A business has a gross income of $1.32 million. It has promised to pay the CEO a bonus of 20% of net income, which is income after taxes. But the bonus is not subject to taxes because the bonus is an operating expense. The total tax owed is 20% of gross income less the bonus. Our goal is to find the company profit after the bonus and taxes are paid. Let B be the amount on which the bonus is based, and let T be the amount on which taxes are calculated, both in millions of dollars. (a) Express the taxes paid in terms of the variable T 0.2T (b) The gross income of $1.32 million equals the amount B on which the bonus is based plus the taxes paid. Express this as an equation involving T and B. (Part (a) may be helpful.) 1.32 = B + 0.2T (c) Express the bonus paid in terms of the variable B. 0.2B (d) The gross income also equals the amount T on which taxes are based plus the bonus paid. Express this as an equation involving T and B. (Part (c) may be helpful.) 1.32 = T+ 0.2B (e) Solve the system of two equations in two unknowns from parts (b) and (d) for the variables T and B. T-1.1 B = 1.1 (f) How much is the bonus? X million $ 0.24 How much is paid in taxes? $ 0.22 v million How much profit is left over? $ 1.3 X million Need Help? Read It

A business has a gross income of $1.32 million. It has promised to pay the CEO a bonus of 20% of net income, which is income after taxes. But the bonus is not subject to taxes because the bonus is an operating expense. The total tax owed is 20% of gross income less the bonus. Our goal is to find the company profit after the bonus and taxes are paid. Let B be the amount on which the bonus is based, and let T be the amount on which taxes are calculated, both in millions of dollars. (a) Express the taxes paid in terms of the variable T 0.2T (b) The gross income of $1.32 million equals the amount B on which the bonus is based plus the taxes paid. Express this as an equation involving T and B. (Part (a) may be helpful.) 1.32 = B + 0.2T (c) Express the bonus paid in terms of the variable B. 0.2B (d) The gross income also equals the amount T on which taxes are based plus the bonus paid. Express this as an equation involving T and B. (Part (c) may be helpful.) 1.32 = T+ 0.2B (e) Solve the system of two equations in two unknowns from parts (b) and (d) for the variables T and B. T-1.1 B = 1.1 (f) How much is the bonus? X million $ 0.24 How much is paid in taxes? $ 0.22 v million How much profit is left over? $ 1.3 X million Need Help? Read It

Linear Algebra: A Modern Introduction

4th Edition

ISBN:9781285463247

Author:David Poole

Publisher:David Poole

Chapter2: Systems Of Linear Equations

Section2.4: Applications

Problem 26EQ

Related questions

Question

What am I doing wrong? I tried everything.

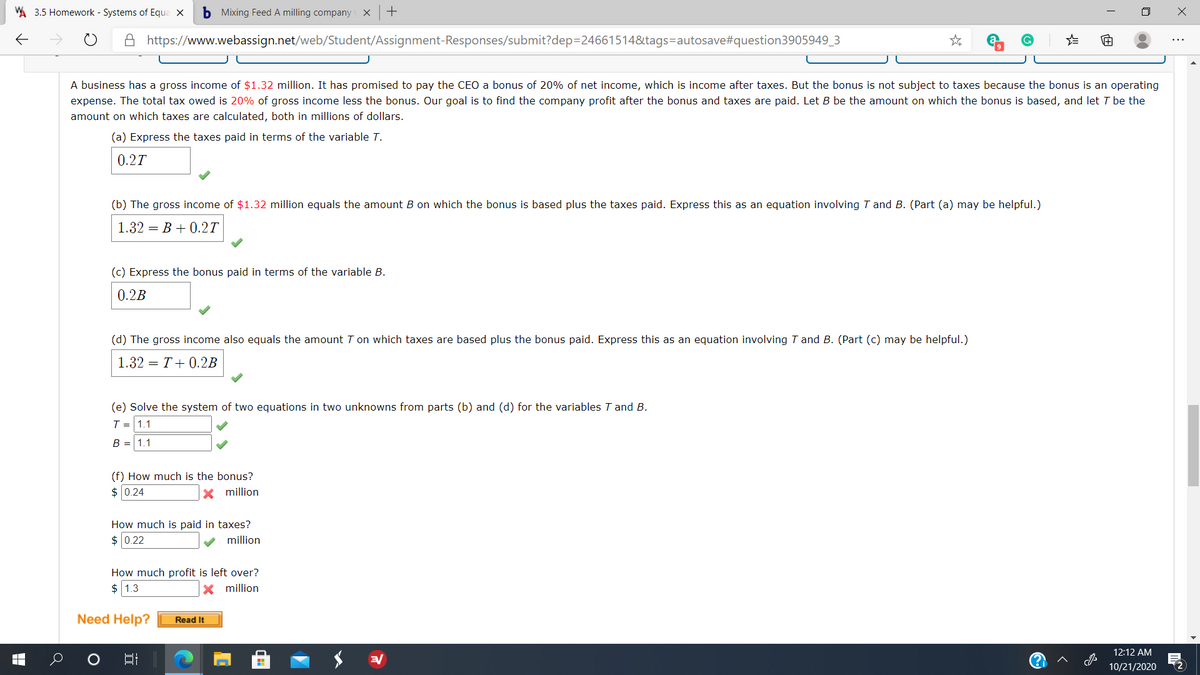

Transcribed Image Text:A 3.5 Homework - Systems of Equa X

b Mixing Feed A milling company

+

A https://www.webassign.net/web/Student/Assignment-Responses/submit?dep=24661514&tags=autosave#question3905949_3

A business has a gross income of $1.32 million. It has promised to pay the CEO a bonus of 20% of net income, which is income after taxes. But the bonus is not subject to taxes because the bonus is an operating

expense. The total tax owed is 20% of gross income less the bonus. Our goal is to find the company profit after the bonus and taxes are paid. Let B be the amount on which the bonus is based, and let T be the

amount on which taxes are calculated, both in millions of dollars.

(a) Express the taxes paid in terms of the variable T.

0.2T

(b) The gross income of $1.32 million equals the amount B on which the bonus is based plus the taxes paid. Express this as an equation involving T and B. (Part (a) may be helpful.)

1.32 = B + 0.2T

(c) Express the bonus paid in terms of the variable B.

0.2B

(d) The gross income also equals the amount T on which taxes are based plus the bonus paid. Express this as an equation involving T and B. (Part (c) may be helpful.)

1.32 = T+ 0.2B

(e) Solve the system of two equations in two unknowns from parts (b) and (d) for the variables T and B.

T = 1.1

B = 1.1

(f) How much is the bonus?

$ 0.24

X million

How much is paid in taxes?

$ 0.22

million

How much profit is left over?

$ 1.3

X million

Need Help?

Read It

12:12 AM

10/21/2020

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, algebra and related others by exploring similar questions and additional content below.Recommended textbooks for you

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Algebra for College Students

Algebra

ISBN:

9781285195780

Author:

Jerome E. Kaufmann, Karen L. Schwitters

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Algebra for College Students

Algebra

ISBN:

9781285195780

Author:

Jerome E. Kaufmann, Karen L. Schwitters

Publisher:

Cengage Learning

Trigonometry (MindTap Course List)

Trigonometry

ISBN:

9781305652224

Author:

Charles P. McKeague, Mark D. Turner

Publisher:

Cengage Learning

Intermediate Algebra

Algebra

ISBN:

9781285195728

Author:

Jerome E. Kaufmann, Karen L. Schwitters

Publisher:

Cengage Learning

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage