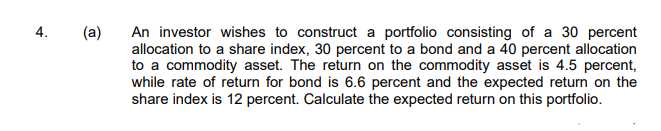

(a) An investor wishes to construct a portfolio consisting of a 30 percent allocation to a share index, 30 percent to a bond and a 40 percent allocation to a commodity asset. The return on the commodity asset is 4.5 percent, while rate of return for bond is 6.6 percent and the expected return on the share index is 12 percent. Calculate the expected return on this portfolio.

Q: You have a portfolio consisting solely of Stock A and Stock B. The portfolio has an expected return…

A: In this we have to calculate weighted average return of portfolio.

Q: Angela’s portfolio holds security A, which returned 12.0%, security B, which returned 15.0% and…

A: expected return of portfolio =wA×rA+wB×rB+wC×rCwhere,w=weights of respective stocksr= return of…

Q: You create a portfolio consisting of $23000 invested in a mutual fund with beta of 1.3, $25000…

A: Capital asset pricing model: This model describes the relationship of the expected return of the…

Q: The Blackwell mutual fund has a stock portfolio that are consists of the following companies. Stock…

A: Beta It helps to measure the stock volatility related to an overall market. It is computed in order…

Q: You own a portfolio that is 28 percent invested in Stock X, 43 percent in Stock Y, and 29 percent in…

A: Portfolio is the collection of securities. portfolio return formula: portfolio return =∑nwn×rn…

Q: You own a portfolio that has $3,200 invested in Stock A and $4,200 invested in Stock B. If the…

A: Value of stock A = $3,200 Value of stock B = $4,200 Value of portfolio ($3,200 + $4,200) = $7,400…

Q: A portfolio consists of assets with the following expected returns (refer to image): a. What is the…

A: A portfolio refers to the mixture of different kinds of funds and securities for the investment.

Q: price

A: Formula to calculate bond price is: P = C* 1 - (1+r)^-n + F/(1+r)^n r Where C…

Q: Suppose that a portfolio consist of three securities: A, B and C with expected rates of return of…

A: Portfolio refers to basket of different financial assets in which investment is made by single…

Q: If you create a portfolio for your client with 73 percent invested in the S&P 500 U.S. stock index…

A: Portfolio return is the weighted average return of the various securities of the portfolio:…

Q: Example: Suppose you want to invest in one stock and one bond. The expected return and standard…

A: Given information : Asset Weight Expected return Standard deviation Stock 70% 9% 16% Bond…

Q: a) Explain what happens to a portfolio's overall risk when securities that are uncorrelated are…

A: Diversified portfolio- It refers to a portfolio of investments in which unsystematic risk or firm…

Q: You own a portfolio that is 26 percent invested in Stock X, 41 percent in Stock Y, and 33 percent in…

A: Formula: Expected return of portfolio=∑i=1nWi×ri

Q: A portfolio that combines the risk-free asset and the market portfolio has an expected return of 7…

A: A portfolio is a combination or group of financial instruments and securities that are held by an…

Q: a) The stock market of country A has an expected return of 5 percent, and standard deviation of…

A: The expected return and standard deviation of a portfolio: The expected return of a portfolio is the…

Q: Angela’s portfolio holds security A, which returned 12.0%, security B, which returned 15.0% and…

A: Return on A = 12% Return on B = 15% Return on C = -5% Weight of A = 45% Weight of B = 25% Weight…

Q: Suppose the 1-year futures price on a stock-index portfolio is 1,914, the stock index currently is…

A: "Since you have posted the question with multiple sub-parts, we will solve first three sub-parts for…

Q: A five-year bond pays interest The par value is GHc 1000 and the coupon rate equals seven (7)…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: A portfolio is invested 27 percent in Stock G, 42 percent in Stock J, and 31 percent in Stock K. The…

A: The expected return of a portfolio refers to the sum of proportionate returns from each element of…

Q: Assume the market portfolio's and risk-free rate's projected returns are 13% and 3%, respectively.…

A: There are various portfolio performance measures and one such measure is Treynors' ratio. This ratio…

Q: Suppose the risk-free rate is 6 percent and the market portfolio has an expected return of 12…

A: The question can be answered by determining the expected return for the stock using the capital…

Q: A two-share portfolio held by an institutional investor has the following information: Years (t)…

A: We will first calculate the standard deviation of the portfolio including ABC & XYZ and…

Q: Stock A has an expected return of 10 percent and a beta of 1.0. Stock B has a beta of 2.0. Portfolio…

A: CAPM stands for capital asset pricing model. It explains the relationship between systematic risk…

Q: A portfolio consists of two securities and the expected return on them is 11% and 15% respectively.…

A: Information Provided: Expected Return of Security 1 = 11% Expected Return of Security 2 = 15% Weight…

Q: Currently the risk-free return is 3 percent and the market risk premium is 8 percent. What is the…

A: Risk-free rate = 3% Market risk premium = 8% According to CAPM: Required return = Risk-free rate +…

Q: Portfolio Standard deviation of What happens to the portfolio risk if market conditions reduce the…

A: Given: Return on A = 12% Return on B = 15% Return on C = -5% Weight of A = 45% Weight of B = 25%…

Q: Required: Calculate the: Cal Bank has a corporate bond that matures in two years but makes…

A: Required in question: Cal Bank has a corporate bond that matures in two years but makes semi-annual…

Q: Suppose the expected return for the market portfolio and risk-free rate are 13 percent and 3 percent…

A: Treynor ratio = (Expected return - Risk free rate) / BetaTreynor ratio of the market = (Expected…

Q: A portfolio that combines the risk-free asset and the market portfolio has an expected return of 7…

A: An expected return is defined as the profit / loss, where an investors used to anticipate on their…

Q: According to the tangency portfolio allocation, stock A contributes 10%, stock B contributes 40%,…

A: Expected return of portfolio 10%-0.5*2%=11%

Q: A portfolio that combines the risk-free asset and the market portfolio has an expected return of 6.4…

A: Given Expected return is 6.4% and standard deviation is 9.4%. The risk free rate is 3.4% Expected…

Q: Stanislas Korowski owns a portfolio con- sisting of the following stocks below: Mytab PERCENTAGE OF…

A: Note: As per our guidelines, we can only answer first three subparts. Please post other subparts…

Q: Assume that you have just received information from your investment advisor that your portfolio has…

A: Portfolio Investment is termed for investor holding whose funds are diversified in several assets…

Q: If you have an investment portfolio which is a mix of stock and bonds, with the stocks having a…

A: Information Provided: Stock return = 1.2% Stock weightage = 30% Bond return = 3.5% Bond weightage =…

Q: You are planning to invest in a portfolio consisting of Shares L, M and N. The following table shows…

A: Meaning of Expected return of portfolio-Expected return of portfolio is the return an investor is…

Q: The Blackwell mutual fund has a stock portfolio that are consists of the following companies. Stock…

A: stock proportional in the portfolio beta Gazprom 0.25 1.4 Shell 0.3 1.6 Exxon Mobil 0.3 1.5…

Q: Consider a well-diversified portfolio composed of stocks with the same beta and standard deviation…

A: 1. Beta of the portfolio = (0.94 + 0.10 + 1.26)/3 = 0.77 when…

Q: Consider two types of assets: market portfolio (M) and stock A. The expected return is 8% and…

A: Given: Market rate = 8% Risk free rate = 2% Standard deviation of market portfolio = 15% Standard…

Q: Alice's portfolio consists solely of an investment in Merrill stock. Merrill has an expected return…

A: Given The investment return is 13% and volatility value is 18%. The market portfolio has anexpected…

Q: A portfolio that combines the risk-free asset and the market portfolio has an expected return of 7…

A: The CAPM the capital assets pricing model gives the risk adjusted return of the security and gives…

Q: Using the CAPM, estimate the appropriate required rate of return for the three stocks listed here,…

A: In the given problem we need to calculate the Required rate of return of three stocks i.e. Stock A,…

Q: An analyst wants to evaluate Portfolio X consisting entirely of US common stocks, using both the…

A: Sharpe and Treynor ratios are calculated by the investors to determine the relationship between the…

Q: Angela’s portfolio holds security A, which returned 12.0%, security B, which returned 15.0% and…

A: Expected return =weighted average return of all=12×0.45+15×0.25-0.3×5 Expected return…

Q: You have $96,055 to invest in two stocks and the risk-free security. Stock A has an expected return…

A: The investment in stock B is $32,861 from the total value of investment is $96,055. Remaining…

Q: In the APT model, what is the nonsystematic standard deviation of an equally-weighted portfolio that…

A: according to ATP Formua: σep2=1n×σei2

Q: Your employer has asked you to investigate the firm’s portfolio risk and return. The portfolio…

A: State of economy Probability Stock-A Stock-B Stock-C Good 60.00% 3.00% 34.00% 70.00% Poor 40.00%…

Q: firm’s portfolio risk and return.

A: Portfolio's Risk and Returns: Portfolio's risk and return states the relationship between the…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- A portfolio is invested 22 percent in Stock G, 37 percent in Stock J, and 41 percent in Stock K. The expected returns on these stocks are 9.5 percent, 12 percent, and 17.4 percent, respectively. What is the portfolio’s expected return?If you create a portfolio for your client with 73 percent invested in the S&P 500 U.S. stock index (which includes T) and the remaining 27 percent in the Vanguard Gold index. The expected return is 30 percent for the S&P 500 and 3 percent for the Vanguard Gold index. The risk is 7.5 percent for the S&P 500 and 5 percent for the Vanguard Gold index. Estimate the portfolio’s return and risk given that the correlation coefficient between the S&P 500 and the Vanguard Gold index is -0.3? (e) Evaluate the effect of a change in the correlation coefficient to 0.8 on the portfolio’s return and risk.Stock M has a relevant risk equals 1.75, and unsystematic risk equals 2. If the real risk-free rate of interest equals 3 percent, inflation premium equals 2 percent, expected market return equals 11 percent, and the required rate of return on a portfolio consisting of all stocks, which is the market portfolio equals 11 percent, what is Stock M's required rate of return? Interpret your answer.

- A portfolio that combines the risk-free asset and the market portfolio has an expected return of 7 percent and a standard deviation of 10 percent.The risk-free rate is 4 percent, and the expected return on the market portfolio is 12 percent. Assume the capital asset pricing model holds. Compute and justify the expected rate of return would a security earn if it had a 0.45 correlation with the market portfolio and a standard deviation of 55 percent.A portfolio is invested 25 percent in Stock G, 55 percent in Stock J, and 20 percent in Stock K. The expected returns on these stocks are 6 percent, 17 percent, and 26 percent, respectively. What is the portfolio's expected return? Multiple Choice 16.85% 16.69% 16.05% 13.07% 15.25%consider a portfolio composed of five securities. All the securities have a beta of 1.0 and unique or specific risk (Standard Deviation) of 25 percent. The portfolio distributes weight equally among its component securities. If the Statement Deviation of the market index is 18 percent calculate the total risk of the portfolio.

- Consider a portfolio consisting of the three risky stocks. You decide to invest 25 percent in Apple, 35 percent in HP and 40 percent in Spree. These stocks show the volatility at the level of 11.15 percent, 24.4 percent and 15.29 percent, and the correlation with the market portfolio at the level of 0.65, 0.83 and 0.36, respectively. Calculate the expected portfolio return using CAPM if the market portfolio shows the expected return of 12.88 percent and its volatility is 10.05 percent. The risk-free rate of return is 3.31 percent. Please make sure your answer is correct tutor. Out of my questions in Bartleby, 90% are wrong all the time. Which is resulting also to my low grades. Don't get it if you don't know the answer. Please use TEXT. not snip or handwriting. Thank youInvestment Corporation is considering a portfolio with 70% weighting in a cyclical stock and 30% weighting in a countercyclical stock. It is expected that there will be three economic states; Good, Average and Bad, each with equal probabilities of occurrence. The cyclical stock is expected to have returns of 25%, 5% and 1% in Good, Average and Bad economies respectively. The countercyclical stock is expected to have returns of -8%, 2% and 14% in Good, Average and Bad economies respectively. Given this information, calculate portfolio variance. a. 0.0045 b. 0.0035 c. 0.0025You have recommended a portfolio comprising of 65 percent in a bond index and 35 percent in a stock index to one of your clients. The bond index has a return of 15% and a standard deviation of 12% per year and the stock index has a return of 20% and standard deviation of 16% per year. The correlation between the bond index and the stock index 37. 1. What is the expected return and standard deviation of this portfolio?

- You create a portfolio consisting of $23000 invested in a mutual fund with beta of 1.3, $25000 invested in Treasury Securities (assume risk-free), and $12000 invested in an index fund tracking the market. According to surveys, the expected market risk premium is 6.6%, risk free rate is 1.3%. What is the expected return of this portfolio according to CAPM? Answer in percent, rounded to one decimal place.A portfolio consists of assets with the following expected returns (refer to image): a. What is the expected return on the portfolio if the investor spends an equal amount on each asset? b. What is the expected return on the portfolio if the investor puts 50 percent of available funds in technology stocks, 10 percent in pharmaceutical stocks, 24 percent in utility stocks, and 16 percent in the savings account?You have a portfolio consisting solely of Stock A and Stock B. The portfolio has an expected return of 10.2 percent. Stock A has an expected return of 11.7 percent while Stock B is expected to return 8.3 percent. What is the portfolio weight of Stock A?