A bank pays simple interest at the rate of 8% per year for certain deposits. If a customer deposits P10,000 and make no withdrawal for three years what is the interest earned in that period of time? A person borrow P100,000 for a period of 6 months. What simple interest rate is being charged if the amount A that must be paid after 6 months is P104,500?

A bank pays simple interest at the rate of 8% per year for certain deposits. If a customer deposits P10,000 and make no withdrawal for three years what is the interest earned in that period of time? A person borrow P100,000 for a period of 6 months. What simple interest rate is being charged if the amount A that must be paid after 6 months is P104,500?

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter8: Specialized Audit Tools: Attributes Sampling, Monetary Unit Sampling, And Data Analytics Tools

Section: Chapter Questions

Problem 28RQSC

Related questions

Question

A bank pays simple interest at the rate of 8% per year for certain deposits. If a customer deposits P10,000 and make no withdrawal for three years what is the interest earned in that period of time?

A person borrow P100,000 for a period of 6 months. What simple interest rate is being charged if the amount A that must be paid after 6 months is P104,500?

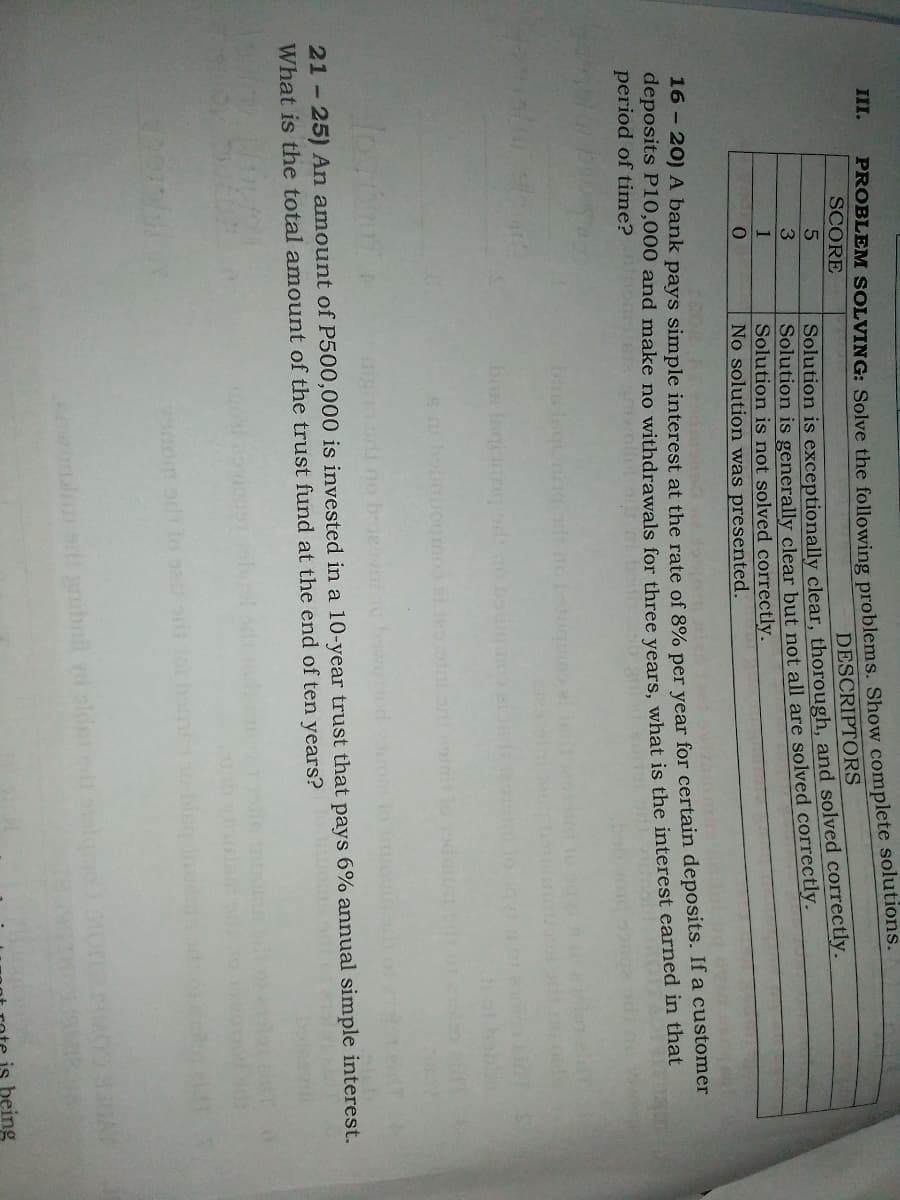

Transcribed Image Text:ROBLEM SOLVING: Solve the following problems. Show complete solutions.

SCORE

III.

DESCRIPTORS

Solution is exceptionally clear, thorough, and solved correctly.

Solution is generally clear but not all are solved correctly.

Solution is not solved correctly.

No solution was presented.

3

16 - 20) A bank pays simple interest at the rate of 8% per vear for certain deposits. If a customer

deposits P10,000 and make no withdrawals for three vears, what is the interest earned in that

period of time?

bs Isqioningod ao ba mo

igh or no

21-25) An amount of P500,000 is invested in a 10-year trust that pays 6% annual simple interest.

What is the total amount of the trust fund at the end of ten years?

wondst aibnil yd slde algmo

being

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning