A buyer receives merchandise on September 7th that is involced for $3,250. The date on the invoice is August 2nd and the terms are 3/15 ROG. How much is due if the buyer pays the bill on September 24th? Answer:

A buyer receives merchandise on September 7th that is involced for $3,250. The date on the invoice is August 2nd and the terms are 3/15 ROG. How much is due if the buyer pays the bill on September 24th? Answer:

Chapter6: Merchandising Transactions

Section: Chapter Questions

Problem 15MC: A customer returns $870 worth of merchandise and receives a full refund. What accounts recognize...

Related questions

Question

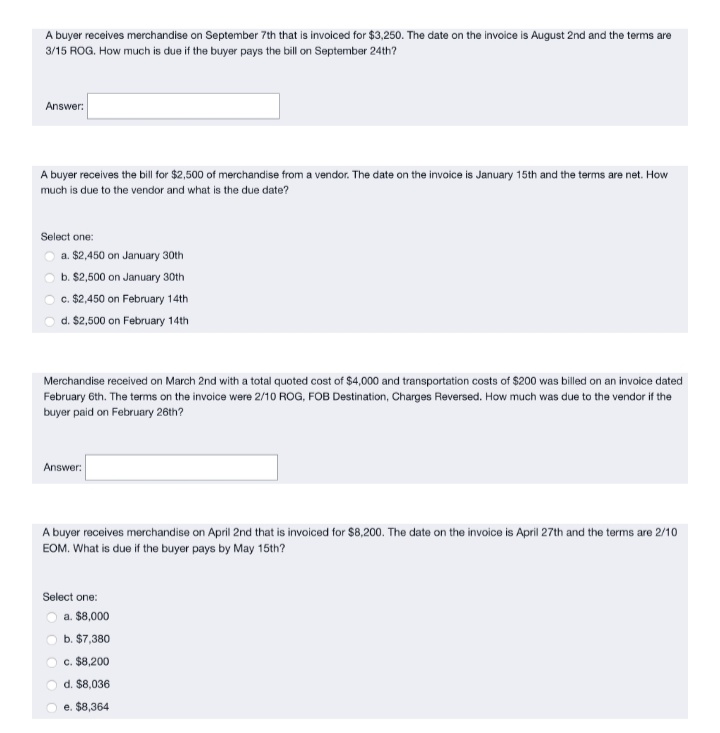

Transcribed Image Text:A buyer receives merchandise on September 7th that is invoiced for $3,250. The date on the invoice is August 2nd and the terms are

3/15 ROG. How much is due if the buyer pays the bill on September 24th?

Answer:

A buyer receives the bill for $2,500 of merchandise from a vendor. The date on the invoice is January 15th and the terms are net. How

much is due to the vendor and what is the due date?

Select one:

O a. $2,450 on January 30th

b. $2,500 on January 30th

c. $2,450 on February 14th

d. $2,500 on February 14th

Merchandise received on March 2nd with a total quoted cost of $4,000 and transportation costs of $200 was billed on an invoice dated

February 6th. The terms on the invoice were 2/10 ROG, FOB Destination, Charges Reversed. How much was due to the vendor if the

buyer paid on February 26th?

Answer:

A buyer receives merchandise on April 2nd that is invoiced for $8,200. The date on the invoice is April 27th and the terms are 2/10

EOM. What is due if the buyer pays by May 15th?

Select one:

a. $8,000

b. $7,380

c. $8,200

d. $8,036

e. $8,364

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub