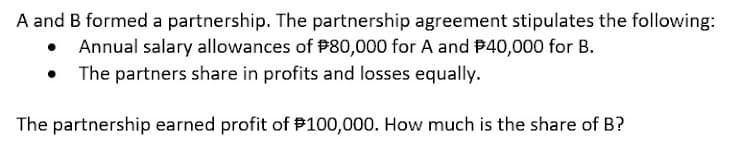

A and B formed a partnership. The partnership agreement stipulates the following: Annual salary allowances of P80,000 for A and P40,000 for B. The partners share in profits and losses equally. The partnership earned profit of P100,000. How much is the share of B?

A and B formed a partnership. The partnership agreement stipulates the following: Annual salary allowances of P80,000 for A and P40,000 for B. The partners share in profits and losses equally. The partnership earned profit of P100,000. How much is the share of B?

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 11MC: Thandie and Marco are partners with capital balances of $60,000. They share profits and losses at...

Related questions

Question

Transcribed Image Text:A and B formed a partnership. The partnership agreement stipulates the following:

Annual salary allowances of P80,000 for A and #40,000 for B.

The partners share in profits and losses equally.

The partnership earned profit of P100,000. How much is the share of B?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT