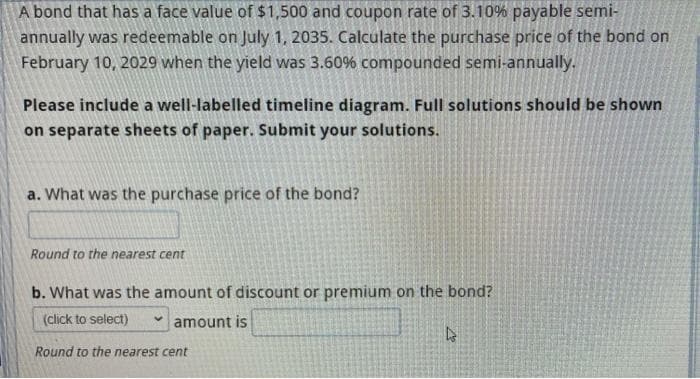

A bond that has a face value of $1,500 and coupon rate of 3.10% payable semi- annually was redeemable on July 1, 2035. Calculate the purchase price of the bond on February 10, 2029 when the yield was 3.60% compounded semi-annually. Please include a well-labelled timeline diagram. Full solutions should be shown on separate sheets of paper. Submit your solutions. a. What was the purchase price of the bond? Round to the nearest cent b. What was the amount of discount or premium on the bond? (Click to select) v amount is Round to the nearest cent

A bond that has a face value of $1,500 and coupon rate of 3.10% payable semi- annually was redeemable on July 1, 2035. Calculate the purchase price of the bond on February 10, 2029 when the yield was 3.60% compounded semi-annually. Please include a well-labelled timeline diagram. Full solutions should be shown on separate sheets of paper. Submit your solutions. a. What was the purchase price of the bond? Round to the nearest cent b. What was the amount of discount or premium on the bond? (Click to select) v amount is Round to the nearest cent

Chapter6: Fixed-income Securities: Characteristics And Valuation

Section: Chapter Questions

Problem 6P

Related questions

Question

Transcribed Image Text:A bond that has a face value of $1,500 and coupon rate of 3.10% payable semi-

annually was redeemable on July 1, 2035. Calculate the purchase price of the bond on

February 10, 2029 when the yield was 3.60% compounded semi-annually.

Please include a well-labelled timeline diagram. Full solutions should be shown

on separate sheets of paper. Submit your solutions.

a. What was the purchase price of the bond?

Round to the nearest cent

b. What was the amount of discount or premium on the bond?

(click to select)

v amount is

Round to the nearest cent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning