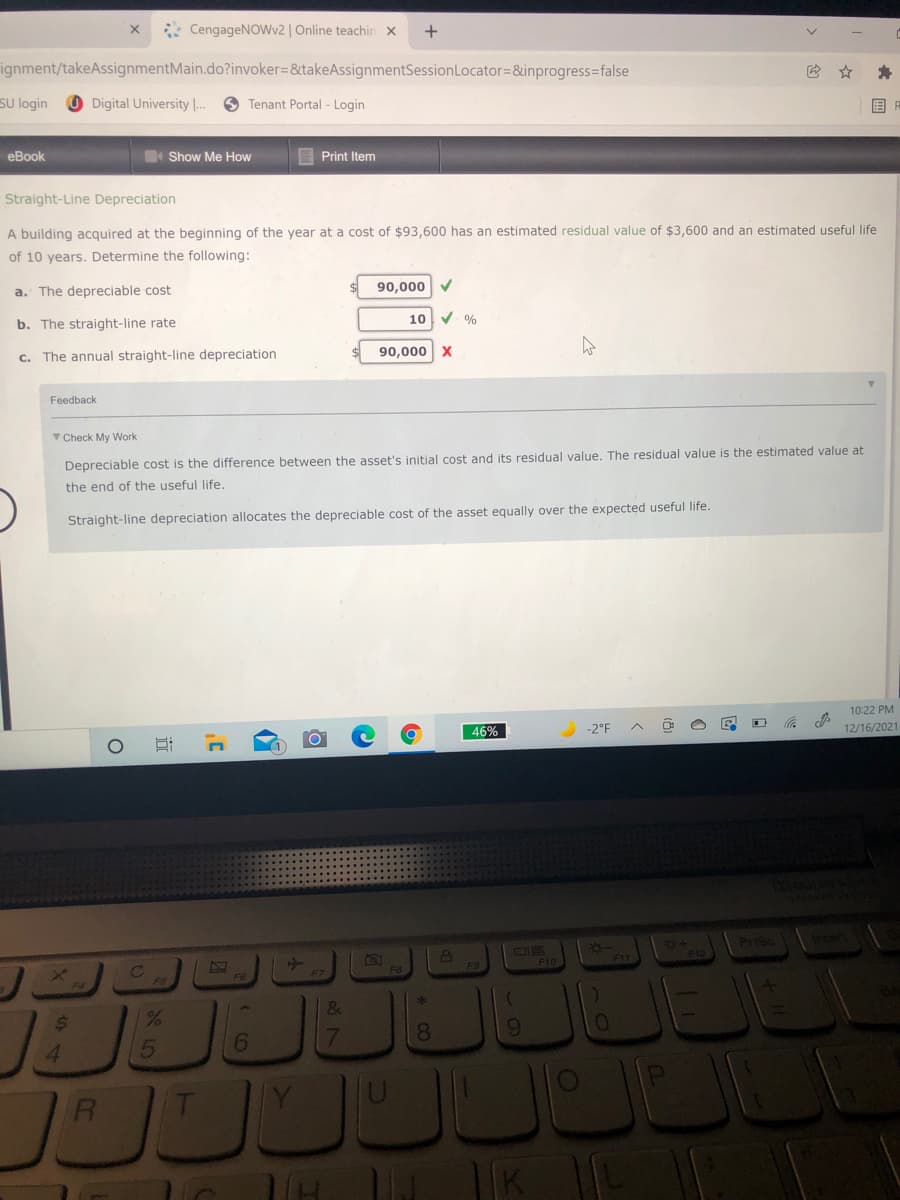

A building acquired at the beginning of the year at a cost of $93,600 has an estimated residual value of $3,600 and an estimat of 10 years. Determine the following: a. The depreciable cost 90,000 V 10 V % b. The straight-line rate c. The annual straight-line depreciation 90,000 x

A building acquired at the beginning of the year at a cost of $93,600 has an estimated residual value of $3,600 and an estimat of 10 years. Determine the following: a. The depreciable cost 90,000 V 10 V % b. The straight-line rate c. The annual straight-line depreciation 90,000 x

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter15: Preparing Adjusting Entries And A Trial Balance

Section15.3: Adjusting Accumulated Depreciation

Problem 1OYO

Related questions

Question

Transcribed Image Text:* CengageNOW2 | Online teachin x

+

ignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false

它 ☆

SU login

O Digital University |..

Tenant Portal - Login

围

eBook

Show Me How

E Print Item

Straight-Line Depreciation

A building acquired at the beginning of the year at a cost of $93,600 has an estimated residual value of $3,600 and an estimated useful life

of 10 years. Determine the following:

a. The depreciable cost

90,000

10

b. The straight-line rate

c. The annual straight-line depreciation

90,000

X

Feedback

V Check My Work

ifference betwee

the asset's initial cost and its residual value. The residual value is the estimated value at

Depreciable cost is the

the end of the useful life.

Straight-line depreciation allocates the depreciable cost of the asset equally over the expected useful life.

10:22 PM

46%

-2°F

12/16/2021

F11

F10

F8

F7

1%/

6.

4.

R.

* CO

5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning