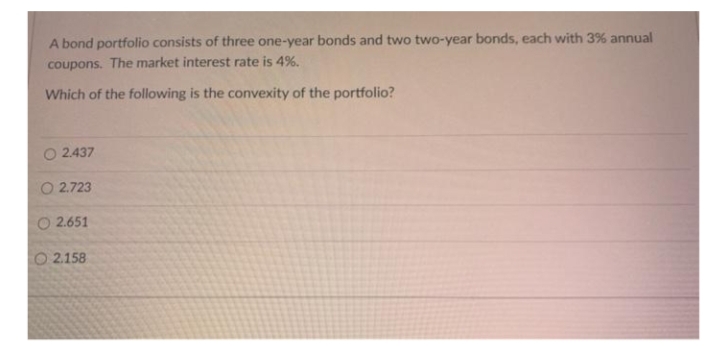

A bond portfolio consists of three one-year bonds and two two-year bonds, each with 3% annual coupons. The market interest rate is 4%. Which of the following is the convexity of the portfolio? O 2.437 O 2.723 2.651 O 2.158

Q: Based on the following data, calculate an expected price and standard deviation. (Face value= 1,000…

A: Here,

Q: A bond with annual coupon payments has a coupon rate of 8%, yield to maturity of 10%, and Macaulay…

A: Modified duration of bond can be calculated by using this equation Modified duration =Macaulay…

Q: For each of the following pairs of Treasury securities (each with $1,000 par value), identify which…

A: In the given question there is comparison between 1) Zero coupon bonds with different years 2) Zero…

Q: A 12-year bond has a 9 percent annual coupon, a yield to maturity of 8 percent, and a face value of…

A: The bond price is calculated as sum of present value of cash flows

Q: Suppose a seven-year, $1,000 bond with an 8.4% coupon rate and semiannual coupons is trading with a…

A: Bond is said to be selling at discount when price of the bond in secondary market falls below the…

Q: A bond that matures in 18 years has a par value of $1,000, anannual coupon of 10%, and a market…

A: Calculation of price:

Q: Suppose a ten-year, $1,000 bond with an 8.8% coupon rate and semiannual coupons is trading for…

A: Here, Par value of bond (FV) is $ 1000 Coupon rate is 8.8% Semi annual coupon amount (PMT)is:…

Q: What is the semi-annual coupon bond’s nominal yield to maturity (YTM), if the years to maturity is…

A: Borrowings are the liability of the company which is used to finance the requirement of the funds.…

Q: Calculate the value of a bond that matures in 12 years and has a $1,000 par value. The coupon…

A: A Bond is an instrument that represents the loan that is made by the investor to the company and…

Q: ) Assuming that the expectations hypothesis is valid, compute the expected price of the four-year…

A: The expected price of the bond can be computed by using yield to maturity, time period, and the face…

Q: Consider a five-year, default-free bond with annual coupons of 7% and a face value of $1,000 and…

A: The yield to maturity on the 5-year bond would be the same as the yield on the 5-year zero coupon…

Q: Suppose you have developed a bond portfolio using the bonds listed below (per $100 par value)…

A: Introduction: Yield to maturity (YTM) refers to the rate of return on a bond provided that the bond…

Q: An investor has two bonds in his portfolio. Each bond matures in 4 years, has a face value of $1000,…

A: FORMULA FOR PRICE OF BOND: PRICE=C×1-1+R-TR+FV1+RT FORMULA FOR ZERO COUPON BOND: PRICE=FV1+RT

Q: Consider the following four bonds that pay annual coupons: Years to Bond maturity Coupon YTM A 1 0%…

A: A bond is a debt instrument that is used by companies to raise capital. They are tradeable on the…

Q: A 30-year bond has a par value of $1,000, a coupon rate of 9% with semiannual coupon payment, and a…

A: The computation of current price of bond as follows: Hence, the current price of bond is $757.58.

Q: Consider a bond with a 4% annual coupon and a face value of $1,000. Complete the following table.…

A: Years to maturity denotes the number of years in which the security amount will be redeemed to the…

Q: Suppose a seven-year, $1,000 bond with a 11.53% coupon rate and semiannual coupons is trading with…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Consider the following two-bond portfolio of option-free bonds; Bond A Bond B Years…

A: 1) Bond B has higher duration.

Q: A bond has an annual coupon rate of 4.1%, and has 4 years until maturity. If the bonding trading at…

A: Let face value of Bond be $1000 Annual coupon = Face value of bond * Coupon rate = $1000 * 4.1% =…

Q: A 12-year bond has a 9 percent annual coupon, a yield to maturity of 8 percent, and a face value of…

A: Bond value is the present value of all the cash flow the bond will generate in its lifetime, it…

Q: What is the duration of a five-year, $1,000 Treasury bond with a 10 percent semiannual coupon…

A: Here, Face Value of Bond is $1,000 Coupon Rate is 10% Coupon Compounding is Semi annual Maturity…

Q: A zero coupon bond of Rs 10,000 has a term to maturity of seven years and a market yield of 9…

A: Par value is Rs 10,000 Bond type is Zero coupon bond Time period is 7 years Market yield is 9%

Q: You have a portfolio of 500 zero coupon bonds each with 4 years maturity, and 300 zero coupon…

A: Duration of the bond measure the sensitivity of the bond price with respect to the change in…

Q: Suppose a ten-year, $1,000 bond with an 8.1% coupon rate and semiannual coupons is trading for…

A: A bond is defined as the financial instrument that is used to raise capital from the market at a…

Q: Compute the following for a 2-years to maturity, 10% semi-annual fixed coupon bond when its yield-…

A: Time to maturity is 2years Coupon rate is 10% Par value of bond is $100 Coupon frequency is…

Q: Consider the following two-bond portfolio of option-free bonds; Bond A Bond B Years to maturity 5…

A: a) Bonds with a larger term maturity have a more drawn out span, as these bonds are increasingly…

Q: A bond with face value $1,000 has a current yield of 7.1% and a coupon rate of 9.1%. a. If…

A: Bonds Bond is a long-term financial instrument issued by a company for which the company pays…

Q: uppose a bond has a coupon rate of 9.5%, a remaining maturity of 15 years, and a face value of…

A: Present value refers to the current valuation for a future sum. Investors determine the present…

Q: A bond has a yield to maturity of 7 percent. The bond matures in 10 years, has a face value of…

A: Coupon payments are the interest payments received by bondholders from the date a bond is issued…

Q: Suppose a 5-year, $1,000 bond with annual coupons has a price of $930 and a yield to maturity of 6%.…

A: A bond is a financial instrument that is issued by many companies and governments to raise…

Q: What is the market value of a bond that will pay a total of 60 semi-annual coupons of $50 each over…

A: The market price of bond is calculated as the present value of coupon and face value

Q: An investor has two bonds in his portfolio. Each bond matures in 4 years,has a face value of $1,000,…

A: Bond refers to the financial debt instruments that are generally issued by banks for certain time…

Q: A bond has a face value of $ 1million with semi- annual coupon of 8% and a yield of 10% and 3 years…

A: Modified duration = duration / (1+ytm) Convexity of bond =(∑ convexity calculation)/(bond…

Q: Consider a five-year, default-free bond with annual coupons of 3% and a face value of $1,000 and…

A: The yield to maturity (YTM) is the rate earned by the bondholder in the life of the bond assuming…

Q: a) Determine the price of Bond X if it has 3 years to maturity, a par-value of $2500, a coupon rate…

A: Given, Par value of bond is $2500 Coupon rate is 5%. Yield is 9%.

Q: A bond has an annual 8 percent coupon rate, a maturity of 10 years, a face value of $1,000, and…

A: The formula to calculate price of bond is given below,

Q: Suppose that a 1-year zero-coupon bond with face value $100 currently sells at $94.34, while a…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Use the table for the question(s) below. Consider the following four bonds that pay annual coupons:…

A: The bond price can determine as the present value of the future stream of all cash flows. The cash…

Q: Consider a $1,000-par-value Bond with the following characteristics: a current market price of $761,…

A: We are required to calculate the discount rate that sets the present value of the bond’s expected…

Q: Suppose a five-year. $1,000 bond with annual coupons has a price of $900 67 and a yield to maturity…

A: The corporation and government can raise finance by issuing bonds. The borrower i.e bond issuer is…

Q: "The current price of a bond having annual coupons is 1,200. The derivative of the price function of…

A: Macaulay Duration and the modified duration are used to calculate the duration of bonds. They use…

Q: Consider a three-year bond with annual coupons, a face value of 10,000$, and a 2% coupon rate. If…

A: The provided information are: Face value : $10,000 Time to maturity : 3 years Coupon rate : 2%…

Q: You have a portfolio of 500 zero coupon bonds each with 4 years maturity, and 300 zero coupon…

A: Duration of bond is the time in which value can be recovered over the life of time. Duration of zero…

Q: Consider the following bonds: 3-year zero coupon bond with a face value of £100 (Bond A), a…

A: Hi there, thanks for posting the questions. But as per our Q&A guidelines, we must answer the…

Q: onsider the following two-bond portfolio of option-free bonds; Bond A Bond B Years to maturity 5…

A: a. Duration is a measure of how sensitive a bond's price is to fluctuations in the market interest…

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 6 images

- Bond Value as Maturity Approaches An investor has two bonds in his portfolio. Each bond matures in 4 years, has a face value of 1,000, and has a yield to maturity equal to 9.6%. One bond, Bond C, pays an annual coupon of 10%; the other bond, Bond Z, is a zero coupon bond. Assuming that the yield to maturity of each bond remains at 9.6% over the next 4 years, what will be the price of each of the bonds at the following time periods? Fill in the following table:Consider the following two-bond portfolio of option-free bonds;Bond A Bond B Years to maturity 5 years 10 years Coupon rate 5% 5% Par value 1000 1000 Yield to maturity 8% 6%Par amount owned R3,45 million R2 millionMarket value R30 367.59 (in 000’s) R18 528 (in 000’s)Assume that the duration of Bond A and B is 4.2 and 7.5 respectively; determine the duration of the portfolio.Consider the following three-bond portfolio in which all the bonds are option free: Bond Price Par Value Yield Market Value Duration 9% 5-year $122.4565 $5 million 4% $6,122,823 4.142 5% 20-year $113.6777 $2 million 4% $2,273,555 13.087 5.5% 30-year $126.0707 $2 million 4% $2,521,413 16.290 What is Bond 1’s (9% 5-year) contribution to portfolio duration? A. 3.23 B. 2.33 C. 4.33 D. 3.00

- Suppose the yield on a two-year-old Treasury bond is 5 percent and the yield on a one-year Treasury bond is a 4 percent. If the maturity risk premium (MRP) on these bonds is zero (0), what is the expected one-year interest rate during the second year (Year 2)?Consider the following three-bond portfolio in which all the bonds are option free: Bond Price Par Value Yield Market Value Duration 9% 5-year $122.4565 $5 million 4% $6,122,823 4.142 5% 20-year $113.6777 $2 million 4% $2,273,555 13.087 5.5% 30-year $126.0707 $2 million 4% $2,521,413 16.290 What is the portfolio duration? A. 7.81 B. 8.81 C. 6.80 D. 8.0You are creating a portfolio that consists of the following two bonds. Bond A pays an annual 7 percent coupon, matures in two years, has a yield to maturity of 8 percent, and a face value of $1,000. Bond B pays an annual 8 percent coupon, matures in three years, has a yield to maturity of 9 percent, and a face value of $1,000. Calculate the Modified Duration for Bond A.

- You are given the following information on two traded bonds making semi-annual coupon payments. Bond Face Value Coupon Maturity Price A $1,000 3% 12 years $850.10 B $1,000 10% 12 years $970.00 Calculate Yield to Maturity (YTM) for bonds A and B.Assume that a bond has a current price of $922.32, a coupon rate of 10 percent (pays $50every six months), and a yield-to-maturity of 11 percent. Based on this information, and assuming that rates remain constant, determine by how much the price of this bond will increase over the next 6 months. $1.38 $1.91 $2.63 $1.00 $0.73(a) Compute the market price (Vb) of the following bonds: (6)$1,000 par value, 10-yr maturity, and 8% coupon rate that is paid semi-annually? Assume the yield to maturity of 12%.$1,000 par value, 10-yr maturity, and 6% coupon rate that is paid semi-annually? Assume the yield to maturity of 12%.$1,000 par value, 10-yr maturity, and 8% coupon rate that is paid semi-annually? Assume the yield to maturity of 6%.(b) Based on your answers comment on the relationship (what happens to one variable when the other goes up/down) of (a) price with yield to maturity and (b) price with coupon rate. (4)

- Consider the following two-bond portfolio of option-free bonds; Bond A Bond B Years to maturity 5 years 10 years Coupon rate 5% 5% Par value 1000 1000 Yield to maturity 8% 6% Par amount owned R3,45 million R2 million Market value R30 367.59 (in 000’s) R18 528 (in 000’s) Required: a) Without doing any calculations, which bond would have a higher duration b) Assuming that Bond A is an option-free bond, calculate the bond’s modified duration using Macauly’s Duration. c) Assume that the duration of Bond A and B is 4.2 and 7.5 respectively; determine the duration of the portfolio. Requires: Macauly's Duration Modified Duration Weight Bond A Weight Bond B Portfolio DurationSuppose a 10-year, $ 1 comma 000 bond with an 8.1% coupon rate and semi - annual coupons is trading for a price of $1 comma 034.81. a. What is the bond's yield to maturity (expressed as an APR with semi - annual compounding)? b. If the bond's yield to maturity changes to 9.7% APR, what will the bond's price be?A bond has a time to maturity of 12 years, a coupon rate of 5% with interest paid quarterly, a current price of $850, and a yield to maturity of 12%. What is the price of the bond today? Group of answer choices 513.53 521.53 531.53 510.53