A bond has a $1,000 par value, a 12% semiannual coupon, and matures in 4 years. What is the price of this bond (to the nearest dollar) if it has a yield of 12%?

Q: A bond with an 8% coupon rate, with a face value of £150 pays coupons semi-annually. The bond has a…

A: The question is based on the concept of calculation clean value of a bond, clean value of a bond is…

Q: A bond has a $1,000 par value, 12 years to maturity,and an 8% annual coupon and sells for $980.a.…

A: a) The computation of yield to maturity as follows: Hence, the YTM is 8.27%.

Q: A bond has an annual 8 percent coupon rate, a maturity of 10 years, a face value of $1000 and makes…

A: Please note that coupons are being paid semi annually. Hence, the period here is half year. All the…

Q: A bond matures in 12 years, and pays an 8 percent annual coupon. The bond has a face value of…

A: Bonds are debts instruments that are issued by entities to raise funds and meet their capital…

Q: A 12-year bond has a 9 percent annual coupon, a yield to maturity of 8 percent, and a face value of…

A: The bond price is calculated as sum of present value of cash flows

Q: A bond sells for $900 and is expected to trade for $1,000 in one year’s time. If the return on the…

A: Current Price = $900 Return on Bond(r) = 12% Price in one year =$1000 Let Coupon amount = X

Q: A bond has an annual coupon rate of 4.3%, a face value of $1,000, a price of $1,186.68, and matures…

A: COUPON RATE = 4.3% FACE VALUE = $1000 PRICE = $1186.68 N = 10

Q: A semi-annual coupon bond has a face value of $1,000 and a coupon rate of 5.6%. Time to maturity is…

A: A financial instrument that does not affect the ownership of the common shareholders or management…

Q: A bond with a face value of P1,000 matures in 12 years and has a 10% percent annual coupon. it can…

A: Yield to call will be the rate at which the PV of all annual coupon till call and redemption price…

Q: Assume a $1,000 face value bond has a coupon rate of 8 percent, pays interest semi-annually, and has…

A: GIVEN, par = $1000 coupon rate = 8% t = 8 n =2 ( semi annual coupon bond) r = 10% A= face value x…

Q: The yield to maturity of a $1,000 bond with a 6.8% coupon rate, semiannual coupons, and two years to…

A: Bond valuation is an important technique of fundamental analysis of security management. The bond…

Q: A zero-coupon bond has a face value of $500,000 and matures in 4 years. If the bond is currently…

A: Face value opf bond is $500,000 Maturity period is 4 years Current selling price is $381,447.61 To…

Q: The KLM bond has a 8% coupon rate (with interest paid semi-annually), a maturity value of $1,000,…

A: Bonds are debts instruments that are issued by entities to raise funds and meet their capital…

Q: What is the yield to maturity of a ten-year, $5,000 bond with a 4.9% coupon rate and semiannual…

A: Bond is a debt instrument issued by companies and government. It is a fixed income instrument which…

Q: A bond with a coupon rate of 6.5% (assume it is paid once annually), matures in 10 years at a value…

A: PRESENT VALUE (CURRENT MARKET PRICE) 695 NPER (n) (MATURITY YEARS) 10 PMT (COUPON AMOUNT) 65…

Q: A coupon bond that pays interest of $60 annually has a par value of $1000, matures in 4 years, and…

A: Working note:

Q: Consider a coupon bond that has a $1,000 par value and a coupon rate of 10%. The bond is currently…

A: Solution:- Bond’s Yield to Maturity (YTM) means the rate of return the bond is providing to the…

Q: A bond matures in 12 years and pays a 12.13 percent annual coupon. The bond has a face value of…

A: The market value of a bond is calculated as the discounted value of cash flows associated with the…

Q: $1,000 bond has a coupon of 8 percent and matures after twelve years. Assume that the bond pays…

A: The price of the bond is what the investors are currently willing to pay for the bond. Yield to…

Q: A bond that matures in 12 years has a par value of P1000 and annual coupon of 10% the market…

A: Price of a bond can be calculated using present value of annuity factor and present value factor…

Q: A 12-year bond has a 9 percent annual coupon, a yield to maturity of 8 percent, and a face value of…

A: Bond value is the present value of all the cash flow the bond will generate in its lifetime, it…

Q: A bond for Firebird, Inc. has a coupon rate of 7%. The yield to maturity is 6.8%. The bond has a…

A: GIVEN, COUPON RATE = 7% R=6.8% N=30 YEARS PAR = 1000

Q: uppose the bond matures in 12 years

A: Price of a bond = present value annuity of interest and Present value of face value of bond. 0.926…

Q: A $1,000 face value bond has a 3% annual coupon rate and 12 years to maturity. If the yield to…

A: A financial instrument that doesn’t affect the ownership of the common shareholders or management of…

Q: A 10-year, 12 percent semiannual coupon bond, with a par value of $1,000 sells for $1,100. What is…

A: Given details are : Par value of bond = $1000 Current price i.e. present value = $1100 Time period =…

Q: A $1,000 bond has a 4 percent coupon and currently sells for $900. The bond matures after five…

A: Anticipated Yield = [ Coupen Amount + { ( Face Value - Price ) / Number of years } ] / [ { ( Face…

Q: A bond with a 10% semiannual coupon matures in 6 years. The bond has a price of $1,200. What is…

A: The computations as follows: Hence, the yield to maturity is 5.98%.

