A bank starts with $200 in deposits. The required reserve ratio is 10%. The bank loans out 70% of all non-required deposits and invests the rest in short-term securities. The bank capital is $15. a) Draw up a T-account for the above bank. List all assets and liabilities(+equity) in $. b) How much money can be withdrawn from this bank before it requires external help to avoid failure? Try and exhaust all internal measures before declaring panic. Would a bank want to reach the point you found in b) before asking for help? Why or why not? c) bl

A bank starts with $200 in deposits. The required reserve ratio is 10%. The bank loans out 70% of all non-required deposits and invests the rest in short-term securities. The bank capital is $15. a) Draw up a T-account for the above bank. List all assets and liabilities(+equity) in $. b) How much money can be withdrawn from this bank before it requires external help to avoid failure? Try and exhaust all internal measures before declaring panic. Would a bank want to reach the point you found in b) before asking for help? Why or why not? c) bl

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 14P

Related questions

Question

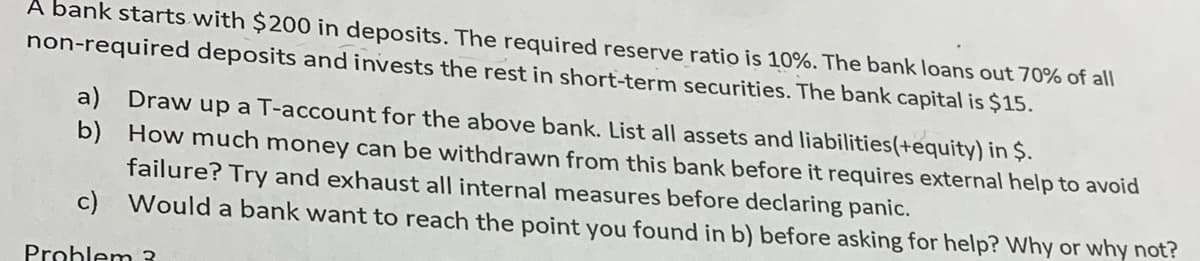

Transcribed Image Text:A bank starts with $200 in deposits. The required reserve ratio is 10%. The bank loans out 70% of all

non-required deposits and invests the rest in short-term securities. The bank capital is $15.

a) Draw up a T-account for the above bank. List all assets and liabilities(+equity) in Ș.

b) How much money can be withdrawn from this bank before it requires external help to avoid

failure? Try and exhaust all internal measures before declaring panic.

c) Would a bank want to reach the point you found in b) before asking for help? Why or why not?

Prohlem 3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning