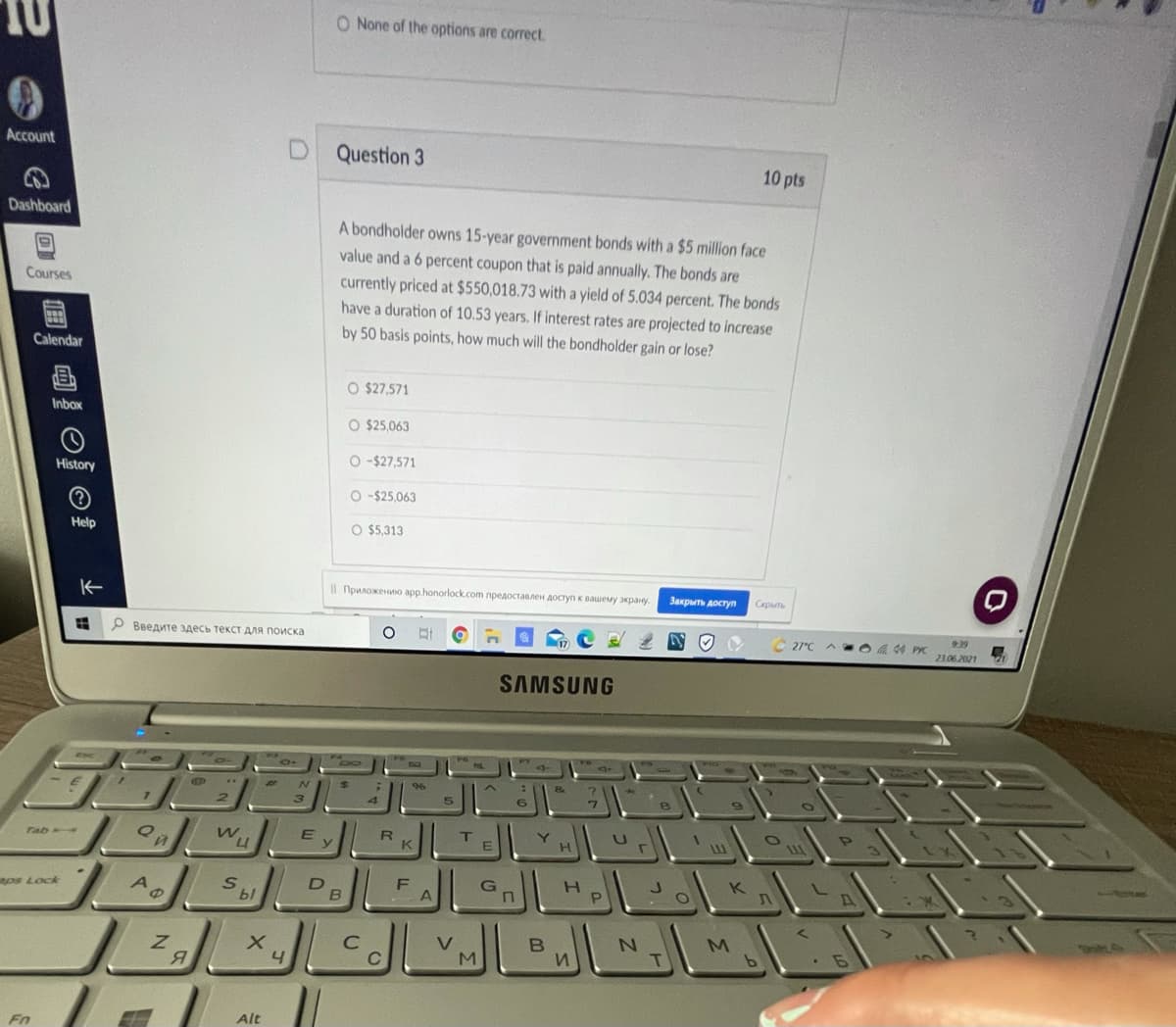

A bondholder owns 15-year government bonds with a $5 million face value and a 6 percent coupon that is paid annually. The bonds are currently priced at $550,018.73 with a yield of 5.034 percent. The bonds have a duration of 10.53 years. If interest rates are projected to increase by 50 basis points, how much will the bondholder gain or lose? O $27,571 O $25,063 O -$27,571 O -$25,063 O $5,313

A bondholder owns 15-year government bonds with a $5 million face value and a 6 percent coupon that is paid annually. The bonds are currently priced at $550,018.73 with a yield of 5.034 percent. The bonds have a duration of 10.53 years. If interest rates are projected to increase by 50 basis points, how much will the bondholder gain or lose? O $27,571 O $25,063 O -$27,571 O -$25,063 O $5,313

Chapter6: Bonds (debt) - Characteristics And Valuation

Section: Chapter Questions

Problem 4PROB

Related questions

Question

Transcribed Image Text:O None of the options are correct.

Account

Question 3

10 pts

Dashboard

A bondholder owns 15-year government bonds with a $5 million face

value and a 6 percent coupon that is paid annually. The bonds are

currently priced at $550,018.73 with a yield of 5.034 percent. The bonds

have a duration of 10.53 years. If interest rates are projected to increase

Courses

by 50 basis points, how much will the bondholder gain or lose?

Calendar

O $27,571

Inbox

O $25,063

O -$27,571

History

O -$25,063

Help

O $5,313

1 Приложенио арp.honorlock.cоm предоставлен доступ к вашему экрану.

Закрыть доступ

Скрыть

9:39

Введите здесь текст для поиска

27°C

d4 PYC

23.06.2021

SAMSUNG

E y

Tab

K

H.

F

K

DB

ps Lock

A

B

C

C

V

M

я

4

Alt

Fn

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College