Q: A bond with 20 years to maturity and a face value of $1000 pays semi-annual coupons at a rate of 9%…

A: Solution:- Bond price means the price at which the bond is currently trading in the market. Price of…

Q: A bond has a $1,000 par value, 8 years to maturity, and a 7% annual coupon and sells for $980. What…

A: Par Value is $1,000 Time to Maturity is 8 years Coupon rate is 7% Coupon mode is annually Selling…

Q: A bond that matures in 20 years has a $1000 par value .The annual coupon interest rate is 14% and…

A: Coupon rate per period (14%/2) 7.00% Face value of the bond $ 1,000 Market…

Q: A 10-year, 12% semiannual coupon bond with a par value of $1,000 may becalled in 4 years at a call…

A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: A bond has a $1,000 par value, a 13% annual coupon, and matures in 5 years. What is the price of…

A: Computations as follows: Hence, the price of the bond is $1036.05.

Q: A $1000 bond with a coupon rate of 6.5% paid semiannually has eight years to maturity and a yield to…

A: Bond Current Price = C*(((1-(1+r)-n)/r)) + (Mv * (1+r)-n) Where C = Coupon amount Mv = Maturity…

Q: A bond that matures in 11 years has a $1,000 par value. The annual coupon interest rate is 8 percent…

A: Here, Par Value of Bond is $1,000 Annual Coupon Interest Rate is 8% Yield to Maturity (r) is 15%…

Q: XYZ Company has a 12-year bond with an 8% annual coupon and a face value of P1000. The bond has a…

A: Bond Valuation: It is the process used for determining the actual or fair price of the fixed income…

Q: A bond has a $1,000 par value, 10 years to maturity, and a 7% annual coupon and sells for $985.…

A: Yield to maturity (YTM) is the total return expected on the bond if the bold is held till maturity.…

Q: Today, a bond has a coupon rate of 12.1%, par value of $1,000, YTM of 8.20%, and semi-annual coupons…

A: The rate of return that represents the current profitability of the bond is known as the current…

Q: A 10 year bond with 5% annual coupon and $1,000 par value sells for $1,200. What is the…

A: Face value = $1000 Duration (n) = 10 years Coupon = 5% of $1000 = $50 Bond price = $1200 Let r =…

Q: A bond has a $1,000 par value, 10 years to maturity, and a 7% annual coupon and sells for $985.…

A: A bond is a debt security that generates periodic coupon payments and matured at its par value. The…

Q: What is the yield to maturity of a eight-year, $10,000 bond with a 5% coupon rate and semiannual…

A: The yield to maturity of the bond can be calculated with the help of RATE function of Excel

Q: A bond with a coupon rate of 10 percent sells at a yield to maturity of 12 percent. If the bond…

A: The Macaulay duration is the weighted average term to maturity of a bond's cash flows. Portfolio…

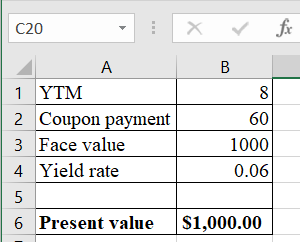

A bond has a $1,000 par value, a 12% semiannual coupon, and matures in 4 years. What is the price of this bond (to the nearest dollar) if it has a yield of 12%?

Computations as follows:

Hence, the bond price is $1000.00.

Step by step

Solved in 2 steps with 2 images

- Suppose a 10-year, 10% semiannual coupon bond with a par value of 1,000 is currently selling for 1,135.90, producing a nominal yield to maturity of 8%. However, the bond can be called after 5 years for a price of 1,050. (1) What is the bonds nominal yield to call (YTC)? (2) If you bought this bond, do you think you would be more likely to earn the YTM or the YTC? Why?Bond Yields and Rates of Return A 10-year, 12% semiannual coupon bond with a par value of 1,000 may be called in 4 years at a call price of 1,060. The bond sells for 1,100. (Assume that the bond has just been issued.) a. What is the bonds yield to maturity? b. What is the bonds current yield? c. What is the bonds capital gain or loss yield? d. What is the bonds yield to call?Bond Value as Maturity Approaches An investor has two bonds in his portfolio. Each bond matures in 4 years, has a face value of 1,000, and has a yield to maturity equal to 9.6%. One bond, Bond C, pays an annual coupon of 10%; the other bond, Bond Z, is a zero coupon bond. Assuming that the yield to maturity of each bond remains at 9.6% over the next 4 years, what will be the price of each of the bonds at the following time periods? Fill in the following table:

- Yield to Maturity and Yield to Call Arnot International’s bonds have a current market price of $1,200. The bonds have an 11% annual coupon payment, a $1,000 face value, and 10 years left until maturity. The bonds may be called in 5 years at 109% of face value (call price = $1,090). What is the yield to maturity? What is the yield to call if they are called in 5 years? Which yield might investors expect to earn on these bonds, and why? The bond’s indenture indicates that the call provision gives the firm the right to call them at the end of each year beginning in Year 5. In Year 5, they may be called at 109% of face value, but in each of the next 4 years the call percentage will decline by 1 percentage point. Thus, in Year 6 they may be called at 108% of face value, in Year 7 they may be called at 107% of face value, and so on. If the yield curve is horizontal and interest rates remain at their current level, when is the latest that investors might expect the firm to call the bonds?Current Yield with Semiannual Payments A bond that matures in 7 years sells for $1,020. The bond has a face value of $1,000 and a yield to maturity of 10.5883%. The bond pays coupons semiannually. What is the bond’s current yield?