A bond investor is analyzing the following annual coupon bonds: Issuing Company Johnson Enterprises Smith Incorporated Irwin Metalworks A B с Each bond has 10 years until maturity and has the same risk. Their yield to maturity (YTM) is 9%. Interest rates are assumed to remain constant over the next 10 years. Identify the curves on the following graph to indicate the path that each bond's price, or value, is expected to follow. BOND VALUE (S) 1200 1100 1000 900 800 700 600 10 B Annual Coupon Rate 6% 12% 9% 6 с a new issue an outstanding bond 4 2 YEARS TO MATURITY 0 Based on the preceding information, which of the following statements are true? Check all that apply. Johnson's bonds have the highest expected total return. The bonds have the same expected total return. The expected capital gains yield for Smith's bonds is greater than 12%. The expected capital gains yield for Smith's bonds is negative. Johnson just registered and issued its bonds, which will be sold in the bond market for the first time. Johnson's bonds would be referred to as

A bond investor is analyzing the following annual coupon bonds: Issuing Company Johnson Enterprises Smith Incorporated Irwin Metalworks A B с Each bond has 10 years until maturity and has the same risk. Their yield to maturity (YTM) is 9%. Interest rates are assumed to remain constant over the next 10 years. Identify the curves on the following graph to indicate the path that each bond's price, or value, is expected to follow. BOND VALUE (S) 1200 1100 1000 900 800 700 600 10 B Annual Coupon Rate 6% 12% 9% 6 с a new issue an outstanding bond 4 2 YEARS TO MATURITY 0 Based on the preceding information, which of the following statements are true? Check all that apply. Johnson's bonds have the highest expected total return. The bonds have the same expected total return. The expected capital gains yield for Smith's bonds is greater than 12%. The expected capital gains yield for Smith's bonds is negative. Johnson just registered and issued its bonds, which will be sold in the bond market for the first time. Johnson's bonds would be referred to as

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter4: Bond Valuation

Section: Chapter Questions

Problem 22P: Yield to Maturity and Yield to Call

Arnot International’s bonds have a current market price of...

Related questions

Question

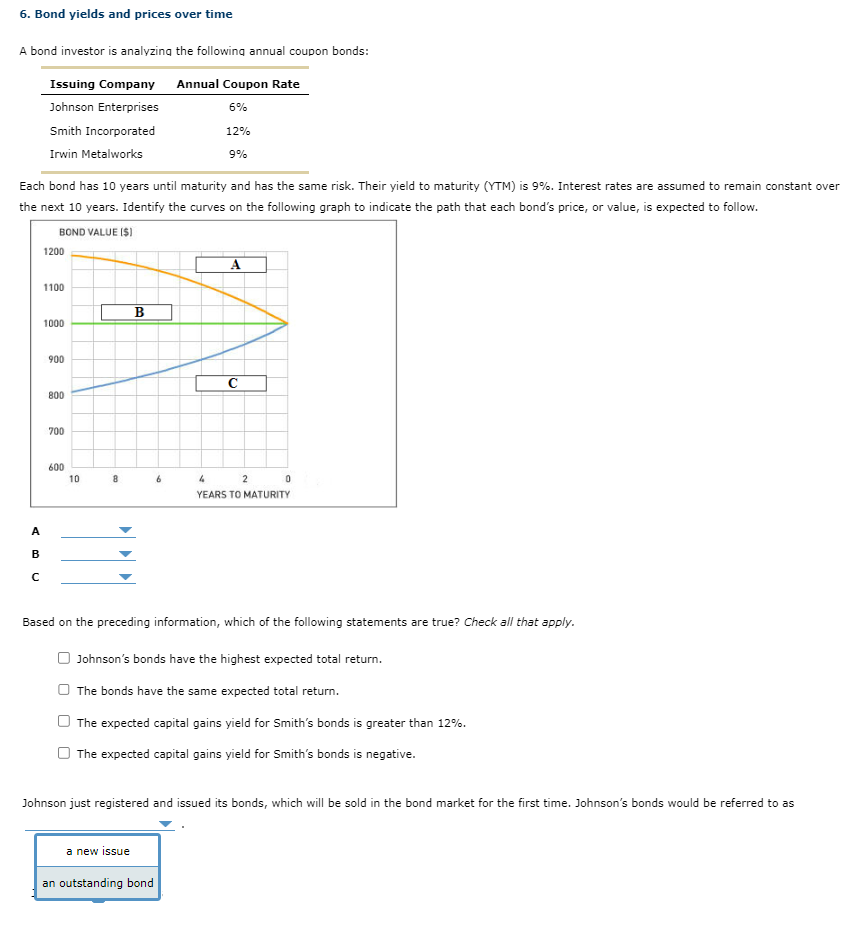

Transcribed Image Text:6. Bond yields and prices over time

A bond investor is analyzing the following annual coupon bonds:

Issuing Company

Johnson Enterprises

A

B

с

Smith Incorporated

Irwin Metalworks

Each bond has 10 years until maturity and has the same risk. Their yield to maturity (YTM) is 9%. Interest rates are assumed to remain constant over

the next 10 years. Identify the curves on the following graph to indicate the path that each bond's price, or value, is expected to follow.

BOND VALUE ($)

1200

1100

1000

900

800

700

600

10

8

to

B

Annual Coupon Rate

6%

12%

9%

6

a new issue

an outstanding bond

4

A

с

2

YEARS TO MATURITY

0

Based on the preceding information, which of the following statements are true? Check all that apply.

Johnson's bonds have the highest expected total return.

The bonds have the same expected total return.

The expected capital gains yield for Smith's bonds is greater than 12%.

The expected capital gains yield for Smith's bonds is negative.

Johnson just registered and issued its bonds, which will be sold in the bond market for the first time. Johnson's bonds would be referred to as

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning