tax rate is 25%. WGC’s after-tax cost of debt is ________. (rounded to two decimal places). 3. At the present time, Western Gas & Electric Company (WGC) has 15-year noncallable bonds with a face value of $1,000 that are outstanding. These bonds have a current market price of $1,555.38 per bond, carry a coupon rate of 11%, and distribute annual coupon payments. The company incurs a federal-plus-state tax rate of 25%. If WGC wants to issue new debt, what would be a reasonable estimate for its after-tax cost of debt (rounded to two decimal places)? (Note: Round your YTM rate to two decimal place.) 4.73% 4.11% 4.93% 3.29%1. Suppose the state of Indiana issued a tax-exempt bond to pay for student fees in its universities. The bond currently has a yield of 0.8 percent. 2. Suppose Mike is paying a marginal tax rate of 20% and Peter is paying a marginal tax rate of 30%. Calculate the equivalent taxable yields of this bond to both Mike and Peter. Mike: 0.8/(1-.2)=1 Peter: 0.8/(1-.3)= 2.67 3. Suppose that the yield on a Baa-rated corporate bond, a bond with the same credit rating as the state of Indiana, is 1.4 percent. Calculate the yield ratio between the tax-exempt bond vs the taxable bond, and briefly interpret what the yield ratio implies.

- 2) To calculate the after-tax cost of debt, multiply the before-tax cost of debt by ------ . Water and Power Company (WPC) can borrow funds at an interest rate of 9.70% for a period of four years. Its marginal federal-plus-state tax rate is 40%. WPC’s after-tax cost of debt is (rounded to two decimal places). At the present time, Water and Power Company (WPC) has 10-year noncallable bonds with a face value of $1,000 that are outstanding. These bonds have a current market price of $1,092.79 per bond, carry a coupon rate of 11%, and distribute annual coupon payments. The company incurs a federal-plus-state tax rate of 40%. If WPC wants to issue new debt, what would be a reasonable estimate for its after-tax cost of debt (rounded to two decimal places)? (Note: Round your YTM rate to two decimal place.) 4.57% 5.14% 5.71% 6.57%Calculate the after-tax return of a(n) 5.625.62 percent, 20-year, A-rated corporate bond for an investor in the 1515 percent marginal tax bracket. Compare this yield to a(n) 3.683.68 percent, 20-year, A-rated, tax-exempt municipal bond, and explain which alternative is better. Repeat the calculations and comparison for an investor in the 3535 percent marginal tax bracket. Question content area bottom Part 1 The after-tax return of the 5.625.62%, 20-year, A-rated corporate bond for an investor in the 1515% marginal tax bracket is enter your response here%. (Round to two decimal places.) Part 2 Compare this yield to the 3.683.68%, 20-year, A-rated, tax-exempt municipal bond and explain which alternative is better. (Select the best answer below.) A. The after dash tax yield of 4.78 % for the corporate bond is a better alternative than the 3.68 % tax dash free municipal bondThe after-tax yield of 4.78% for the corporate bond is a better…Municipal bonds are yielding 4.4 percent if they are insured and 4.7 percent if they are uninsured. Your marginal tax rate is 28 percent and the inflation rate is 1.645%. Your equivalent taxable yield on the insured bonds is _____ percent and on the uninsured bonds is _____ percent. How would your answers change if your marginal tax rate falls to 13.5% and the inflation rate increases to 2.0639%? What would happen to the YTM of the uninsured bond if negative news was announced resulting in a decline in its credit rating? What would happen to the YTM of the insured bond if it suddenly lost its insurance?